Controversial IBR Rule Change Remanded Back to TAC

More than 12 months of negotiations and meetings between ERCOT staff and stakeholders have failed to resolve their differences on a rule change imposing ride-through requirements on inverter-based resources.

ERCOT’s Board of Directors on April 23 punted the issue back to the Technical Advisory Committee, directing that the Nodal Operating Guide revision request’s (NOGRR245) language be modified to address reliability concerns.

“I don’t think it’s ready for approval in its current state,” Director Bob Flexon, chair of the Reliability & Markets Committee, said April 22 after staff and stakeholders made presentations to the R&M. “I’d like to see kind of less daylight between the two positions that are out there.”

“I’m agreeing that this is not a finished discussion,” Director Linda Capuano said.

The board unanimously approved R&M’s recommendation to remand the NOGRR to TAC. The Office of Public Utility Counsel abstained from the vote.

Eric Goff, who has served as the lead spokesperson and represented the interests of renewable developers during the process, asked for direction from R&M as to whether TAC should bifurcate new versus existing resources within the NOGRR.

When ERCOT first proposed the guide change in January 2023, it specified ride-through requirements for existing IBRs and required strengthened obligations for future IBRs by requiring compliance with the Institute of Electrical and Electronics Engineers’ standards as soon as reasonable.

“All our disputes so far have been about existing resources,” he said. “TAC did not bifurcate at ERCOT’s request previously. I think it would be helpful to know if you want us to do that.”

“TAC needs to work with ERCOT,” Flexon responded. “[We’ll] let you guys work it out, since you’re all the experts.”

The revision request already has generated nearly 80 filings. It’s meant to align the grid operator’s rules with NERC reliability guidelines and the most relevant parts of the IEEE’s standard for IBRs interconnecting with the grid. Two IBR-related voltage disturbances in West Texas in 2021 and 2022, dubbed the Odessa Disturbances I and II, have added urgency to the measure’s eventual passage. (See NERC Repeats IBR Warnings After Second Odessa Event.)

Stakeholders have proposed software changesfixing the issues NERC and ERCOT have identified and have said continued regulatory uncertainty could put a damper on further investment in Texas. Unable to reach a compromise with ISO staff, TAC in March approved amended language that stakeholders pushed through over ERCOT’s objections. (See ERCOT Technical Advisory Committee Briefs: March 27, 2024.)

“It appeared that we had reached a point where additional progress between ERCOT and joint commenters was unlikely based on the foundational differences in language that came to the March TAC meeting,” Oncor’s Collin Martin, TAC’s vice chair, said.

ERCOT staff again focused their comments on grid reliability, saying the NOGRR’s latest version does not address the “current, critical” reliability risk they sought to mitigate. Dan Woodfin, vice president of system operations, said stakeholders’ proposed exemption process from the new standard for existing IBRs would leave up to 30 GW of resources that wouldn’t have to comply with the new standard.

“The whole point of trying to do this going forward is that that standard is better than what our current standards are,” he said. “Under the TAC-approved version, if a unit fails to meet [its] currently applicable requirements, they can request an exemption that sets a new standard going forward. If they fail to meet that, then they can ask for another exemption.

“And my question is, what is the point of a standard when anytime you fail it you can ask for an exemption to set a lower standard going forward?”

“At the end of the day, resource owners, operators, manufacturers and investors want the same thing as ERCOT: to rely on and support a reliable grid,” said Sara Parsons, Avangrid’s vice president of development. “To succeed in that, however, we need clear and understandable rules for reliability based on both engineering principles and economic principles that enable plants to keep operating and businesses to keep investing.”

IMM’s McDonald Meets R&M

Jeff McDonald, director of the ERCOT Independent Market Monitor, made a brief appearance before the Reliability & Markets Committee to brief directors on his first five weeks on the job.

He said the IMM team’s work has been focused on changes to ERCOT contingency reserve service, an ancillary services study, and preparations for supporting the performance credit mechanism’s development. On May 1, the IMM plans to share its annual report on the state of ERCOT’s market with the PUC for its review.

“To the extent I’ve been involved in those conversations, I’ve seen fantastic cooperation between PUC staff or ERCOT staff and the IMM staff,” he told the committee. “Those efforts have been fantastic to watch, with everyone coming together and trying to move forward.”

McDonald was named the IMM’s director in March. He replaced Carrie Bivens, who resigned from the position in November after 3 ½ years following several disagreements with PUC and ERCOT leadership. (See Bivens Resigns as ERCOT’s Market Monitor.)

McDonald has 22 years of experience monitoring wholesale markets. He has led ISO-NE’s Internal Market Monitoring Unit and was senior manager of CAISO’s Market Monitoring Unit. Previously, he was vice president of Concentric Energy Advisors and principal of Libertas Market Analysis.

ERCOT Manages Total Eclipse

Woodfin told R&M that ERCOT breezed through the April 8 solar eclipse. Sort of.

“It wasn’t quite as easy as what I read in the newspaper, but we did make it through,” he said.

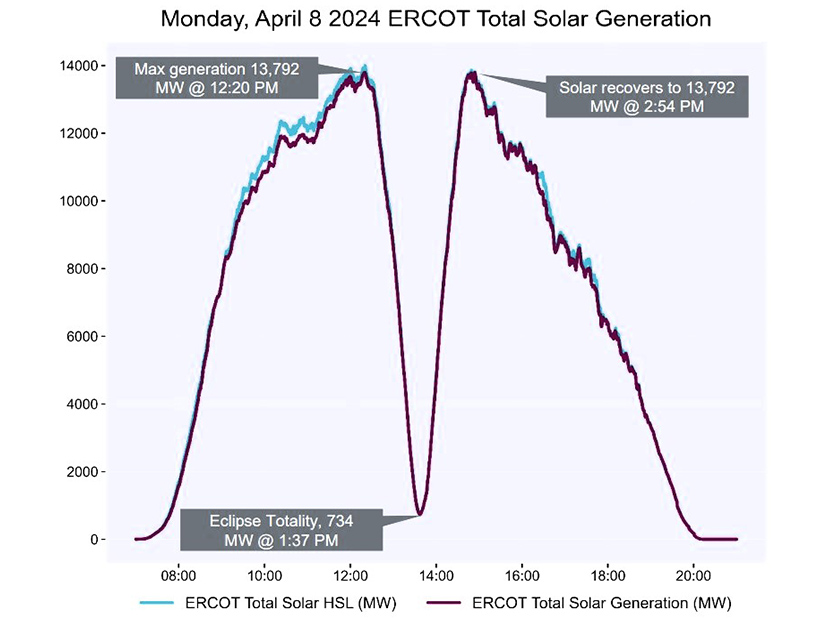

Solar generation dropped from 13.8 GW to about 700 MW at its low point at 1:36 p.m. CDT. Solar production once again hit 13.8 GW by 3:10 p.m.

Woodfin said ERCOT procured extra ancillary services, committed extra generation and took some manual actions to ensure there was enough headroom as various resources ramped up and down. Cloudy skies in portions of the state also reduced the eclipse’s effect.

“It was certainly less than a clear-sky-type day,” Woodfin said.

Board OKs $435M Project

The board approved several items already endorsed by TAC:

-

- The $435 million San Antonio South Reliability II Project that addresses reliability issues south of the city. (See “$435M San Antonio Project OK’d,” ERCOT Technical Advisory Committee Briefs: April 15, 2024.)

- Two price corrections to real-time prices that met the criteria for review when any single counterparty’s absolute value effect is either 2% and greater than $20,000 or 20% and greater than $2,000. (See “ERCOT Reviews Price Corrections,” ERCOT Technical Advisory Committee Briefs: March 27, 2024.)

The board also approved two nodal protocol revision requests (NPRRs) and a change to the Retail Market Guide (RMGRR) that:

-

- NPRR1197: Enables resources to separately meter and settle loads located behind ERCOT-polled settlement meters at their points of interconnection.

- NPRR1205: Strengthens ERCOT’s market entry eligibility and continued participation requirements for counterparties by clarifying minimum credit quality qualifications for banksissuing letters of credit and insurance companies issuing surety bonds on behalf of market participants.

- RMGRR177: Clarifies a customer’s lease agreement option when a competitive retailer tries to remove a switch hold applied to a premise it is seeking to enroll.