NEW ORLEANS — Five Northeast states have seen contracts for offshore wind projects totaling more than 12 GW canceled in the past year.

Getting them back on track to construction and avoiding future derailments for other projects is a central concern for the advocates and officials working to expand offshore wind in the United States.

An International Partnering Forum panel discussion April 25 looked at lessons learned and ways to move forward. There is much to learn from and much to move forward from: The Northeast scratch sheet reads like a who’s who in the offshore wind industry.

In the past year, the contracts for SouthCoast and Commonwealth in Massachusetts, Park City in Connecticut and Skipjack in Maryland were canceled because of rising construction costs, as were Empire 1 and 2, Sunrise and Beacon in New York; Ocean Wind 1 and 2 in New Jersey were canceled due to construction costs and nonavailability of installation vessels; and provisional contracts for Attentive 1, Community 1 and Excelsior were canceled in New York after development of the 18-MW turbine specified in those contracts was halted.

Empire 1 and Sunrise already have tentative replacement contracts with New York, and bids have been resubmitted for some of the others.

But the wholesale reset of the pipeline in Northeast states inevitably will raise costs and extend timelines.

“You can’t look at everything that has happened over the last year and say, ‘No, we should just keep doing everything exactly the way we have been doing it,’” said Abby Watson, president of The Groundwire Group. “We clearly have designed a system that was not sufficient to meet some of the potential shifts in the market and macroeconomic environment that could come along, and so we need to find more resilient strategies for building this out because these are really long timeline projects … we’re going to have other shocks and disruptions to the system.”

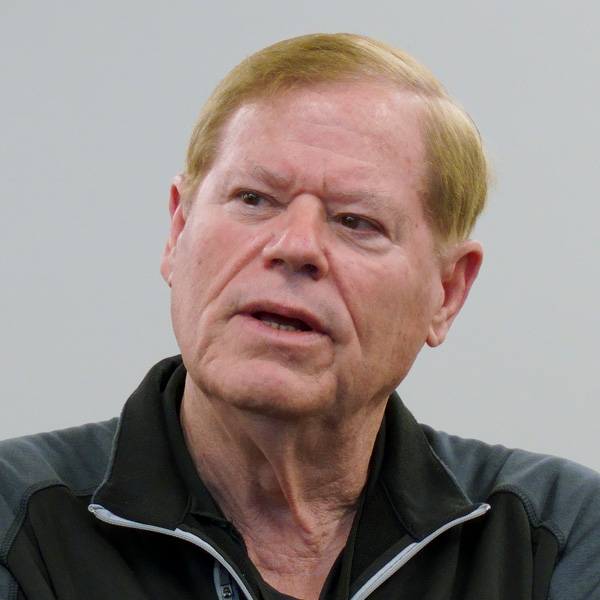

Fred Zalcman, director of the New York Offshore Wind Alliance, said policymakers need to be flexible.

“Let’s remind ourselves that what we’re trying to achieve here is nothing short of standing up a new U.S.-based heavy industry,” he said. “It’s not just the steel in the water, but it encompasses localizing our manufacturing, standing up a new workforce, Jones Act-compliant vessels, community benefits. Those are all very laudable public policy goals, and I don’t mean to question them, but it also comes with some risks and some cost.”

Zalcman said he already is seeing that flexibility in the actions of the New York State Energy Research and Development Authority, which is seeking stakeholder input through a request for information (RFI) as it prepares the state’s fifth offshore wind solicitation and concurrent requests for supply chain development proposals.

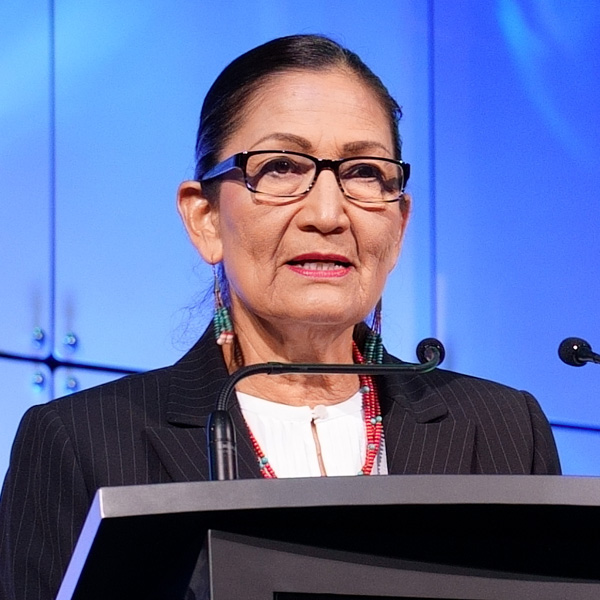

NYSERDA Director of Offshore Wind Greg Lampman described the situation as a clean slate.

“We are now … working to not continue to engage and negotiate and revise but really just to start fresh, build a new solicitation gathered by input from the RFI and push forward to continue to develop the industry.”

Power Advisory President John Dalton said his firm is working with Massachusetts and Rhode Island on their latest offshore wind solicitations.

He said the contracts in Massachusetts involve electric distribution companies as counterparties, so they have a more commercial focus than the holistic contracts NYSERDA pursues.

Dalton said the interest rate considerations outlined in New York’s RFI are intriguing.

“Hats off to NYSERDA. The RFI that came out on Tuesday has an interesting formula, which I think really moves the industry forward in terms of one possibility how to better reflect interest rates and the impact on contract pricing,” he said.

Watson raised a larger consideration about renegotiating failed contracts: “Something that we need to be really mindful of in this environment is that there are risks here regarding public perception of offshore wind,” she said.

Traditionally there have been three public selling points for offshore wind, Watson explained: A significantly higher capacity factor to offset its slightly higher levelized cost of electricity; hedging against future increases in the cost of renewables by locking in huge blocks of capacity with a single contract; and development of supply chain, with its economic benefits.

The second and third points have been undercut by the contract cancellations and rebidding, she said. Supply chain confidence is particularly important, she added, because of the long time frames involved. A manufacturer cannot commit to retooling for a project that may change.

“Developers are hugely incentivized to take big risks and big gambles in securing these procurement awards because that’s the way that our process tends to be — expect the developer to take on a lot of that risk and they’re competing on the lowest price with a very limited amount of information about their lease areas,” Watson said.

“We have to find a way to do this better if we want to attract those domestic manufacturing jobs and the supply chain piece,” she added, “also making good on our commitments to the people who have gone through workforce programs expecting to have jobs on a certain timeline that now we’re looking at pushing those timelines out.”

Lampman called that a chicken-and-egg problem: Manufacturers want market certainty before setting up factories to build offshore wind components, and offshore wind developers won’t give it to them until it is too late to add new production capacity for a given project.

Dalton said a helpful change would be a steadier cadence in development — a sense that there will be regular, manageable procurement, rather than states trying to lock down the supply chain for themselves with ever-larger procurement goals.

Watson flagged another issue: Financing is expensive and the interest costs for a new offshore wind farm trickle down to electric ratepayers.

“I think it’s worth noting that if you can get close to 6% on a Treasury bond right now, to be putting your capital at risk on something as long term and challenging as an offshore wind project, it is a fundamental challenge that the industry is facing,” she said.

Lampman said projects bids often are viewed as too high for ratepayers to afford or too low for developers to follow through on. The middle ground is missing in the conversation, he said.

“People sometimes cringe when I say this: We want everybody to make money — just not too much money,” Lampman said. “We continually say we’re trying to build an industry that’s going to be sustainable in the long term and keep persevering.”

Zalcman said the industry and those surrounding it could do a better job communicating the value of offshore wind, explaining why costs are high and explaining the requirements placed on developers — whether it’s sailing ships more slowly to avoid killing whales or expending money and effort for community benefit.

“We really don’t expect of other energy resources what we’re expecting of onshore wind,” he said. “We’re not asking coal plants to do workforce development or invest in ports and harbors, drive the trucks slower. We are encumbering the offshore wind industry with a lot of expectation. And again, I’m not challenging that, I just think as an industry, we probably need to do a little bit better messaging about the value proposition of onshore wind.”

Additional IPF24 Coverage

Read NetZero Insider’s full coverage of the 2024 International Partnering Forum here:

Central Atlantic Region Prepares for OSW Development

How Best to Address OSW’s Effects on Fisheries

Interior Announces Updated OSW Regs, Auction Schedule at IPF24

Louisiana Manufacturers Expand into Offshore Wind

New York Starts Another OSW Rebound