DENVER — Backers of the West-Wide Governance Pathways Initiative want to move quickly on the first part of their proposed plan to shift CAISO’s governance to an independent entity, leaders of the effort told Western state energy officials April 25.

The straw proposal released by the Pathways Initiative’s Launch Committee on April 10 outlines a “stepwise” approach for gradually transitioning much of the authority of the ISO’s state-run governance into an independent “regional organization” (RO). (See Western RTO Group Floats Independence Plan for EDAM, WEIM.)

Effecting that transition is the initiative’s key mission as it attempts to lay the groundwork for a single Western electricity market that includes California and builds on CAISO’s Extended Day-Ahead Market (EDAM).

“We’re not talking about market design in this group, we’re talking about governance, and that’s been the box we’ve stayed in,” CalCCA General Counsel and Director of Policy Evie Kahl, co-chair of the Launch Committee’s Functions and Scope Work Group, said at the spring joint conference of the Committee on Regional Electric Power Cooperation and Western Interconnection Regional Advisory Body (CREPC-WIRAB) in downtown Denver.

Kahl was speaking on a panel moderated by Washington Utilities and Transportation Commission member Milt Doumit — also a Launch Committee member.

“The problem we’re trying to solve is a perceived lack of independent governance in today’s CAISO Western Energy Imbalance Market [WEIM] and Extended Day-Ahead Market [EDAM],” Kahl said.

Step 1 of the proposal entails elevating the “joint” authority the WEIM’s Governing Body shares with the ISO’s Board of Governors over WEIM and EDAM matters to “primary” authority, a move that would require FERC approval but not a change to California law, according to legal analysis performed for the Launch Committee.

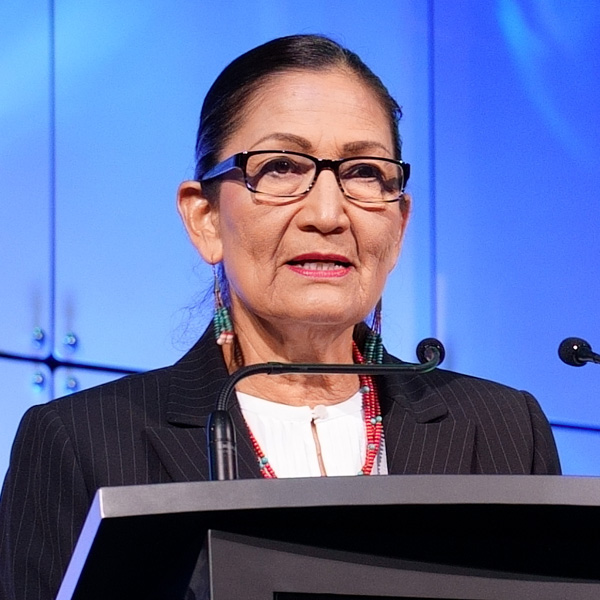

Launch Committee Co-Chair Pam Sporborg, director of transmission and market services at Portland General Electric (PGE), said Step 1 was built on previous work done by the WEIM’s Governance Review Committee (GRC).

“And that’s one of the reasons we’ve been able to move so quickly into a Step 1 recommendation, because so much of these challenges and discussions have taken place with the GRC,” Sporborg said.

Step 2 would establish the RO as a legal entity and, after passage of required California legislation, transition the Governing Body’s primary authority defined in Step 1 to “sole” authority seated within the RO.

Kahl told RTO Insider that Pathways backers are pushing for CAISO to this summer kick off the stakeholder process that would establish the Governing Body’s primary authority, with the hope the ISO would complete the relevant tariff revisions by late fall.

Waiting on NV Energy

According to the straw proposal, CAISO’s filing of those tariff changes with FERC wouldn’t be triggered until EDAM obtains implementation agreements from a “set of geographically diverse” WEIM participants representing load equal to or greater than 70% of CAISO balancing authority area annual load in 2022.

“Assuming all the entities who have expressed an intent to join EDAM as of April 10, 2024, execute implementation agreements, only one additional utility representing at least 10,000 GWh of load and located in the Southwest would be required to trigger the Step 1 governance transition,” the proposal says.

PacifiCorp on April 26 became the first Western utility to announce it will sign such an agreement. (See related story, PacifiCorp Fully Commits to CAISO’s EDAM.) Other entities signaling their intent to join EDAM include the Balancing Authority of Northern California, Idaho Power, Los Angeles Department of Water and Power, and PGE.

“We are not counting NV Energy in [the assumed commitments], but NV Energy could trip the trigger,” Kahl told state officials.

The Nevada-based utility is expected to decide on a market this year, multiple sources have told RTO Insider. A recent study by The Brattle Group indicated NV Energy would gain significantly more benefits from participating in EDAM than Markets+. (See NV Energy to Reap More from EDAM than Markets+, Report Shows.)

Sporborg said PGE’s decision in favor of EDAM came down to an assessment of customer value based on studies by Brattle and Environmental+Energy Economics that examined benefits based on various market footprints.

“We found that the EDAM footprint would provide benefits to PGE’s customers in all ranges of scenarios,” she said. “We also found Markets+ would provide benefits, but to a lesser extent.”

PGE also determined that unwinding its current participation in the WEIM would reduce its financial benefits by about $20 million annually.

Sporborg also noted PGE is a net purchaser in the electricity market and that “getting the right congestion protections for our load was incredibly important to us in our decision making.”

First Step for Step 2

Kahl said Pathways backers will spend the latter part of the year working with California lawmakers to craft the legislation needed to fulfill Step 2 of the straw proposal, with a bill to be taken up in the 2025 session. Still, the group expects to stand up the new RO as a legal entity by the end of this year.

“We do not need legislation to do that,” she said.

After establishing the RO, Sporborg said, Pathways could seat an independent board and begin to work through market oversight issues.

“I think that legislation helps smooth the path towards the RO’s ultimate destination, but that we can do many things and take a lot of action absent a legislative change,” Sporborg said.

Oregon Public Utility Commission Chair Megan Decker asked Sporborg and Kahl how the Pathways Initiative can sustain its efforts both “financially” and “administratively.” The group, which so far has covered its budget from money pledged by supporters, recently was rejected for an $800,000 grant by the U.S. Department of Energy. (See Pathways Initiative Rejected for $800K in DOE Funding.)

“We were disappointed not to receive a DOE grant, but we do have an opportunity to reapply, and based on the feedback we received [from the DOE], we think that we are in a much better position to have a more detailed and specific proposal,” Sporborg said.

Sporborg added the group likely will seek more contributions from supporters.

“It’s been a real challenge, honestly, to stand up a brand-new organization, without the kind of institutional budget that normally comes with a lot of these efforts,” she said. “I think that’s a unique part of this journey, and something that I’ve been really just glad about, which is the support we’ve gotten from a really diverse group of stakeholders.”