Sen. Joe Manchin (D-W.Va.) is not ready to give up on getting permitting legislation out of the Energy and Natural Resources Committee and to the chamber’s floor, he said in his opening remarks during a May 21 hearing on the opportunities and risks of growing electricity demand in the U.S.

Approved May 13, FERC’s long-awaited Orders 1920 and 1977 address regional transmission planning and the commission’s backstop permitting authority but will only “help with one aspect of one part of a bigger set of grid permitting problems,” said Manchin, who chairs the committee. “They are a Band-Aid on congressional inaction.” (See FERC Issues Transmission Rule Without ROFR Changes, Christie’s Vote.)

Manchin said he has been working with Sen. John Barrasso (R-Wyo.), the committee’s ranking member, on a permitting bill, and “we finally have language. We want to start sharing that language with everyone [so] that people can see where we are and hopefully that we can get our act together.”

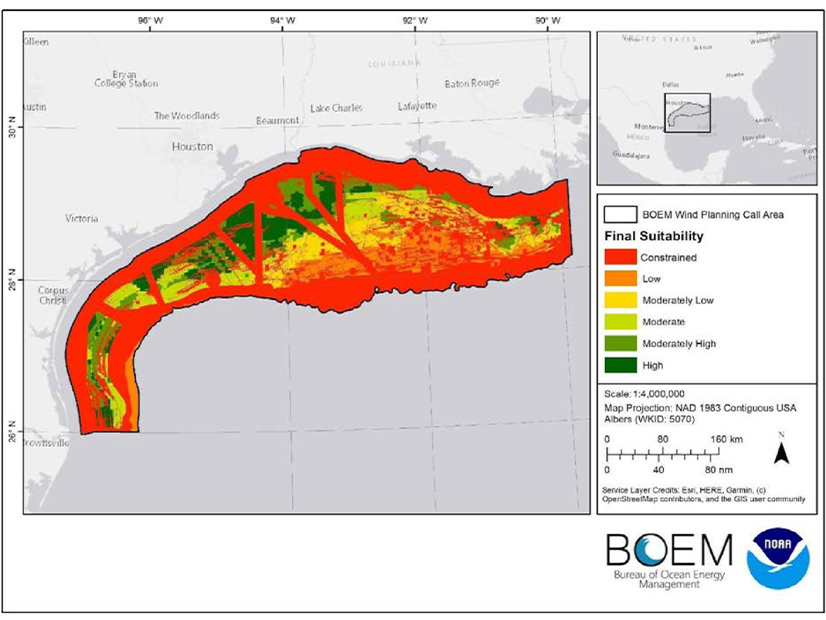

Accelerating permitting was one of several familiar themes raised at the hearing, which primarily served as an echo chamber for the argument that meeting rising electricity demand from new factories and data centers across the U.S. will require not only keeping existing coal- and natural gas-fired power plants online, but also building more.

EPA’s recent rules on cutting carbon emissions from existing coal and new natural gas plants were a particular target for both Manchin and Barrasso, who represent major coal-producing states. Already facing legal challenges from a group of Republican-led states and an industry trade association, the rules could require coal-fired plants without some form of carbon capture to close by 2039. (See Republican-led States Sue EPA over Power Plant Emissions Rule.)

“These plants play a major role in ensuring electric reliability,” Barrasso said. “They also make electricity more affordable. President Biden doesn’t seem to care at all. He wants the cost of complying with EPA rules to be high. He wants to force operators to shut down these plants before the end of their useful life. It is a disgrace. We cannot regulate our way to more electric generation.”

That additional generation is needed, Barrasso said, to keep the U.S. ahead of China in the emerging competition for dominance in artificial intelligence. China is continuing to build coal-fired plants to power its data centers, while the U.S. is closing down plants. “The president’s opposition to coal, to natural gas and even to hydropower … is a white flag. It is … an act of surrender to China,” he said.

Both lawmakers also pointed to NERC’s recent summer assessment warning that extreme heat waves could put reliability at risk in some regions. (See NERC’s Summer Assessment Sees Some Risk in Extreme Heat Waves.)

Witnesses at the hearing generally provided variations on the same core themes: the need for reliable power to meet increased demand and rising concerns that the U.S. grid will not be able to deliver.

To a certain extent, the U.S. electric system has fallen victim to the success of the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and CHIPS and Science Act, all of which have catalyzed new investment in domestic industry and manufacturing, but also new demand, said Benjamin Fowke III, interim CEO of American Electric Power.

“Just a few years ago, a large industrial manufacturing facility might require 100 MW,” Fowke said. “A facility that size would typically be one of a kind in a region, would be the major source of economic activity for that region. Now it is common for a single data center to require three [or] up to 15 times this amount of power for a single site.”

Demand growth related to data processing could double nationwide in three years, he said. FERC, other federal agencies and state officials should collaborate “to evaluate the establishment of a central planning authority focused on reliability and directing FERC to ensure that viable reliability safety valve mechanisms are in place to prevent premature plan retirements,” Fowke said.

Congress should also work to expedite permitting of resources ― “new 24/7 dispatchable and clean energy” ― that utilities identify as critical for system reliability, he said.

Mark P. Mills, founder and executive director of the National Center for Energy Analytics, went further. “The fastest way to increase power supplies ― because we’re talking about demands that are occurring in the next few years, not decades ― it’s not things we don’t know how to build, but things we know how to build,” he said. “The best construction of dispatchable power will come from gas pipes and gas turbines. They’ll be the primary source of new supply.

“This will be true with the United States, [in] almost every state; and it’s also true in Europe. It’s what’s happening around the world, but especially here,” he said.

The Cost of a Tow Truck

Speaking for big industrial power users, Karen Onaran, CEO of the Electricity Consumers Resource Council, said U.S. industry could need an additional 36 GW of power by 2030, which will require right-sizing the grid and reducing regulatory barriers. She also criticized EPA’s power plant rules, saying they “further complicate a tenuous situation on our grid,” impeding access to affordable and reliable energy, she said.

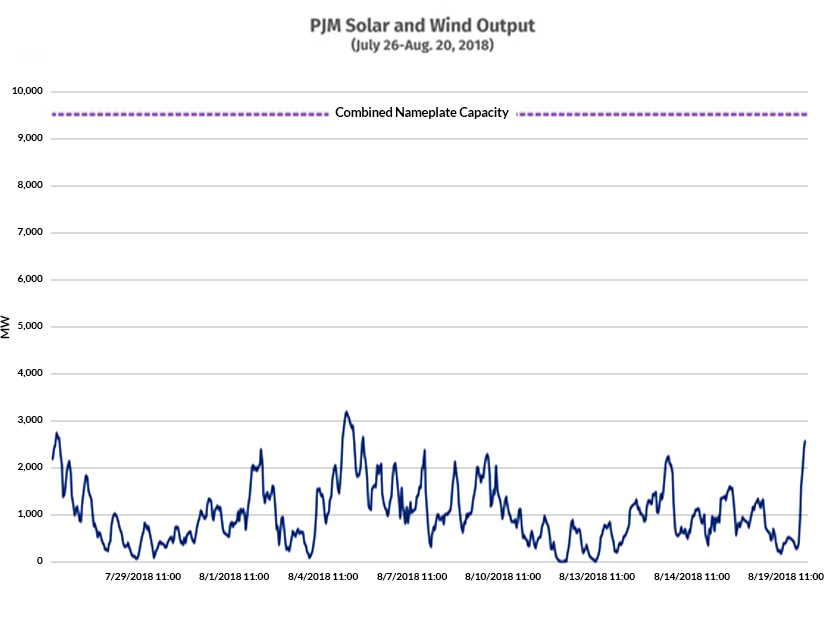

“We cannot afford to take any options off the table right now,” Onaran said. “We need all-of-the-above resources, and we need the infrastructure to support those resources. We need an agile and flexible grid that can manage variable supply, as well as variable demand. Demand is going to change [its] profiles.”

Scott Gatzemeier, corporate vice president for front-end expansion at Micron Technology, spoke of the memory chip maker’s need for firm, 24/7 power and its efforts to reduce its power demand as it builds out new capacity for energy-efficient chips in New York, Virginia and its own home state of Idaho.

The company’s site in Onondaga, N.Y., is 40 miles north of a nuclear power plant “with a direct line connection to a 345-kV substation across the street from [our] site,” Gatzemeier said. “Reliability of the system is incredibly important [for] semiconductor fabs because a small millisecond blip in our power would take down our factory for up to a week by interrupting processing.”

For its Idaho facility, Micron is waiting for Idaho Power’s Boardman-to-Hemingway transmission line, which will allow bidirectional flows of clean power — hydro and wind — with the rest of the Pacific Northwest. The project has been in development and permitting since 2007 and is now waiting for final federal and state notices to begin construction, according to a project timeline on Idaho Power’s website.

At the same time, Micron has committed to use 100% renewable power at its U.S. factories by the end of 2025. Gatzemeier said in his written testimony that its customers are always pushing it for more energy-efficient chips. Customers are reporting that Micron’s most recent memory chip, designed for AI, uses 30% less energy.

One of the last senators to speak, Sen. Angus King (I-Maine) said the hearing’s discussion was missing the critical role of climate change in the energy transition.

“We’re only talking about half the equation,” King said. “We’re like in a car on a railroad track with a train coming toward us, and we’re talking about the cost of a tow truck. The cost of not addressing climate change dwarfs the cost of addressing climate change. …

“To act like the transition is just something we’re doing because it’s a nice thing to do or because some elite group says we should do it is just not accurate.”

From grid-enhancing technologies to pumped hydro storage to old-fashioned conservation, other options exist for meeting increased demand, he said, but permitting reform will be the key.

Speaking to reporters May 13, Senate Majority Leader Chuck Schumer (D-N.Y.) said he had told Manchin he did not think permitting reform would go anywhere in the current Congress. “I think it must go somewhere,” Manchin countered May 21. “We have it ready to go, and we will … see if we can move this from this committee forward on the floor.”