The U.S. Department of Energy is looking to boost interregional transmission with its announcement May 8 of 10 proposed National Interest Electric Transmission Corridors (NIETCs), where projects could be eligible for a share of $2 billion in federal loans and special permitting under FERC’s backstop permitting authority.

DOE defines a NIETC as a geographic area where “it is determined that consumers are harmed, now or in the future, by a lack of transmission in the area and the development of new transmission would advance important national interests for that region, such as increased reliability and reduced consumer costs.”

The list was compiled based on DOE’s 2023 National Transmission Needs Study and public input, according to a senior DOE official speaking on background during a May 7 media briefing. Issued in October, the study specifically identified potential interregional transmission needs across the country. (See DOE Signs up as Off-taker for 3 Transmission Projects.)

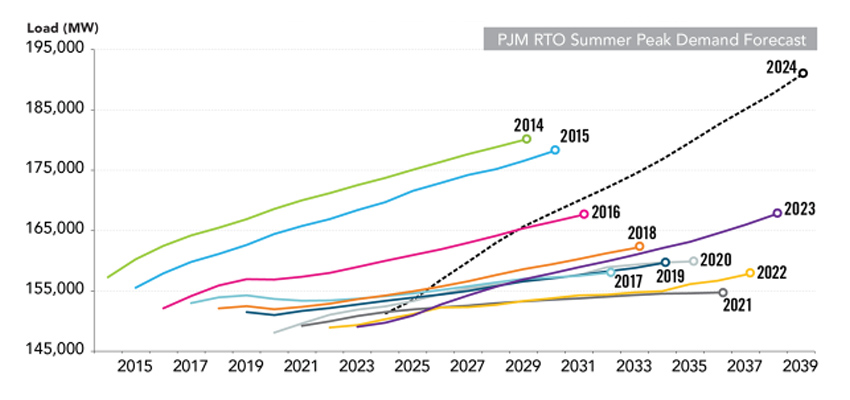

But beyond those findings, the department looked at factors such as reliability, resilience, congestion, consumer costs and future generation demand growth, “which is a very important issue right now,” the official said. “And for some of these also, we’re looking at what ultimately unlocks clean energy and allows for clean energy resources to interconnect to the grid.”

Energy Secretary Jennifer Granholm said the preliminary list includes areas that are high priority for more transmission buildout. “This program is going to help us build out transmission capacity quickly and efficiently for the people who need it most without compromising on the quality of environmental reviews or community outreach.”

The list includes corridors as narrow as 0.3 miles across and as wide as 345 miles east to west, for example:

-

- the New York-New Jersey corridor, 4 miles wide and 12 miles long, providing an interregional connection between PJM and NYISO, as well as interconnection points for offshore wind projects;

- the Plains Southwest corridor, running 345 miles east to west and 220 miles north to south, covering portions of Kansas, New Mexico, Oklahoma and Texas; and

- the Mountain-Northwest corridor, 0.3 miles wide and 515 miles long, running from Oregon to Nevada.

Some corridors also stretch over multiple parallel or adjacent sections, such as the Mid-Atlantic corridor, covering parts of Maryland, Pennsylvania, Virginia and West Virginia with parallel lines 2 miles across and up to 180 miles long.

These and the other corridors on the list all have one or more potential transmission projects under development, which a NIETC designation could help accelerate, according to the DOE announcement.

Other considerations include co-location with an existing highway or transmission right-of-way, and the potential to get more renewable energy online and increase transmission capacity between the Eastern and Western interconnections. The longest potential NIETC, the Midwest-Plains corridor, runs 780 miles, beginning in Kansas, crossing Missouri and Illinois and ending in Indiana.

The proposed corridors on the list could be reconfigured through further public and industry input, DOE officials said. But projects located within any NIETC corridor are eligible for federal loans drawn from a $2 billion fund set up by the Inflation Reduction Act.

NIETC projects also could be eligible for permitting through FERC’s backstop authority, established in the Infrastructure Investment and Jobs Act, allowing the commission to permit projects in a corridor if state regulators don’t have permitting authority or have delayed project approvals.

FERC has yet to decide if and how it might use the backstop permitting option, but the issue is on the commission’s agenda for May 13, when it is expected to vote on its long-awaited transmission planning and cost allocation rule.

The senior DOE official stressed that the NIETC designation process is separate from any FERC decision on its backstop permitting authority but said the backstop authority can only be used for a project in a NIETC.

‘A Few Backyards’

The NIETC announcement was the latest in a string of initiatives DOE has rolled out in recent weeks expanding transmission capacity across the country and streamlining the permitting process. On April 25, DOE launched its Coordinated Interagency Authorizations and Permits (CITAP) program, which is intended to cut environmental permitting time for transmission projects to two years.

DOE also is standing up artificial intelligence tools to streamline and accelerate permitting for transmission and other clean energy projects, announced April 29. (See DOE: AI Critical to US Clean Energy, Grid Modernization Goals.)

Even more strategically, the release of the preliminary NIETC list comes less than a week before FERC is scheduled to vote on its long-awaited transmission planning rule, which administration officials again stressed is separate from the NIETC program, which may not be directly affected by the decision.

“We’re looking forward to a rule that will … give people certainty and stronger tools to make sure these projects get built,” John Podesta, White House senior adviser on international climate policy, said at the May 7 briefing. “[FERC] will at the end of the day render their judgment about how far to go in that regard, but I think it’s another important step to ensure we have the ability to cut through the red tape.”

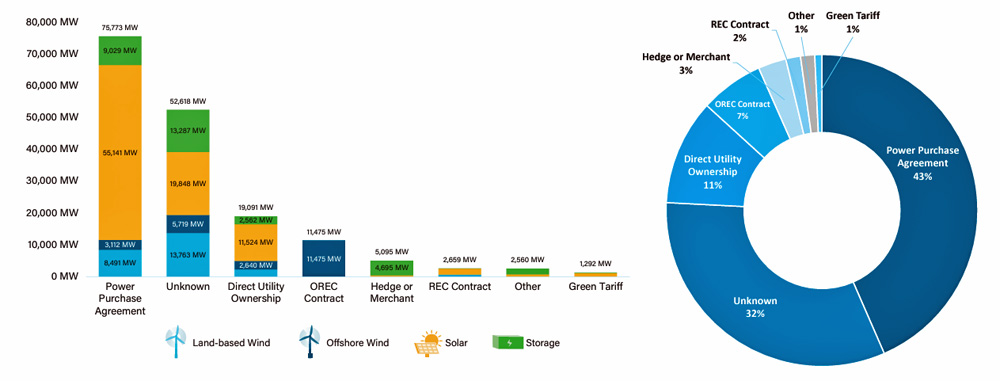

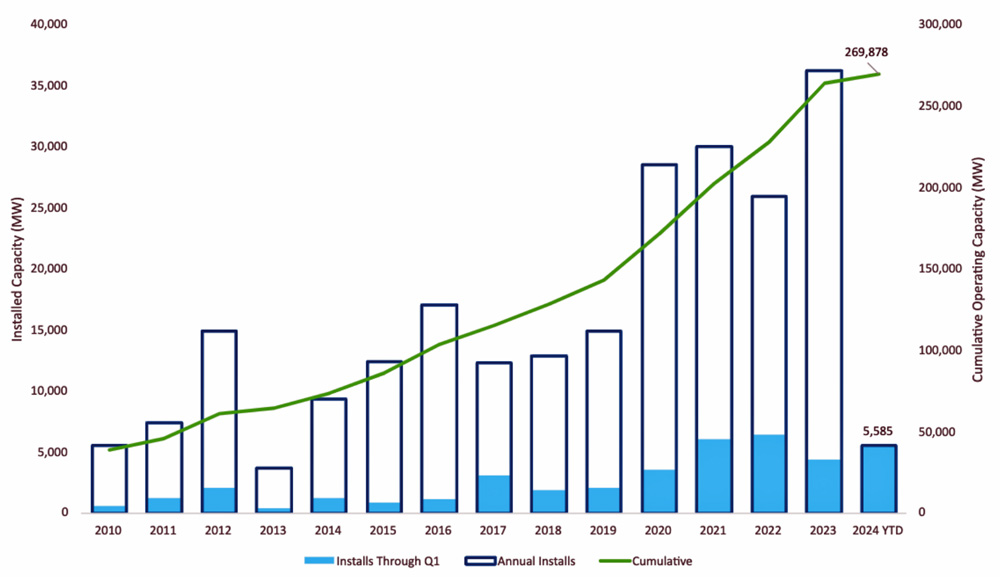

The need for an acceleration of transmission planning and permitting remains pressing. About 2.6 GW of projects, mostly solar, wind and energy storage, are sitting in RTO and ISO interconnection queues across the country, according to Lawrence Berkeley National Laboratory’s 2024 Queued Up report.

To meet President Joe Biden’s 100% clean power goals by 2035, “we need to more than double our current transmission capacity,” Podesta said. “The truth is, if we can’t build critical clean energy projects through a few backyards, then no one will have a backyard.”

The May 8 announcement marks the beginning of the second of four phases of NIETC designation as outlined in the guidelines DOE issued in December. In the first phase, which ran from mid-December to early February, DOE gathered input from stakeholders.

The release of the preliminary list kicks off a 45-day comment period, which will run through June 24. Phases 3 and 4 will include a due diligence process and environmental reviews under the National Environmental Policy Act, which could take up to two years.

DOE has yet to state how many NIETCs may be on the final list or when it will be released.