BALTIMORE — The Public Interest and Environmental Organization User Group (PIEOUG) discussed costly generation deactivations, RTO versus member filing rights over regional planning and long-term transmission projects with members of the PJM Board of Managers on May 8, the final day of the 2024 PJM Annual Meeting.

Much of the discussion centered around transmission, how PJM can increase the amount of regional planning it conducts, the cost of utility-designed supplemental projects and a proposal to shift filing rights over the Regional Transmission Expansion Plan (RTEP) from the Members Committee to PJM’s board. (See Members Vote Against Granting PJM Filing Rights over Planning.)

Ari Peskoe, director of the Electricity Law Initiative at Harvard University, argued that proposed revisions to the Consolidated Transmission Owners Agreement (CTOA) to grant PJM sole filing rights over the RTEP under Federal Power Action Section 205 include language that would allow TOs to supplant PJM-initiated projects with more expensive plans introduced by utilities and would create a “shadow governance” where CTOA signatories could challenge PJM prospective Section 205 filings, PJM regional plans, or other PJM actions through a confidential mediation process.

Peskoe argued the CTOA revisions to allow utilities to declare their intention to build a similar project as one in the RTEP could interact with existing tariff language prohibiting PJM from “planning a duplicative project” to force PJM to remove components from its plan without consideration of the merits of each proposal or whether they are likely to be built. Following the PIEOUG meeting, he submitted a letter to the board recounting his comments.

“The CTOA creates new veto powers and broad rights of first refusal, as well as new opportunities for each utility to interfere with regional planning, PJM’s FERC filings and other PJM actions. The new CTOA also subjugates PJM’s RTO status to the CTOA, reduces transparency for PJM members and states, and limits PJM’s options as it navigates the energy transition. It would create a new shadow governance system where utilities will have the advantages,” he said in the letter.

The MC overwhelmingly rejected corresponding revisions to the PJM Operating Agreement and tariff to transfer filing rights May 6, which several members argued were being rushed through the stakeholder process and could lead to PJM being able to make unilateral economic determinations about the viability of generators. The transfer would require revisions to both the CTOA through the agreement of the Transmission Owners Agreement-Administrative Committee (TOA-AC) and the PJM board, as well as the amendment of the OA and tariff. The board notified stakeholders May 10 it’s deferring deciding on the CTOA revisions until after the FERC filing on long-term transmission planning, noting the MC’s rejection of the changes.

Attorneys representing transmission owners supporting the CTOA revisions responded to Peskoe’s comments in a May 9 letter to the board, stating the changes would not empower TOs to remove PJM-selected projects from the RTEP in lieu of their own, but rather would allow them to continue to move forward with projects at the risk of FERC finding them imprudent.

“Nothing prevents PJM from continuing with the RTEP project,” the letter states. “PJM is obligated to go ahead with the regional project. If any change occurs, it would be PJM revising its project to address the Transmission Owner project need, in which case the risk would be on the Transmission Owner to move forward with its project, as outlined above.”

The TO letter also states the new mediation process is similar to those approved by the FERC in the past and would allow PJM or TOs to be party to a complaint to dispute the results at the commission.

Consumer Advocates Call for More Holistic Thinking at PJM

Brian Lipman, of the New Jersey Division of Rate Counsel, said the number of stakeholder meetings and the pace at which consequential topics are discussed can make it difficult for consumer advocates to stay engaged. His concern about timing extends to the Base Residual Auction (BRA) schedule as well, which has been compressed from its usual three-year advance cycle to allow multiple market changes to be implemented. He said running auctions in close succession increases the odds of errors being introduced, as he said happened with the results of the 2024/25 BRA for the DPL South zone, where FERC ordered PJM to recalculate the results using parameters that caused a substantial increase in prices. (See related story, Following Court Ruling, FERC Reluctantly Reverses PJM Post-BRA Change.)

“It’s so important that we make sure that PJM is not making mistakes … the timing, the rushing makes us nervous,” he said.

Lipman said the advocates’ outside position in the market and planning processes make it difficult for them to receive and analyze data about the drivers behind costs faced by consumers. Generation and transmission owners hold data about their assets and operations that can be difficult for advocates to request, even when it is shared with PJM.

Board Member Vickie VanZandt said determining the most reasonable cost requires breaking down silos and holistic solutions, but that transmission owners are best placed to understand the condition of their infrastructure. She questioned how the advocates view where supplemental projects fit into risk management.

Lipman responded that TOs look only at their own assets, whereas PJM can consider regional solutions that could meet the needs of multiple supplemental projects at a lower cost. However, it does not factor local transmission issues into its RTEP proposals.

“We’re losing those opportunities, and frankly, they’re costing ratepayers a significant amount of money,” he said.

Environmentalists Call for More Flexibility Around Deactivations

Casey Roberts, of the Sierra Club, said PJM’s lack of a proactive plan for replacing retiring resources is missing opportunities to improve the reliability and flexibility of the grid, speed the development of clean energy and save consumers money. She said deactivating generators tend to be older and have lower capacity factors that contribute to them receiving capacity market signals that they no longer are needed for resource adequacy. By holding onto those resources through RMR contracts to resolve transmission violations, she argued the reliability of the grid is dependent on resources that themselves are less reliable. (See PJM Rejects Storage as Alternative to Brandon Shores RMR.)

Generators operating on RMR contracts also prevent the redeployment of transmission capability, slowing the pace of new generation coming online, including those that might resolve the same violations necessitating the RMR contract.

She said a study conducted by Gridlab and Telos Energy looking at the feasibility of installing an 800-MW battery at the point of interconnection of the 1,295-MW Brandon Shores found that storage paired with transmission upgrades could resolve the violations at a lower cost than PJM’s solution. And it would replace a 40-year-old coal generator with a battery boasting a quick ramp rate and other parameters that thermal generators may lack.

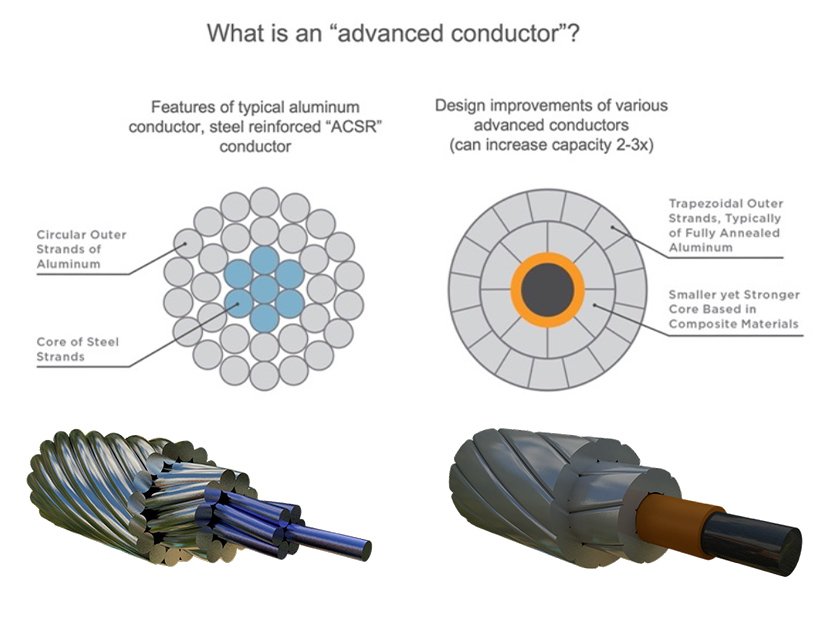

Introducing alternatives to operating generators on RMR contracts while lengthy transmission projects are completed would require a mechanism for CIRs to be transferred to new resources, a longer notification period for generation owners seeking to take units out of commission and TOs working grid-enhancing technologies (GETs), such as dynamic line ratings (DLRs), into their solutions.

Katie Siegner, of RMI, said FERC has made clear that its Order 2023 on generator interconnection should be seen as a floor by RTOs and encouraged PJM to not simply comply with its requirements. She said incorporating GETs into the network upgrade studies performed by PJM and developers for new resources could speed the entry of renewable resources and save customers $1 billion annually by reducing transmission congestion and integrating lower-cost resources onto the system. (See RMI Report: GETs Could Speed Renewable Development, Save Consumers Billions.)

Nick Lawton, of Earthjustice, said development of clean energy, deactivation of fossil generation and transmission planning are intricately linked, but are viewed through siloed stakeholder processes. He said about 5% of the energy produced in PJM is generated with renewable resources, while other regions are far ahead.

“It’s hard for me not to conclude that PJM is behind,” he said, adding that means the RTO doesn’t need to reinvent the wheel because the success of others shows the path forward.

Lawton also argued the backlog of proposed generation projects in the interconnection queue has contributed to the slow pace of new entry in PJM and urged staff to continue improving the cluster-based approach the RTO initiated this year. (See PJM Initiates Transitional Interconnection Queue.)

“PJM can make the energy transition work but the pace of the transition depends on how quickly PJM acts,” he said.

Board of Managers Chair Mark Takahashi said about 40 GW of generators have cleared the interconnection queue and have signed interconnection service agreements (ISAs). Most are renewables, but they haven’t yet moved to construction.

Lawton responded that in many cases, the amount of time it took resources to receive an ISA affected their ability to hit the ground running once it arrived, particularly because of changing economic conditions.