AUSTIN, Texas — ERCOT stakeholders plumbed the depths of Robert’s Rules of Order and amended motions before endorsing a rule change May 22 that allows the grid operator to manually release ERCOT contingency reserve service (ECRS) from economically dispatched resources after repeated violations of the system power balance constraint.

Following multiple failed attempts, the Technical Advisory Committee finally met the two-thirds threshold for approval by lowering the nodal protocol revision request’s (NPRR1224) offer floor from the originally proposed $1,000/MWh to $750/MWh. The measure passed 20-10, opposed by the consumer and retail segments over concerns of price increases.

The change introduces a trigger that ERCOT can use to manually release ECRS from security-constrained economic dispatch (SCED)-dispatchable resources when the amount of the power balance violation is at least 40 MW for 10 consecutive minutes. With TAC’s modification, it would also require that energy offer curves for capacity assigned to ECRS be offered at the new floor.

ERCOT staff and the Independent Market Monitor have been collaborating on the issue since late 2023 after ancillary service methodology discussions for this year at TAC and the Board of Directors. The board directed staff to review the processes used to compute the minimum quantities of ECRS and identify potential alternatives by May.

The grid operator has been operating under a conservative posture since the 2022 summer. It has been procuring huge quantities of ancillary services to ensure it has enough operating reserves to account for intermittent solar and wind resources.

However, that has increased costs in ERCOT’s energy-only market. The Monitor says ECRS, the newest ancillary product, created artificial supply shortages that produced “massive” inefficient market costs totaling about $12.5 billion last year through Nov. 27. (See ERCOT Board of Directors Briefs: Dec. 19, 2023.)

The Monitor suggested the deployment trigger to avoid sequestering large quantities of ECRS out of SCED that it said caused the mechanism to perceive shortages that weren’t real and set energy prices much higher than their true marginal reliability value. It also proposed a re-evaluation of the ECRS procurement quantities and eliminating the $1,000/MWh offer floor.

“Such a provision would retain a significant portion of the artificial shortage pricing that we documented in 2023, mitigating only those prices that exceeded $1,000/MWh,” the Monitor said in its comments. “While this may be in the economic interest of suppliers in the short term, setting prices that are not based on market fundamentals … will undermine the credibility of the ERCOT markets over the longer term.”

Generation owners, led by Michele Richmond, executive director of Texas Competitive Power Advocates, and Lower Colorado River Authority’s Blake Holt and ENGIE’s Bob Helton, disputed the IMM’s valuation of ancillary service reserves.

After first jokingly suggesting that the issue be placed on TAC’s combination ballot, Luminant’s Ned Bonskowski reminded members that ECRS was originally intended to be deployed with real-time co-optimization, which is still two years away.

“It’s a tough problem where we’re trying to bridge two worlds,” he said. “We’ve got a lot of folks that are thinking about the extreme heat and scarcity that we had last summer and reacting to that, whereas I think the joint commenters looked at this and said, ‘Well, while we may not agree that the way ECRS is currently operated is the problem, we recognize that there is a concern, and so as a step towards compromise, let’s try to align whatever it is in NPRR2024.’”

Bonskowski shared data that he said indicated releasing 500 MW of ECRS has a value “well above” the level recommended by the Monitor. He said the Protocol Revision Subcommittee’s (PRS) $1,000/MWh proposal falls “somewhere reasonably” in the middle.

ERCOT’s Jeff Billo, director of operations planning, said the grid operator agrees with the concept of a floor and that it needs to be done correctly “regardless of the quantity.”

“Then we can continue to work on what is the right methodology for determining the quantity,” he said. “We’re coming at this with different viewpoints on the offer floor.”

TAC’s first attempt to endorse NPRR1224, as amended by the Monitor’s comments, fell flat at 10-18 with two abstentions. Its only support came from the consumer and retail segments.

A second motion to endorse the change with the offer floor set at $500/MWh met the same fate by an identical vote. The retail segment was joined by the municipal segment.

A third attempt at passage, this time as originally proposed by the PRS, also failed, at 15-11, with four abstentions. It was opposed by the consumer and retail segments.

Finally, on its fourth attempt, TAC endorsed the measure. It must still be approved by the board and Texas Public Utility Commission, but it has been assigned urgent status so it can be effective this summer.

TAC Endorses $1.2B Project

TAC endorsed the ERCOT Regional Planning Group’s recommended $1.2 billion project to rebuild 345-kV infrastructure in West Texas that will address thermal overloads and petroleum production load-growth issues in the region.

The project easily cleared the $100 million threshold to be classified as a Tier 1 project, necessitating board approval.

Assuming the rebuild is approved, Oncor, the transmission provider, will disconnect existing 345- and 138-kV transmission lines before rebuilding about 245 miles of new transmission lines and switches. It will also build a new substation and upgrade terminal equipment.

The project was first identified in the grid operator’s 2021 Permian Basin Load Interconnection Study. Staff conducted a subsynchronous resonance (SSR) screening for the rebuild. They found no adverse SSR effects to the existing and planned generation resources and also determined the project did not cause new congestion within the area.

The utility plans to complete the work by summer 2028.

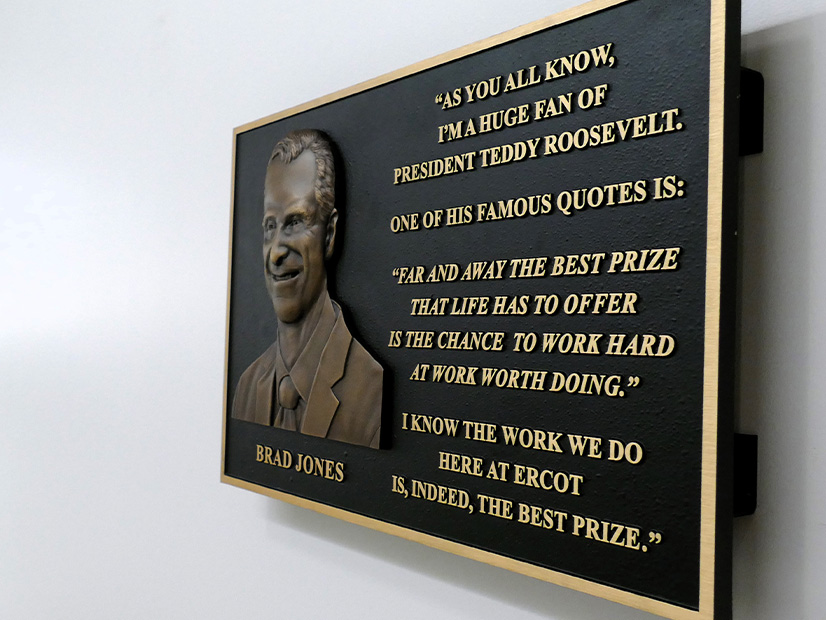

Plaque Honors Brad Jones

ERCOT has installed a plaque across from the board room memorializing former interim CEO Brad Jones, who died last year.

Jones took over the grid operator’s reins in the wake of the disastrous and deadly February 2021 winter storm. He worked to raise public confidence in ERCOT and steady the ship before handing the helm to current CEO Pablo Vegas. (See Brad Jones, Former ERCOT, NYISO CEO, Dies at 60.)

The plaque includes a quote from Teddy Roosevelt, Jones’ favorite president. It reads: “‘Far and away the best prize that life has to offer is the chance to work hard at work worth doing.’ I know the work we do here at ERCOT is, indeed, the best prize.”

Staff have also planted a tree in his memory outside ERCOT’s operations center in nearby Taylor.

Theme of the Month

The meeting got off to a rocky start when ENGIE’s Helton attempted to submit a friendly amendment to the phrase of the month brought forward by American Electric Power’s Richard Ross.

Ross, who provides a monthly theme for both ERCOT and SPP stakeholder meetings, called in to say May’s was “words matter.”

“It’s been used quite well this week at SPP meetings,” Ross said. “I’m quite confident you guys can pull it off.”

He resisted Helton’s suggestion to add “innovation” as a nod to the ERCOT Innovation Summit the day before.

“I hate to be difficult, but it’s my phrase of the month,” Ross said as members erupted in laughter.

2 Combo Ballots Pass

TAC members approved a separate combined ballot containing NPRR1198 and related changes to the Planning Guide (PGRR113) and Nodal Operating Guide (NOGRR258) that adds an extended action plan as a constraint-management plan suitable to managing congestion resolvable by SCED.

Calpine, CenterPoint Energy, Jupiter Power and South Texas Electric Cooperative abstained from the unanimous vote, with Calpine’s Bryan Sams saying his company prefers SCED solutions.

EDF Renewables’ Alexandra Miller, the NPRR’s sponsor, said her group included all input and requests to ensure transparency was consistent throughout the changes.

“This is not something that is done outside of SCED, and it is a change to the system configuration. … Scalability is allowing transmission owners to operate and choose what to respond with,” she said.

TAC unanimously endorsed its combo ballot and the withdrawal of a Planning Guide revision request (PGRR105) that would have added DC ties to the list of resources that must meet minimum deliverability conditions. ERCOT staff said the PGRR was contrary to a recent PUC decision and that it raises a policy issue that is best suited for the commission.

The ballot also included the Real-time Co-optimization Battery Task Force’s recommended mitigated offer cap for all hydro resources and five NPRRs that, if approved by the ERCOT board, would:

-

- NPRR1218: update the state’s renewable energy credit trading program to clarify that it only applies to solar renewable energy.

- NPRR1220: modify the market’s restart process to require board and TAC approval and provide an alternative mechanism to board approval under certain circumstances.

- NPRR1222: elevate final approval of the “ERCOT Methodologies for Determining Minimum Ancillary Service Requirements” other binding document from the board to the PUC, consistent with commission discussions.

- NPRR1223: update a protocol form to require transmission and/or distribution service providers to provide contact information to ERCOT.

- NPRR1228: decrease the number of firm fuel supply service obligation periods awarded in a procurement from two to one.