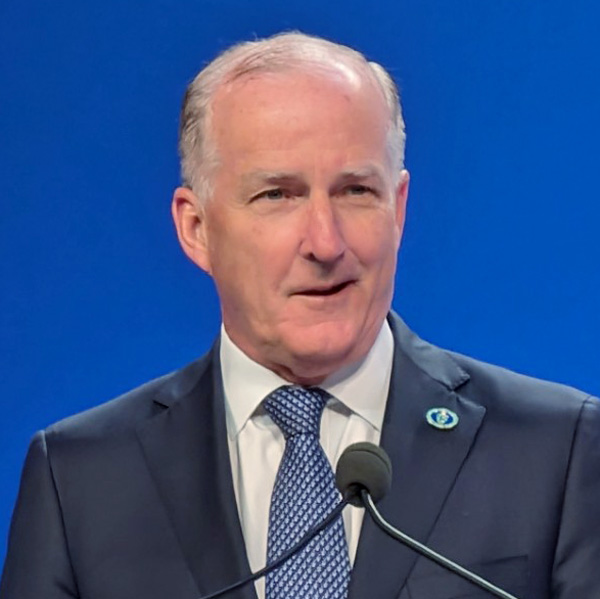

WASHINGTON, D.C. — David Crane opened the Department of Energy’s Deploy 2024 conference with the facts and figures of the money he and other DOE officials have helped to distribute from the Infrastructure Investment and Jobs Act and the Inflation Reduction Act over the past three years.

“We’ve committed over $95 billion in grants and loans, and with more [going out] each day,” Crane, DOE’s under secretary for infrastructure, told an audience of more than 1,800 at the Walter E. Washington Convention Center. “So, within the next few days and weeks, it will be over $100 billion and moving northwards.”

That money has gone to about 1,900 grant selectees and another 4,500 recipients of formula grants, Crane said. “And all that is tied with over $100 billion — well over $100 billion — committed from the private sector.”

Those public and private dollars have created irreversible momentum the U.S. clean energy transition, said White House Senior Advisor John Podesta, who closed the conference’s opening plenary with a call to action for the private sector facing the uncertainties of the incoming Trump administration.

Donald Trump and congressional Republicans have declared their intention to roll back the IRA and other clean energy initiatives. Chris Wright, a fracking CEO and Trump’s nominee for secretary of energy, is an unabashed advocate of fossil fuels.

But, Podesta countered, “the economics of the clean energy transition have simply taken over. New power generation is going to be clean. The desire to build our next generation nuclear is still there. The [data center] hyperscalers are still committed to powering the future with clean energy. The auto companies are still investing in electrification and hybridization.

“All those trends are not going to be reversed,” he said. “Are we facing some new headwinds? Absolutely. But will we revert back to the energy system of the 1950s? No way.”

Echoing Podesta, the buzz at the conference was upbeat. Crane noted that many of DOE’s funding opportunities have continued to draw more applicants than could be funded. The Grid Resilience and Innovation Partnerships Program was eight times oversubscribed, he said.

Crane also pitched to investors at the event that DOE-funded projects are well-vetted and derisked.

“One of the most important things … the Department of Energy has done for the private sector is that we put immense effort into picking the best of the best in terms of projects,” he said. “Of course, any [investor] here is going to do their own due diligence, but I think it’s fair to say that if the Department of Energy has … provided a grant to a company, if we’ve provided a loan to a company, they’ve been subject to extensive due diligence, and we believe the technology that we’re financing can scale and the projects can be commercially viable.

“Treat us as like a Good Housekeeping seal of approval,” he said.

Podesta also argued that U.S. innovation in clean energy will continue to be critical to ensure the nation can compete in global markets.

“The prices of clean technologies will keep dropping, and the need to compete with the rest of the world, as they move full steam ahead on clean energy, is going to only increase and increase and increase,” he said. “Now it’s up to you, America’s clean energy entrepreneurs and clean energy companies, to lead that transition.

“We need you to keep innovating, showing the world that America leads with big ideas.” Podesta said. “We’re counting on you to carry this work forward, for the sake of your businesses, for the sake of the communities you’ve invested in, for the sake of the American people, of our economy, our security, our young people and our planet.

“Thank you for what you’re doing. Just keep doing it. Do it faster. Do more of it, and we’ll all be better off.”