VALLEY FORGE, Pa. — The Market Implementation Committee endorsed a PJM proposal to revise how the capacity offered by energy efficiency resources is measured and verified, rejecting competing proposals from EE providers and the Independent Market Monitor. The package passed with 65.5% support during the Aug. 7 MIC meeting. (See PJM Hears Proposals to Redesign EE Participation in Capacity Market.)

The proposal requires that EE providers demonstrate that capacity market revenues were the only factor in allowing a project to come to fruition and that it would not have occurred otherwise. The package also would reduce the period for which an EE project can participate in the capacity market from three years to one year after completion, which would address a possible delay in load-serving entity cost savings on lower peak load contributions (PLC).

Any EE megawatts that did clear the Base Residual Auction (BRA) under PJM’s proposal would continue to be tacked onto the load forecast in a process known as the addback, which is meant to ensure that EE cannot act on both the supply and demand side. A withdrawn proposal from CPower included language that would have opened a separate problem statement and issue charge to consider the continued role of the addback, which also is the subject of a FERC complaint filed by three state consumer advocates (EL24-118). (See PJM Consumer Advocates File Complaint on EE Market Design.)

The ability for EE to participate in fixed resource requirement (FRR) plans also would be eliminated on the grounds that the option has not been used and would be redundant, as cleared EE would be added back to the FRR obligation.

“It’s a complicated package, but if members choose and they want to keep energy efficiency as a market product, we think this package can help put those checks and balances in there,” PJM’s Tim Horger said while presenting the proposal Aug. 7.

The resource has been the focus of stakeholder attention over the past year, as PJM contends that under the current framework, EE providers have not demonstrated the capacity market revenues they receive have a causal link with reduced load and should not receive capacity market revenues until that link can be demonstrated. Several complaints have been filed at FERC during that time, alleging PJM’s market structure discriminates against EE, its treatment of market participants is unfair and EE resources have not demonstrated they meet the Reliability Pricing Model (RPM) participation requirements.

Presenting PJM’s first read of the proposal during the July 24 Markets and Reliability Committee meeting, PJM’s Pete Langbein said he believes there’s a large amount of “naturally occurring” EE from consumers wanting to reduce their carbon footprint or energy bills by buying more efficient devices. He argued those installations should not be eligible for BRA revenues.

PJM CEO Manu Asthana gave the example of a recent washing machine purchase he made, where the deciding factor was appliance features rather than the efficiency of the device. He said it’s possible it had a lower load than competing models and therefore would qualify for mid- or upstream EE programs that seek to use capacity market revenues to discount the purchase price, even though the purchase would have occurred regardless. While in aggregate EE programs may be successful in shifting consumer behavior in favor of reducing capacity needs, he said the capacity market isn’t entirely designed for that kind of cost allocation.

Several stakeholders said the causal link sets an impossible standard for EE providers to meet and would result in all programs being eliminated from the market.

Market participants proposed competing visions of how the accuracy of market participating EE could be improved. Affirmed Energy proposed a standardized approach for the measurement and verification (M&V) methodologies providers submit, an EE registration process akin to the rules around demand response, and third-party review for PJM’s verification. Mid- and upstream EE programs that use capacity market revenues to discount efficient devices in an effort to incentivize their purchase would not be required to obtain contracts with each consumer to offer the capacity associated with the energy savings into PJM’s market.

The Affirmed proposal initially sought to eliminate the addback by increasing the amount of EE data PJM incorporates into its load forecast. That component was dropped as the number of complaints pending at FERC regarding EE market design multiplied. The proposal received 2.2% support.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said there’s a concern the addback leads to capacity market payments going to EE providers without any corresponding increase in reliability.

A proposal from Exelon aimed to preserve the ability for utilities administering EE programs on behalf of their states to enter savings into the capacity market by positing that programs run “under the direction, authorization and/or supervision of state public utility regulatory authorities are de facto qualified as EE capacity market products.”

The proposal also would differentiate the state directed, authorized and supervised programs from those offered by third-party EE providers with respect to the approval of M&V plans. Those plans outline how the EE provider intends to demonstrate the amount of capacity it will offer and validate that figure, as well as PJM’s evaluation of post-installation measurement and verification (PIMV) reports, where providers describe how they put those methodologies into practice.

Exelon’s Alex Stern said the utility believes that if PJM approves a M&V plan, it should not reject PIMV reports that accurately follow through on the described approach that has been reviewed and accepted by the states. The proposal received 37.2% support.

Stern said for as long as the states want their programs to have the ability to participate in the PJM capacity market, a distinction should exist between the rigor and regulatory scrutiny states already exercise over utility-run EE programs and EE that is bid into the capacity market by other EE market participants.

“We certainly don’t oppose other energy efficiency market participants … so long as the rules are fair. And by fair, I mean allowing opportunities for all, but [respecting] that the state programs are different in regard to measurement and verification,” he said.

The Independent Market Monitor proposal would go the furthest by removing EE from the capacity construct entirely, arguing that the energy savings have been incorporated in PJM’s load forecast since the 2016/17 delivery year and there is no basis in the tariff for keeping them in the market. Though the package received 54% support over the status quo, it failed to receive endorsement with a tie.

“The IMM’s proposal is the only one to recognize the current reality. EE is factually not a capacity resource under the tariff, EE is not in the capacity market, and PJM has not treated EE as a capacity resource since 2016. It is not PJM’s role to choose to subsidize EE outside the market. The lack of credible measurement and verification and the absence of causality make the subsidies even more unsupportable,” Monitor Joe Bowring told RTO Insider in an email.

He noted that the votes were not on a sector-weighted basis and the results of PJM’s proposal and the IMM’s proposal in a sector-weighted vote could be quite different, whereas rejection of the other packages likely would not have changed with sector weighting.

CPower withdrew its proposal during the Aug. 7 meeting, which focused on standardizing M&V and creating a separate process to reconsider the addback. It threw its weight behind the Exelon package while urging stakeholders to vote against the proposals from PJM and the Monitor.

“The Market Monitor’s proposal would by definition eliminate [EE] from the market … and as others have noted as well … the PJM proposal would de facto eliminate it because it continues to include this unmeetable 100% causality test,” CPower’s Aaron Breidenbaugh said.

CPower Complaint on PJM Guidance Ahead of 2025/26 Auction

In a July 17 complaint to FERC, CPower argued PJM has improperly taken a step toward implementing some of those changes, in contravention of the reigning tariff and manual language. It did so by issuing a guidance document on June 13 that informed EE market participants that it was limiting the project installation years eligible to participate in the 2025/26 BRA to the 2023/24 and 2024/25 delivery years.

The document also revised how PJM determines the standard baseline used for measuring EE savings for lightbulbs, requested documentation showing that providers hold exclusive capacity rights, and added a process where the Monitor can review PIMV plans to provide comments and recommendations to PJM (EL24-128).

The complaint asks FERC to allow CPower to participate in the Incremental Auctions (IAs) for the 2025/26 delivery year under the status quo rules and establish a settlement process or an administrative law judge to mediate disputes around PJM’s market rules for EE in the 2025/26 BRA. The amount of EE that cleared in the 2025/26 auction fell to 1,459.8 MW from 7,668.7 MW for the prior year.

CPower argued that the PJM tariff and the 2010 FERC order establishing EE participation in the RPM hold that resources can offer into four auctions and that limiting that period would constrain participants’ ability to use past projects as replacement capacity to cover any shortfalls caused by new installations not being completed by the start of the delivery year.

The change to the standard baseline resulted in LED lightbulbs being set as the standard practice for consumer behavior. The standard baseline determines the device that more efficient devices included in EE plans are measured against. CPower argued that the shift was made with little evidence that it reflects typical consumer behavior, stating that a memo sent from Apex Analytics to Rutgers University staff was the basis for the change.

“PJM does not offer any robust sets of studies or analyses about standard practice. It conducted no stakeholder process to seek input on standard practice. Allowing PJM to issue edicts about what standard practice is throughout the region with alleged support as flimsy as the Apex memo would set damaging precedent and allow PJM to wield an inordinate amount of power outside of the commission’s just and reasonableness FPA [Federal Power Act] review process, both as to EE and beyond,” the company wrote in its complaint.

The company took issue with including the Monitor in the approval of PIMV reports on the grounds that complaints have been filed against EE providers by the Monitor, calling into question whether it can be impartial and independent when reviewing reports submitted by those parties. CPower said it received two letters from the Monitor on June 26 stating it would recommend PJM not approve its M&V plan for the 2025/26 delivery year unless the company provided several items to the Monitor, including its justification for opposing PJM’s June 13 guidance.

“PJM is thus effectively denying CPower’s ability to withhold from the IMM what amounts to discovery outside of a commission-mandated process. Given the consequences of not providing the information, which included precluding its participation in the upcoming BRA, CPower had no real choice but to provide it to the IMM, despite its legal objections,” CPower said.

PJM responded on Aug. 5, stating that the tariff language provides that EE may participate in the auction for four delivery years but does not mandate it. It also argued that the M&V review is within the Monitor’s scope and responding to its inquiries is a condition of PJM membership.

“CPower unreasonably claims it is entitled to a four-year installation period for EE projects that clear a BRA even under a compressed auction schedule when two of the delivery years have already been completed and the load forecast reflects those efficiency projects as having already been installed. CPower’s position is irrational from an economic or operational perspective and is grounded in a gross misinterpretation of the tariff, RAA and PJM Manual 18B,” PJM said.

PJM Argues Addback Necessary to Implement EE

PJM has responded to a complaint filed by the New Jersey Division of Rate Counsel, Maryland Office of People’s Counsel and Illinois Citizens Utility Board arguing that the RTO’s use of the addback deprives consumers of the reliability benefits EE can offer while still requiring them to pay market participants. Given the significance of the addback, they also state that it should be enshrined in the governing documents, rather than business manuals, and be subject to FERC review.

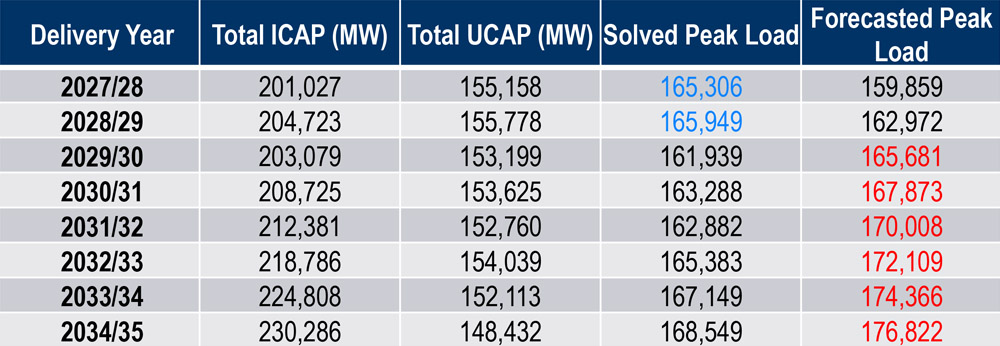

In a July 10 response, PJM said the addback is necessary to avoid contravening tariff language prohibiting the double counting of EE resources as a capacity resource while also reducing peak load forecasts. PJM argued that the addback is envisioned by the tariff and can be accomplished through the manuals under the “rule of reason” as a mechanism to implement tariff language. Without the addback, it said the reliability requirement for the 2024/25 BRA would have been 142,973 MW, short of the 151,631-MW peak summer load requirement.

“The addback was designed to address changes in the methodology for determining the PJM load forecast to preserve the ability of EE resources to qualify for capacity payments as they had under the previous load forecast methodology. Thus, far from being a ‘fundamental change’ that undermined the participation of EE resources in RPM auctions, as complainants argue, the introduction of the addback preserved the status quo for EE resources seeking to receive capacity commitments,” PJM wrote.

Both Advanced Energy United and the PJM Power Providers submitted comments supporting the consumers’ call for FERC to convene a technical conference to consider the addback and EE market design more thoroughly.

In its July 10 complaint against PJM, the Monitor also argued that PJM’s implementation of the addback violates the tariff, stating that EE is permitted to offer capacity only for savings that are “not reflected in the peak load forecast prepared for the delivery year for which the energy efficiency resource is proposed.” The complaint says PJM should have eliminated EE from the capacity construct once it revised its load forecast approach to include EE data produced by the Energy Information Administration’s Annual Energy Outlook (EL24-126).

“When EE was added to the forecast and EE was removed from the capacity market, PJM should have simply followed the tariff, recognized that EE was not capacity, recognized EE resources do not meet the definition of EE resources in the filed tariff and eliminated payment to EE resources. Instead, PJM recognized that EE resources are not capacity, stopped including EE resources in the capacity auction, and began to pay EE resources an uplift payment equal to the capacity market clearing price without making any provision for such payments in the filed tariff,” the Monitor wrote.

PJM responded that the addback is permitted under the rule of reason and that it cannot change the results of the 2024/25 BRA because of the filed rate doctrine, citing a March 2024 3rd U.S. Circuit Court of Appeals decision rejecting a post-auction change to a regional reliability requirement. (See 3rd Circuit Rejects PJM’s Post-auction Change as Retroactive Ratemaking.)

The New Jersey Board of Public Utilities asked FERC to reject the Monitor’s request to cease EE payments, consolidate the remainder of the complaint with the consumer advocates’ filing and convene a technical conference centered on EE’s role in the capacity market.

“The New Jersey BPU supports a holistic review of [energy efficiency resource] eligibility and discussions around whether including EE in the market clearing mechanism is preferable to the EE addback. However, this decision must be the result of a process that allows for participation and input from all relevant stakeholders,” the board wrote.

PJM Responds to Monitor Complaint Against EE Providers

In a July 3 response to a complaint filed by the Monitor alleging that several EE market participants have not demonstrated they were eligible to participate in the 2024/25 and subsequent capacity auctions, PJM defended its approach to reviewing PIMV reports and said the Monitor proposed an unworkable approach to determining what qualifies as EE (EL24-113). (See Monitor Alleges EE Resources Ineligible to Participate in PJM Capacity Market.)

The complaint argued that EE mid- and upstream programs must be able to demonstrate that the more efficient products purchased with EE rebates actually were installed and are being operated within the PJM footprint. It asks the commission to either bar the EE providers from receiving capacity revenues in the 2024/25 delivery year or open an investigation to determine eligibility.

“For instance, short of conducting on-site audits for every location where EE is claimed right before the start of each delivery year, it is unclear whether any other methodology or estimate would satisfy the Market Monitor’s allegation that the post-installation M&V reports fail to establish that the indicated energy efficiency sellers have actually installed the resources in homes or businesses,” PJM wrote. “However, such an approach would clearly [be neither] feasible nor cost-effective given that 7,716 MW of EE resources cleared the capacity auction for the 2024/2025 delivery year alone, which could include tens of thousands, or even hundreds of thousands, of individual end-use customer sites that would need to be audited.”

While PJM agreed that improvements should be made to measurement and verifications, it said that should be done through the stakeholder process instead and indicated it plans to file M&V changes within the coming months. It also stated it intends to solicit an independent third party with expertise in EE to review the PIMV reports submitted for the 2024/25 delivery year.

“These audits will confirm or amend the final nominated EE value and capacity performance value for the EE resources that comprise the indicated energy efficiency sellers’ portfolios for the 2024/25 delivery year,” PJM said.

The American Council for an Energy Efficient Economy commented that a technical conference would be the proper forum to resolve the dispute and that the approaches favored by PJM and the Monitor would constrain EE’s ability to participate in the capacity market.

“ACEEE believes that PJM and IMM are not appropriately assessing the benefits of energy efficiency, not assigning it its deserved value and trying to kill its role in capacity markets to the detriment of electricity consumers. Energy efficiency with appropriate evaluation belongs in the capacity system, both to benefit consumers and to ease growing demand for new electric generation,” the trade group wrote.

The Environmental Law and Policy Center argued that the Monitor’s complaint is a collateral attack on past FERC orders mandating the ability for EE to offer capacity.