The economic forecasts for both New York state and the U.S. are reasonably healthy, stakeholders learned at NYISO’s annual Spring Economic Conference on June 17.

“The track that we’re on is pretty sustainable,” said Adam Kamins, senior director of Moody’s Analytics. “It doesn’t look like there’s any sort of recession imminent.”

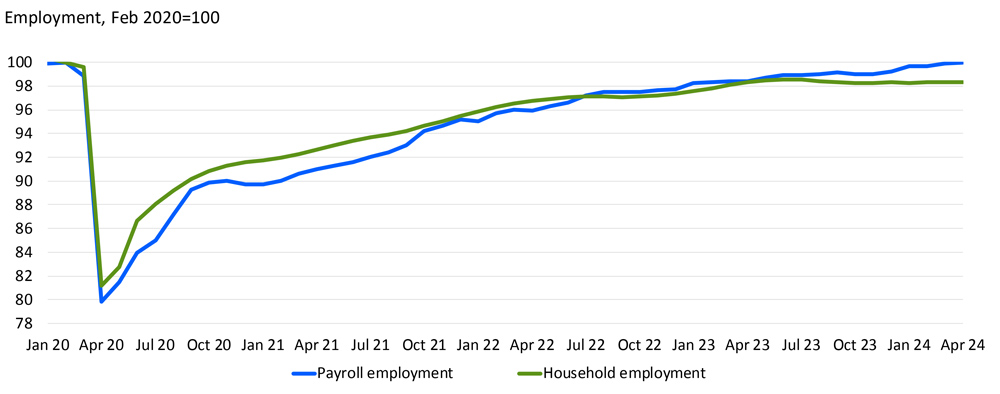

Nationally, 200,000 to 250,000 new jobs were created every month in the fourth quarter of 2023 and first quarter of 2024. This was ahead of expectations and “far stronger than expected,” Kamins said.

Kamins anticipates that while new jobs should level off nationally to closer to 100,000 per month, this is unlikely to cause additional inflation. Kamins attributed this to immigration, both documented and undocumented. New families are taking otherwise-unfilled jobs and growing the population.

“We’ve had a surge of immigrants come in and fill all of these jobs and continue to contribute to 250,000 jobs per month,” Kamins said. “But it’s not created this sort of inflationary pressure that we thought it would have if we took the census numbers at face value.”

Later in the presentation, Kamins showed that New York state was among the top destinations for new immigrants, highlighting data from immigration court filings. Many were coming to New York City, but growth could also be seen in other metro areas of Albany, Rochester and Buffalo.

Job growth in New York recovered slowly from the shock it endured during the pandemic, but it has recovered, Kamins said. He pointed to New York City as the primary driver.

“It’s not being driven by the traditional kinds of jobs of the New York City economy. This is not runaway growth in Wall Street jobs,” Kamins said. He explained that this was mostly consumer-facing jobs, driven by tourism and health care services.

The rest of the state has not recovered nearly as well, but Kamins said the outlook was pretty good for markets like Syracuse, Buffalo and Albany.

“Syracuse is clearly outgrowing the U.S. and is actually the second fastest-growing metro area in the region,” Kamins said.

He went on to highlight a “chip corridor” through the Capital Region and Central New York that extends into part of the Southern Tier and the Rochester area. This area is benefiting from the Biden administration’s increased investment in computer chip production as new facilities come online.

“The bigger picture in New York is that, with all of the investment in chip production that’s happened, Upstate New York is really becoming, if not the chip production capital of the U.S., [then] one of two or three [important] areas. … There’s a huge opportunity here.”

This “regional cluster” of chip production and similar high-tech industries could lead to substantial, sustainable growth, unlike the beleaguered Tesla electric vehicle facility in Buffalo, Kamins said.

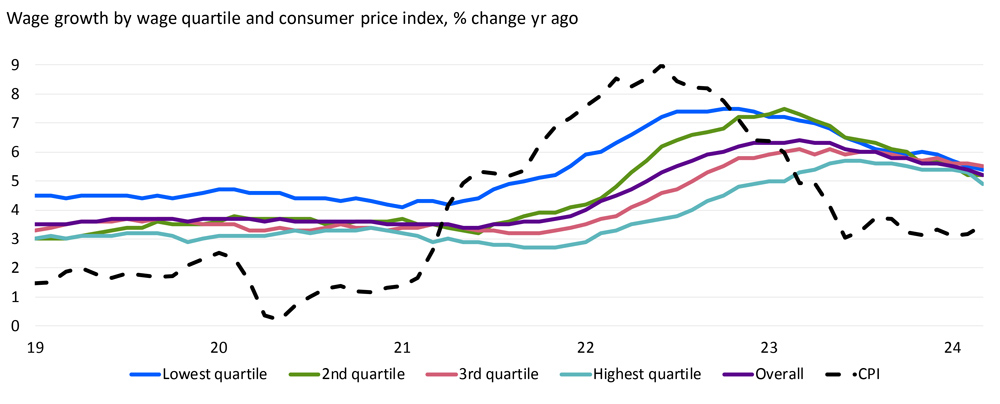

At the same time, inflation seems to have slowed down such that it is back to the Federal Reserve’s target of 2% per year. Rent growth has slowed nationally, and wage growth is catching back up to price growth. Kamins said Moody’s anticipates the Federal Reserve will cut interest rates this year.

‘Scars Remain’

Kamins cautioned that despite the stronger-than-anticipated economic picture, there were very real problems faced by consumers that have led to decreased confidence in the economy.

The past few years of inflation have outpaced wage growth, leading to an overall decrease in real wages.

“All these income quartiles, including the lowest earners, saw wage growth not keep up with inflation, meaning they’re experiencing real wage declines,” Kamins said. “That doesn’t feel good for people, and the pain is very broad.”

Kamins said this was particularly felt in lower wage earners who were already struggling to make ends meet prior to the increase in inflation. While the recovery in wage growth has begun, it hasn’t made it to where it needs to be.

“We will need another year or so of wage growth exceeding growth in inflation, which we think will happen,” Kamins said.

Another major constraint on the economy is housing. Kamins said that nationwide, including New York, lack of supply is driving increased home prices. He said that while the rate of house price growth was slowing, it wasn’t at all close to declining. Builders just aren’t building enough housing to meaningfully curtail prices. This is particularly pronounced in Buffalo.

High housing costs are partly responsible for New Yorkers migrating outward. While that has slowed in recent years, it’s still persistent. Both young professionals and retirees are leaving the state for the Carolinas, Tennessee, Florida, Connecticut and New Jersey.

Novel Emission Considerations

The conference also featured two presentations about optimizing for carbon emissions impact on both the generation and consumption sides.

Lee Taylor, CEO of clean energy advisory firm REsurety, explained the problem of local marginal emissions, the emissions rate of a particular node of the electrical grid. This is the carbon-accounting version of LMP. As load and generation change hour by hour, the ratio of renewables to fossil fuels can change depending on weather, load demand and transmission bottlenecks.

“You have a highly impactful carbon footprint of the projects that are close to the city,” Taylor said. “As you move up into the area toward the Canadian border, you get farther from the load, [and] the impact of the generation profile gets lower and lower in terms of its carbon offset.”

This means that if a renewable energy project is sited far away from the point of delivery, it has less ability to reduce emissions near that point. Taylor noted wind projects close to Canada run often but are often either curtailed or end up competing with other renewables because the power they produce can’t get to where the load is.

Taylor said the renewable energy industry was starting to take this into account when determining where to build, optimizing for cheap emission reductions rather than simply building where it is cheapest.

“A project that is 50% more expensive to build but 70% more carbon-abative is actually cheaper when your goal is to spend the least amount of money to impact the highest amount of carbon, which is, ultimately, the goal of most voluntary carbon actors,” Taylor said.

In addition to siting renewable projects in places where they would have the most emissions impact, large load customers are increasingly taking this into account when considering where to build their facilities.

“Businesses are cost optimizing,” Taylor said. “They’re looking for where does that go the furthest in dollar per ton of carbon.”

On the demand side of things, Gavin McCormick, executive director of nonprofit research group WattTime, said many companies were moving to smart load shifting to offset their emissions.

“We’ve just hit, as of today, 700 million devices worldwide that are optimizing every five minutes their consumption of electricity to reduce emissions,” McCormick said. “All signs point towards sort of roughly a doubling per year for the next four or five years.”

McCormick said this meant that about 20% of smart devices were committed, via software, to implementing this emissions-reduction strategy worldwide. While most of these devices are currently smart phones, McCormick listed several EV manufacturers, including Toyota, Honda and General Motors, as committing to this strategy.

McCormick said the impact of this load shifting on emissions wasn’t clear yet. He said his organization had joined several universities, tech companies and grid operators to attempt to empirically research the impact of this kind of mass, distributed load shifting on emissions.

“We would be very interested in speaking with ISOs about whether we are measuring emissions correctly [and whether] the effects of this [is] what we believe them to be,” McCormick said. “There’s so much corporate interest in shifting load to the cleanest time that I think it should be recognized.”