ERCOT CEO Pablo Vegas on Tuesday threw cold water on the possibility of linking the ISO and the national grid’s other two interconnections.

Reacting to “one of the important topics that comes up on a regular basis,” Vegas told his Board of Directors that interconnecting the Texas grid with its neighbors is a complex issue requiring extensive analysis and input from legislators and regulators. Connecting with other grids is not just a reliability and resilience issue, he said, but one of economics.

“It’s really a question as to whether it would be the most economical way to improve reliability and resiliency by interconnecting the grid to other grids, or would the dollars spent be better served and give us better reliability if we were to invest inside of Texas in additional transmission and other resources to help with reliability and resiliency,” Vegas told the directors during their bimonthly meeting. “That’s really the fundamental question. We’re not debating that there could be reliability or resiliency benefits by having interconnections. The question is, is it the best way to spend the dollars to get them?”

During severe weather conditions, he said, ERCOT’s neighbors would also likely be dealing with the same storms, making it less likely they could share energy with the Texas grid operator. Vegas also warned that the interconnections could have a “chilling” effect on new generation investment in ERCOT.

“[DC ties] could have the effect of making it less economically advantageous to build power plants inside of ERCOT,” Vegas said. “You could see scenarios where it would make more economic sense to build them right outside of our economy, potentially benefiting from some of the capacity market and revenues that would be available in the SPP market or in the MISO market, and then selling that power back into ERCOT when market pricing is high.

“There’s a lot of really important considerations,” he added. “You really need to model the economic impacts … between regions when [they’re] interconnected to fully understand the cost benefit or the cost impact on the ERCOT market. Those models don’t exist today. Those have to be developed and really assessed to understand the true economic impact inside of ERCOT and outside of our economy.”

An economic study is coming, said University of Texas engineering professor Michael Webber. Webber posted during the board meeting that his research team has conducted an analysis of the economic, environmental and reliability benefits of connecting ERCOT to neighboring grids.

The study has been presented and will be published “soon,” he said.

The calls for interconnection outside of Texas have grown since the 2021 winter storm. During that February, ERCOT was forced to shed load to keep the system balanced as generators dropped offline in the frigid temperatures.

U.S. Rep. Greg Casar (D-Texas) introduced a bill earlier this month mandating interconnections between ERCOT and its neighboring grids. He says the bill would reduce load shed like that during Winter Storm Uri and allow low-priced renewable energy to be sold outside the Texas grid.

The legislation was roundly derided by speakers at an ERCOT conference after it was released. (See “AC Link to National Grid Unlikely,” Overheard at Infocast’s 2024 ERCOT Market Summit.)

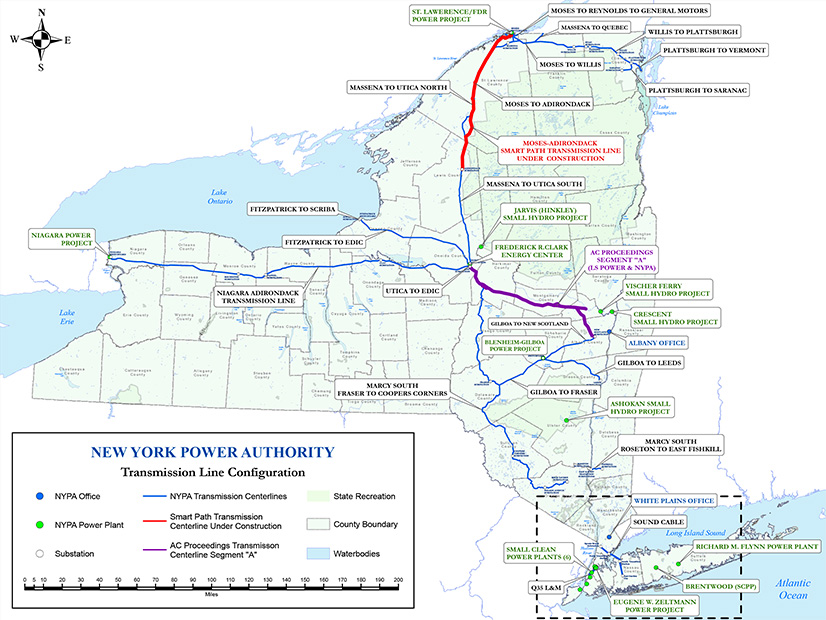

Texas does have four DC ties — two with the Eastern Interconnection and two to Mexico totaling about 1,200 MW — that are used for scheduled and emergency trades and are not treated as interstate interconnections.

A proposed DC tie, Pattern Energy’s Southern Spirit 345-kV link into the SERC Reliability region, gained regulatory approval in 2022 after seven years of review. FERC has said the project, formerly known as Southern Cross Transmission, would not trigger its jurisdiction over Texas. (See “SCT Proceeding Closed,” Texas Public Utility Commission Briefs: Sept. 29, 2022.)

The Public Utility Commission of Texas and ERCOT have both taken steps to address the issue. The PUC has opened a proceeding on DC ties’ minimum deliverability and planning assumptions and asked stakeholders to submit feedback (55984). The commission is expected to discuss the item during its March 7 open meeting.

At ERCOT, stakeholders have tabled a revision to the planning guide (PGRR105) since September over cost-allocation concerns. The measure would add DC ties to the list of resources subject to minimum deliverability conditions.

Vegas, echoing ERCOT’s comments in the PUC’s docket, told the board that any interconnections will require transmission infrastructure on both sides of the tie to “fully leverage and import the energy across them.”

“You really need to think about the economic cost overall and the economic cost of having those ties and what it means to pricing between ERCOT and the other regions that it’s connected to,” he said. “When pricing is high in ERCOT and lower in areas outside, there is the potential that you could see benefit in lowering the cost to residents inside of ERCOT in that circumstance. The flip is also true. When pricing is higher outside and lower inside of ERCOT, you could see a raising of the pricing inside of ERCOT as the price arbitrage is normalized through these DC ties.”

R Street Institute’s Beth Garza, who doubted during the ERCOT market summit that Casar’s bill would go anywhere, told RTO Insider she was “intrigued” by Vegas’ questioning of whether interconnection costs would be reasonable compared to other actions to improve reliability.

“He and the ERCOT board have vigorously challenged the [Independent Market Monitor’s] estimate of the cost of other reliability enhancements,” she said, pointing to the ERCOT contingency reserve service product. The IMM has said the new ancillary service created artificial supply shortages that produced “massive” inefficient market costs totaling about $12.5 billion last year through Nov. 27. (See ERCOT Board of Directors Briefs: Dec. 19, 2023.)

“We really need to look at the true cost, the economic impacts to the market, the economic impacts to the decision-making around generation and how generation would develop,” Vegas said. “And those are important issues that should be worked through the Public Utility Commission.”

There were no questions from the board when Vegas finished his comments.