NV Energy’s virtual power plant market potential could grow from an estimated 134 MW this year to 1,230 MW in 2035, according to a new analysis.

But the utility isn’t taking full advantage of VPPs in its resource planning, Advanced Energy United said in the July 23 report, “Moving the Needle on DERs and VPPs in Nevada.”

And that means a missed chance to reduce the need for new gas-fueled generation in the state, said AEU, an association representing the alternative energy industry.

In March, Nevada regulators approved NV Energy’s proposal to convert its coal-fired North Valmy Generating Station to gas. And in its 2024 integrated resource plan (IRP) filed in May, the utility is seeking approval for a 411-MW gas-fired unit at North Valmy to start operating in mid-2028. The estimated cost is $573 million.

“Adding new gas instead of maximizing virtual power plant (VPP) capacity is a mistake Nevada cannot afford to make,” AEU staff said in a blog post accompanying the report’s release.

VPP Benefits

In a virtual power plant, customers allow a utility or third-party firm to control their distributed energy resources in a coordinated way to provide grid benefits, such as reducing peak-hour demand.

VPPs can help utilities address resource adequacy concerns and meet decarbonization goals, proponents say. They can keep costs down for a utility, and customers who participate in VPPs receive compensation that may help offset rising utility bills.

The AEU report is the latest analysis touting the potential of VPPs.

The Brattle Group released a report in April for GridLab that estimated California’s VPP market potential in 2035 at 7,671 MW — an amount roughly equal to 15% of peak demand. (See Virtual Power Plants Could Save Calif. $750M a Year, Study Says.)

A Brattle study for Google last year found that VPPs could provide resource adequacy at a net utility system cost that’s about 40% of the net cost of a gas peaker and 60% of the net cost of a battery. (See Brattle Group Finds VPPs Cheapest Alternative for Resource Adequacy.)

“If VPPs are left out of resource planning as load grows and fossil fuel assets retire, Nevada runs the risk of saddling ratepayers with unnecessarily expensive sources of capacity,” AEU said in its report.

‘Meaningful’ Compensation

NV Energy’s new IRP includes a distributed resource plan and a demand-side management plan. It features a proposed “grid value” portfolio, aimed at providing “flexible resources to manage operating conditions of the power grid,” the IRP states.

“It’s definitely going in the right direction, but we see areas for improvement,” AEU industry analyst Chloe Holden told RTO Insider.

AEU is concerned about the “vagueness” in NV Energy’s plan, Holden said, including a lack of detail about how different devices would be treated and how customers would be compensated.

“It is essential that customers are compensated in a predictable, meaningful fashion for VPP participation and that the level of compensation drives ongoing enrollment in the VPP,” AEU said in its report.

As another “best practice,” AEU recommends that NV Energy invite collaboration with third-party VPP companies and allow VPP participants to bring their own devices rather than being restricted to utility-owned equipment.

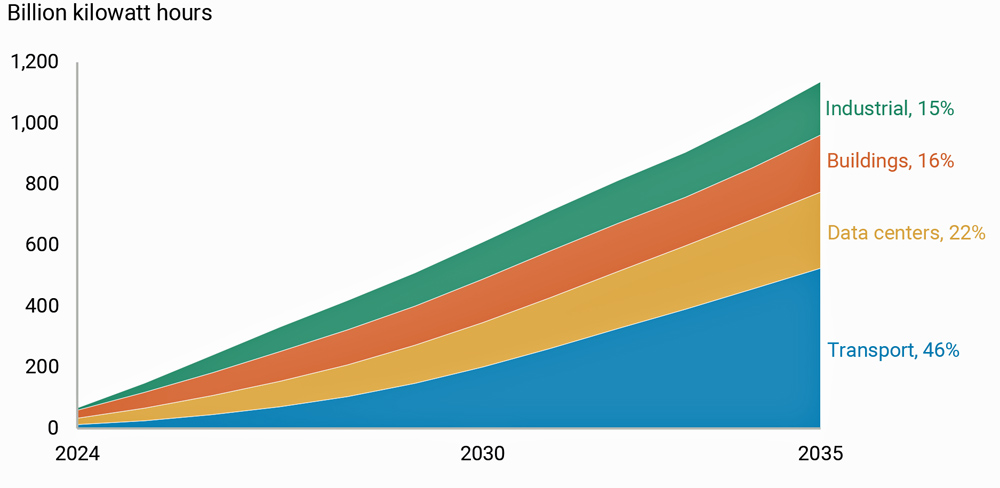

Holden said AEU took a conservative approach in its estimates of VPP market potential in Nevada. The potential increases from 134 MW in 2024 to 552 MW in 2029, 750 MW in 2031 and 1,230 MW in 2035.

The figures reflect the share of DER capacity that VPP participants are expected to provide at peak times, accounting for expected customer behavior.

DERs included in AEU’s analysis are smart thermostats, residential and commercial behind-the-meter battery storage, managed residential EV charging and managed commercial and public EV charging for both light- and heavy-duty vehicles.

The analysis doesn’t include traditional commercial demand response.

According to AEU, the 100 highest load hours for the NV Energy grid could be moderated with 721 MW of DER capacity, which is expected to be reached by 2031.