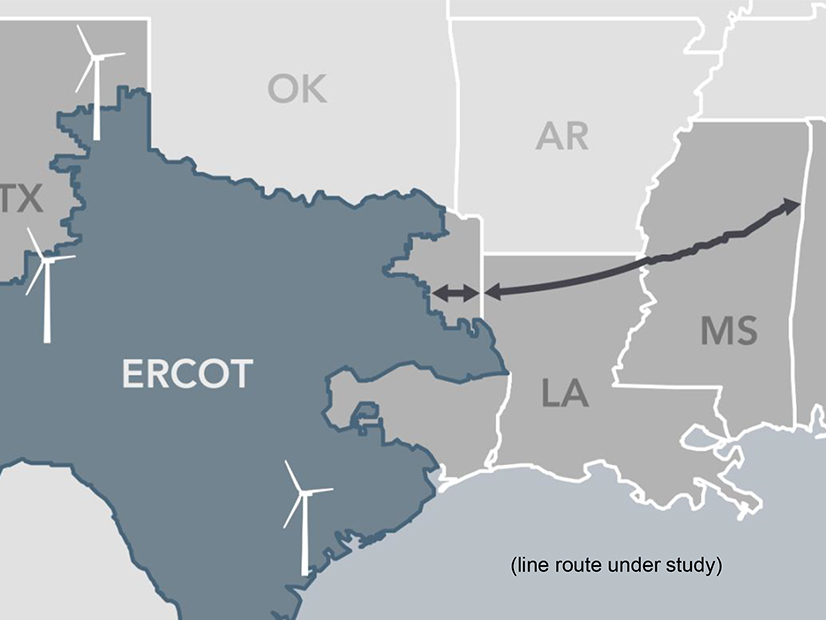

The Southern Cross Transmission (SCT) project, a merchant long-haul HVDC transmission line that would connect ERCOT with systems in the SERC Reliability region, has found new favor among Texas regulators — a development that may speed its completion.

The Public Utility Commission on Thursday directed staff to file a memo asking the proceeding’s parties for suggestions on accelerating the project, which has been under regulatory review for seven years (46304).

The SCT would be capable of carrying 2 GW of power between Texas and SERC over a 400-mile, double-circuit 345-kV line. The project has FERC approval and a waiver from the commission’s jurisdiction. It also has a certificate of convenience and necessity granted by the PUC in 2017 to Garland Power & Light, which owns the project’s western endpoint.

Renewable developer Pattern Energy’s representatives are working with ERCOT to respond to 14 PUC directives to determine whether DC ties should be economically dispatched or subject to a congestion-management plan. Five of the 12 directives have been completed and two others related to status reports are ongoing, the ISO said in its latest filing with the commission.

“We need to ensure it is crystal clear what ERCOT has to do, what the applicant has to do, what we have to do, and the time frames to get them resolved,” Commissioner Jimmy Glotfelty said during the open meeting.

Glotfelty said that if the private capital being spent is in the public interest, “we should ensure we resolve our issues so the private capital can be spent, or it will go somewhere else.”

“The regulatory responsibility and the ERCOT review are things we can speed up, finalize and be done with,” he said. “We need the parties to come forward and tell us the steps to take to move this forward.”

<img src=”//www.rtoinsider.com/wp-content/uploads/2023/06/140620231686783798.jpeg” data-first-key=”caption” data-second-key=”credit” data-caption=”

Mark Bruce, Cratylus Advisors

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”Mark-Bruce.jpg” align=”left”>Mark Bruce, Cratylus Advisors

| © RTO Insider LLC

Mark Bruce, whose Cratylus Advisors consults for the project, said he has been encouraged to hear the commission “raise broader issues applicable to all the ERCOT-connected DC ties, such as ensuring emergency imports are included in ERCOT’s planning process. (See Texas PUC Considers Adding Grid Interconnections.)

The Texas grid has two DC ties with SPP and a third with Mexico, but they are limited to a combined 1.1 GW of capacity and are primarily used for commercial purposes. ERCOT uses the same ties to exchange power with its neighbors during emergency conditions.

“This commission is taking action on all fronts to address the weaknesses revealed by Winter Storm Uri,” Bruce said in an email to RTO Insider. “Southern Cross is an important reliability component of the extreme weather solution package, so it was good to see the PUC commit to completing its review of the SCT project in the near term.”

Prioritizing Dispatchable Generation

Glotfelty and Commissioner Will McAdams agreed to collaborate on developing grandfathering provisions for fully collateralized projects in ERCOT’s generator interconnection queue with notifications to proceed.

The agreement followed a discussion over a McAdams memo calling for transmission service providers [TSPs] to prioritize the interconnection of dispatchable generation at transmission voltages. McAdams said a formal order is not necessary, but interconnections should be prioritized accordingly:

-

-

- non-inverter-based dispatchable resources;

- inverter-based resources (IBRs) or projects co-located with IBRs that can be dispatched for two or more hours;

- all other intermittent resources.

-

McAdams said his memo doesn’t push a resource to the back of the queue or restart a process but calls for policy that “provides guidance to transmission service providers in the event of a real land rush in interconnection interest.”

“Our [TSPs] need guidance from the commission on what is important to take up first,” he said, noting a need to also allow ERCOT staff to determine how a battery in the two-hour dispatch parameter would be used.

PUC Chair Peter Lake and Commissioner Lori Cobos agreed with the need to incent more dispatchable generation in ERCOT, a need also pushed by Gov. Greg Abbott during the summer. “We need to have some signal, some mechanism, so investors will associate intermittent resources with storage,” Lake said.

But as Glotfelty pointed out, “a great dispatchable resource at $12 [per MMBtu] gas is not as valuable as a zero-cost wind resource.” He called for a bigger discussion than one in a memo and two meetings.

“We will need dispatchable resources, I know that, but I’m cognizant of the guy in the interconnection queue who is deploying capital,” Glotfelty said.

“There has to be a line in the sand,” McAdams said. “We have gigawatts of power that are bearing down on our system in the next two years that will have real reliability consequences.”

The commissioners separately granted a good cause exception to ERCOT, allowing the grid operator to deploy emergency response service (ERS) before an energy emergency alert is declared. Current rules limit ERS’ use during emergency events.

“I’d move the deployment up even more,” Lake said. “I don’t want to be asking Texans to turn down lights and their businesses before fully deploying ERS. We need to use the demand response and load resources we’ve paid for before we start asking 25 million people to change the way they run their daily lives.”

Kenan Ögelman, ERCOT’s vice president of commercial operations, said ERS’s earlier deployment can be done quickly, but training operators could add time to its full implementation.

Ögelman also asked that the commissioners provide options for the appropriate balance in its ERS winter budget. The ISO procures $50 million of ERS over four contract periods during the program’s year, which runs from December to November. Over-allocating the winter period could create a shortage in another contract period.

Stakeholders File Input on Market Design

As of Monday, ERCOT stakeholders have filed 49 responses as to commission staff’s Oct. 25 memo seeking input on the PUC’s proposed market design. Stakeholders were given until Nov. 1 to file their responses and are limited to 15 pages, excluding a required executive summary (52373).

The commissioners appear to have landed on a load-serving entity obligation and reforming ERCOT’s operating reserve demand curve (ORDC). The LSE obligation is meant to address resource adequacy concerns by introducing a formal reliability standard and a mechanism to ensure sufficient resources meet this standard. (See Texas PUC Nears Market Redesign’s Finish Line.)

The questions focus on:

-

-

- whether to separate the ORDC’s “blended curve” into seasonal curves.

- modifications that can be made to existing ancillary services to better reflect seasonal variability.

- whether ERCOT should develop a discrete fuel-specific reliability product for winter.

- alternatives to the LSE obligation that could be used to impose a firming requirement on all generation resources.

-

The commission will hold another work session on the market redesign Thursday.

PUC Opens Competition Docket

Following up on discussion during its Oct. 7 open meeting, the commission opened a docket to allow non-ERCOT customers to comment on whether they should become part of a competitive market. (See Regulators Debate Competition in Entergy’s Texas Footprint.)

The docket only applies to Entergy Texas, Southwestern Public Service Company and Southwestern Electric Power Company (SWEPCO) customers (52760).

In other actions, the PUC:

-

-

- assessed a $20,000 administrative fee to SWEPCO for once again exceeding the system average interruption duration index standard for outages in the 2019 reporting year. It was the fifth straight year SWEPCO has exceeded the SAIDI standard (52116); and

- approved 2022 energy efficiency cost recovery factors of $63,052,922 for CenterPoint Energy (52194) and $26,921,197 for AEP Texas (52199).

-