New Jersey legislators backed a bill Monday that would prevent state agencies from requiring buildings to use electric heating or hot water boilers as part of the state’s carbon reduction efforts, echoing efforts in 20 states to keep natural gas and other alternative fuel options viable.

New Jersey’s Senate Community and Urban Affairs Committee voted 5-0 to support the bill, S4133, which would prohibit any state agency from enacting a requirement that makes electric heating the “primary means” of heating or providing hot water to commercial or residential buildings in the state.

Although some supporters of the bill acknowledged that the state has made no move to mandate the use of electric heating, they said that such a mandate could result from Gov. Phil Murphy’s 2019 Energy Master Plan, and his drive to power the state with 100% clean energy by 2050. Murphy’s plan calls for heavy investment in electricity infrastructure, including solar and offshore wind facilities, and in promoting the use of electric vehicles (EVs).

The plan also calls for the building sector, which accounts for 62% of the state’s end-use energy consumption, to be “largely decarbonized and electrified” by 2050, with a focus on “new construction and the electrification of oil- and propane-fueled buildings.”

Following his narrow re-election last month, Murphy signed an executive order setting a new target for greenhouse gas reduction in the state — 50% over 2006 levels by 2030 — moving toward his goal of an 80% reduction by 2050. (See Murphy Toughens NJ Emission-reduction Goals.)

The bill’s advance follows the introduction of so called “preemption bills” that would prevent electrification requirements in 20 states this year, 16 of which have been enacted or await their governor’s signature, said Rita Yelda, spokeswoman for the Natural Resources Defense Council (NRDC). Another four such preemption bills designed to stop electrification took effect in 2020, Yelda said.

Preemption legislation is put in place to stop the later enactment of a policy that the preemption supporters oppose. Media reports depict the opposition to electricity as a campaign waged by the natural gas industry to protect its interests. The impetus for these laws can be traced back to ordinances in more than 20 cities in California either requiring or encouraging building electrification in new construction.

The committee’s approval came as the Assembly Telecommunications and Utilities Committee amended and supported a bill, A5655, that could also put a damper on Murphy’s focus on electricity. The bill would require the state Board of Public Utilities (BPU) to create a program to “encourage the procurement of renewable natural gas (RNG) and utility investment in supporting infrastructure.”

The bill, which defines RNG as biogas, hydrogen gas or methane gas, initially set a target that by 2022 5% of gas used in the state should be RNG, rising to 30% by 2045. But an amendment removed the targets before the committee released the bill. It also sets out a mechanism by which ratepayers would fund investments made in line with the bill’s requirement to encourage the use of RNG. The funds will be “recovered from ratepayers by means of a periodic recovery mechanism established by the” BPU, the legislation states.

Neither of the two bills is close to enactment, as both still need Senate and Assembly approval, before going to Murphy’s desk. To be enacted, they will need to pass both houses by the time the session ends in mid-January or start the legislative process again in the new session.

Mandate or not?

The Senate hearing on the possible prohibition of an electricity mandate drew support for S4133 from more than a dozen business groups and private companies, among them the New Jersey Chamber of Commerce and the New Jersey Business & Industry Association, two of the biggest business lobbying groups in the state. Supporters also included the New Jersey Propane and Gas Association, the Fuel Merchants Association of New Jersey and several advocacy groups for the building industry.

In opposition, environmental groups argued that the bill is misleading in its concept and would limit the state’s ability to fight climate change.

“This bill presumes that mandates are already happening, are about to happen, and they are not, not even close,” said David Pringle, a steering committee member of Empower NJ, which represents a coalition of environmental groups. “And it ties the hands of government to tackle the climate crisis, which is unacceptable.

“Making it harder to appropriately electrify means more people will die sooner,” he said, adding that the fossil fuel industry is “shamelessly using scare tactics.”

Proponents of the legislation said that the bill would merely allow the state to keep its options open and adopt low-carbon alternatives to electrification if such technologies are developed to the point where they are viable.

“We believe it’s far too early to pick winners and losers and force one type of energy on our residents,” said Robert Pohlman, managing director of innovation and strategic initiatives at New Jersey Natural Gas, a natural gas utility.

He said the ratepayers had invested $17 billion to create the infrastructure through which natural gas is supplied to their homes. That infrastructure could be used to bring alternative fuels, such as hydrogen or RNG, to consumers, but it would be discarded if buildings transitioned to electricity.

“The state must not close itself off from the future benefits of investment, innovation and competition happening around low-carbon fuels today,” Pohlman said.

Arguing that Murphy will ultimately want to mandate electric heating, Eric DeGesero, executive vice-president of the Fuel Merchants Association of New Jersey, cited proposed rules that the state Department of Environmental Protection issued Monday that would place additional permit requirements on fossil-fuel fired boilers. The proposed rules would also ban the use of No. 4 and No. 6 fuel oils, both of which can be used for space heating and power generation, according to the U.S. Energy Information Administration.

“It’s absolutely true,” that the master plan does not mandate electric heating use, DeGesero said. Instead, the master plan “says we’re going to get rid of heating oil and propane first, because you guys are smaller market share. And then we’ll get to natural gas later.”

Echoing other bill supporters, DeGesero said that the association agrees with Murphy’s climate change goals but not with the governor’s plan for achieving them. He said some of the policies create a scenario in which “the clock is ticking on putting the Fuel Merchants Association members out of business.”

Cost of Electricity

Much of the discussion centered on the cost of electrification and the cost of implementing Murphy’s masterplan. So far, his administration has not estimated the cost and in May moved to hire a consultant to make that calculation, with the outcome expected around the end of 2022.

Sen. Troy Singleton, (D), the committee chair, said there is little doubt that natural gas heating is cheaper than electricity and that some low-income homeowners would be “potentially priced out” if they had to convert their home to electric heat. But he added that even if the bill passed, and there could be no mandate to use electric heating in the state, there would be nothing to stop the government from offering incentives to persuade homeowners to convert.

“We do (that) in a whole host of other renewable energy spaces, which have proven to work,” said Singleton, who voted in support of the bill.

Eric Miller, energy policy director for the Natural Resources Defense Council, argued that the greater use of heat pumps would help keep costs down, and so make electrification attractive in the long run. Heat pumps employ an electric heating and cooling technology that extracts heat from the air, water or ground outside a building and transfers it inside.

He cited studies by the Acadia Center, a clean energy advocacy group, which has reported that a home that fully converts from propane to heat pumps could save $1,650 a year on fuel. He argued that the bill could limit the ability of government departments to back energy programs that their studies show are effective and consumer friendly.

“Those programs need the flexibility to adapt to new technologies and make sure that customers have affordable and clean heat in their homes,” he said.

Sen. Declan J. O’Scanlon, (R) a committee member and sponsor of the bill, said he is concerned about the cost of the governor’s master plan. He said the legislation is designed to stop “the government putting its hand on the scale,” and restricting consumer choices by picking one particular way to get to a carbon-free energy.

“It’s got to save money,” he said. “And (if) you’re saying that it will ultimately save money, people will naturally choose these things.”

Joseph Uglietto, president of Diversified Energy Specialists, a Massachusetts-based renewable energy consultant that helps biofuel distributors reduce their carbon emissions, said the topic is key because so many households in the state use fossil fuels to heat their homes, He cited a project by the Massachusetts Clean Energy Center that concluded that retrofitting an existing building with a heat pump costs on average $20,000.

DeGesero, who has been working with Uglietto, said, “It sounds very expensive, very time consuming and very inefficient.”

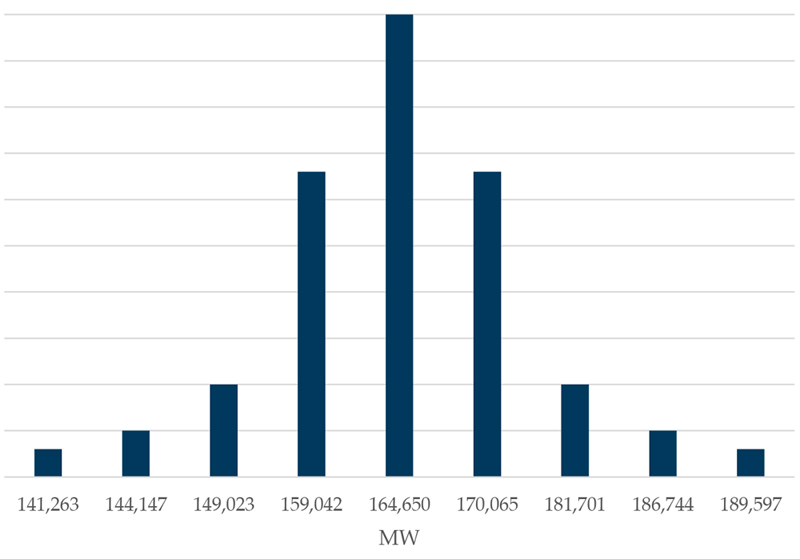

Peak hour demand variability across the Western Interconnection | WECC

Peak hour demand variability across the Western Interconnection | WECC