New York enters 2022 having greenlighted the state’s largest transmission projects in 50 years, with its first offshore wind project ready to put steel in the water and with officials having approved a plan for reaching emission limits set by the Climate Leadership and Community Protection Act (CLCPA).

The 2019 CLCPA and other statutes set high clean energy targets staggered every five years from 2025 to mid-century, with strict emissions limits that regulators cited in October when denying air quality permits to proposed gas-fired generators in the Hudson Valley and New York City. (See NY Regulators Deny Astoria, Danskammer Gas Projects’ Air Permits.)

Here’s a roundup of some of the biggest developments of 2021 and a look ahead to the new year.

Transmission to Deliver Renewable Power

The New York State Energy Research and Development Authority (NYSERDA) in November signed a contract for the 174-mile Clean Path New York transmission line being developed by a joint venture of Invenergy, EnergyRe and the New York Power Authority to bring solar and wind energy from upstate to New York City (15-E-0302).

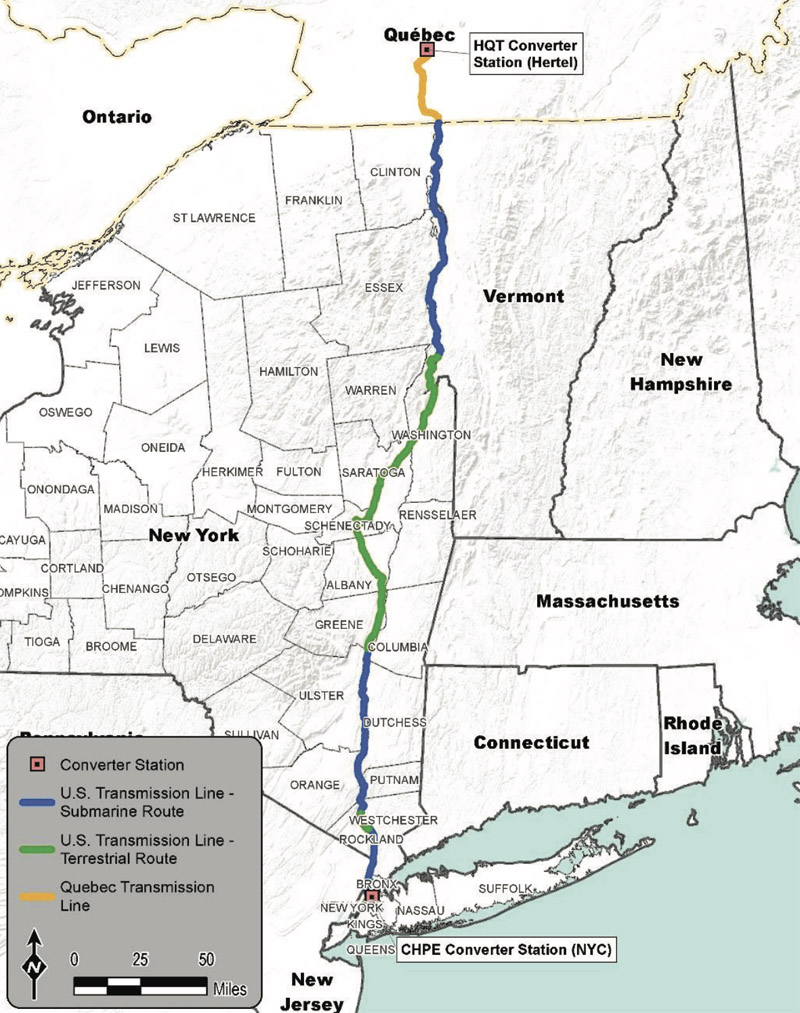

Map shows the full length of the Champlain Hudson Power Express transmission line from Quebec to New York City. | HQUS

Map shows the full length of the Champlain Hudson Power Express transmission line from Quebec to New York City. | HQUSThe agency also signed a contract with Hydro Quebec Energy Services for the 339-mile Champlain Hudson Power Express line being developed with Transmission Developers Inc. to bring Canadian hydropower and some upstate renewables to the city. (See Two Transmission Projects Selected to Bring Low-carbon Power to NYC.)

The contracts are subject to approval by the Public Service Commission, which will accept public comments through Feb. 7.

Some environmentalists oppose the developers’ plan to lay the Canadian line’s cable along 200 miles in Lake Champlain and the Hudson River. Environmental organization Riverkeeper said that process could churn up long-dormant contaminants such as polychlorinated biphenyl (PCBs), which were dumped into the Hudson by General Electric between 1947 and 1977.

The Clean Path line runs from Delaware County, in New York’s Southern Tier economic development region, through the Mid-Hudson region to New York City. A majority of the transmission line will be built on existing rights of ways already used by roads and transmission lines, developers said.

Construction could begin this year for the 1,250-MW Champlain Hudson, which is targeting a 2025 commercial operation date. The 3,800 MW Clean Path project is expected in service by 2027.

OSW Turbines for Downstate

The U.S. Bureau of Ocean Energy Management (BOEM) in November approved the construction and operations plan for the 132-MW South Fork Wind Project being built for the Long Island Power Authority, the second major offshore wind project in the country to move forward following the 800-MW Vineyard Wind I project. (See Interior Greenlights South Fork Wind Project COP.)

A joint venture between Ørsted and Eversource Energy (NYSE:ES), South Fork will be located approximately 19 miles southeast of Block Island, R.I., and 35 miles east of Montauk Point, N.Y. The developers say they hope to begin construction on the project’s underground transmission line this month. Commercial operation is expected by the end of 2023.

Meanwhile, BOEM plans to auction new wind energy areas in New York early this year. (See New York Writing Ending to Tale of Two Grids.)

Last year, New York said it had selected Equinor and its partner BP to build 2.5-GW of offshore wind: an additional 1,260 MW for their Empire Wind project in the New York Bight, and 1,230 MW for Beacon Wind, to be situated 60 miles east of Montauk. The state, which has targeted 9 GW of offshore wind for construction by 2035, previously selected the 816-MW initial phase for Empire Wind. Beacon Wind could add up to 1,170 MW in the future. (See NY Awards 2.5-GW Offshore Deal to Equinor.)

Equinor has begun constructing the port facilities needed to build and operate their projects, using the Port of Albany for tower manufacturing, the nearby Port of Coeymans for turbine foundation manufacturing, and turning the South Brooklyn Marine Terminal into an assembly and operations and maintenance hub. (See NY Builds OSW Ports in Brooklyn, Albany, Long Island.)

Without coordinated planning, NYISO says transmission congestion around New York City could increase after the first 6,000 MW of offshore wind is interconnected.

In a NYSERDA-commissioned study released in November, The Brattle Group concluded that high voltage alternating current (HVAC) would be better than high voltage direct current (HVDC) for a cost effective meshed offshore grid. Because most of the offshore wind lease areas are close to shore, distance constraints associated with HVAC will not be an issue, the study said.

“Most lease areas up for auction are within 20 miles from each other. At this distance HVAC is a much more suitable option,” the study said. “HVAC also allows for less expensive upfront costs and technology risks to developers, which will enable higher degrees of cooperation and acceptance of a meshed solution.”

Climate Scoping Plan

In March, the state’s Climate Action Council will begin holding at least six regional public hearings on the draft scoping plan it approved in December for meeting the state’s climate goals. (See NY Officials Approve Draft Climate Action Plan.)

The scoping plan incorporated recommendations from the Climate Justice Working Group, the Just Transition Working Group and seven advisory panels: Transportation; Agriculture and Forestry; Land Use and Local Government; Power Generation; Energy Efficiency and Housing; Energy Intensive and Trade Exposed Industries; and Waste.

Climate projections for New York state. | NYSERDA

Climate projections for New York state. | NYSERDA

The public will have at least 120 days to submit comments on the plan, and the Council will incorporate the feedback over the course of the new year before issuing a final plan by Jan. 1, 2023.

New York officials in December also announced the release of a roadmap outlining expanded programs to achieve 10 GW of distributed solar in the state by 2030 (Case No. 21-E-0629).

The state defines distributed solar as projects under 5 MW, including rooftop installations and community solar projects. The new framework builds on New York’s solar energy progress so far, with installed distributed solar and projects under development already totaling 95% of the state goal of 6 GW by 2025.

NYSERDA and the Department of Public Service (DPS) submitted the roadmap to the Public Service Commission for public comment, which is due March 7. (See New York Issues 10 GW Solar Roadmap for 2030.)

The expanded NY-Sun initiative aims to encourage the construction of at least 1,600 MW of new solar capacity to benefit disadvantaged communities and low-to-moderate income New Yorkers. It proposes that at least 450 MW be built in Con Edison’s service territory covering New York City and parts of Westchester, which would increase solar capacity in the ConEd region to more than 1 GW by the end of the decade.

NYSERDA also proposes that at least 560 MW of new solar generation be built on Long Island through the Long Island Power Authority.

NYISO Market Changes

NYISO last month updated stakeholders on several wholesale market changes it is making to accommodate the thousands of megawatts of state-solicited renewable resources coming online in New York over the next decade. (See NYISO Updates Grid in Transition Work and Plan for 2022.)

The measures range from carbon pricing — which has not been endorsed by the governor or the legislature — to buyer-side mitigation reforms and distributed energy resource participation models, including for storage, hybrid and co-located resources, all part of the ISO’s Grid in Transition initiative announced in 2019. The Grid in Transition initiative is focused on aligning New York’s competitive markets with the state’s clean energy objectives, valuing reserves for resource flexibility, and improving capacity market valuation.

In addition to working on buyer-side mitigation tests and capacity accreditation, the ISO expects to complete development and deployment of the remaining software for its distributed energy resources (DER) participation model in 2022.

The ISO also posted the final version of its 2022 Master Plan for changes to the energy, ancillary services and capacity markets.

In addition to addressing climate change, state officials hope offshore wind and other clean energy policies will have an economic payoff: A study commissioned by New York officials predicts that clean energy employment in the state will increase by at least 211,000 jobs this decade and by nearly 350,000 by mid-century. (See NY Predicts 200K+ New Clean Energy Jobs by 2030.)