CHARLOTTE, N.C. — About 300 representatives from independent power producers, utilities, law firms and regulatory agencies met at Infocast’s sixth annual Southeast Renewable Energy conference last week to discuss the region’s progress in integrating solar power.

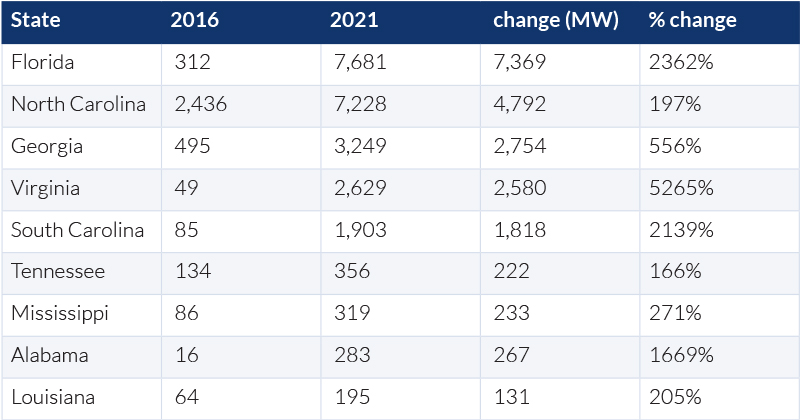

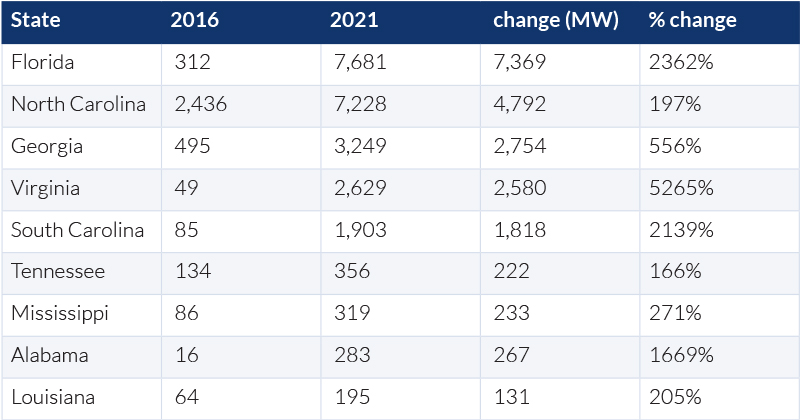

Michael B. Woodard, a partner with McGuireWoods, introduced a panel of regulators by showing a chart of states’ growing solar capacity since 2016, with Florida now in the top spot, having supplanted North Carolina. The Sunshine State trails only California and Texas nationally as of the second quarter of 2021, according to the Solar Energy Industries Association.

Other states in the Southeast, however, are playing catch-up, speakers said. Here’s some of what we heard.

State Regulators Panel

Arkansas regulator Ted Thomas joined Georgia’s Lauren “Bubba” McDonald and Mississippi’s Brandon Presley (participating virtually) in a panel on issues facing their states.

Ted Thomas, Arkansas PSC | © RTO Insider LLC

Ted Thomas, Arkansas PSC | © RTO Insider LLCThomas, chairman of the Arkansas Public Service Commission, said state regulators must be flexible to respond to the pendulum swings of federal clean energy policy. “We don’t know what’s going to happen. What happens might, in fact, change in four years,” he said. “What we’re trying to do is be prepared regardless of which of the scenarios happen.”

Thomas said regulators look to entrepreneurs to help them judge emerging technologies. “We don’t know what the customer wants. We don’t know what the feds are going to tell [us we] have to have,” he said. “But entrepreneurs test demand.”

McDonald, re-elected to the Georgia Public Service Commission last year, defended his support of the delayed and overbudget Vogtle Units 3 and 4, which he proudly noted are the first new nuclear plants built in the U.S. in more than three decades. The cost of the project has nearly doubled from early estimates of $14 billion to about $27 billion.

Southeast solar capacity by state (MW) as of Q2 2021 | Solar Energy Industries Association

Southeast solar capacity by state (MW) as of Q2 2021 | Solar Energy Industries Association“It hasn’t been easy, [but] I’ve committed to it,” he said. “Nuclear is the best friend that solar energy has, because [it] runs 24/7 [at] 99.8% [capacity factor]. And it’s cheap, and it’s clean.”

McDonald acknowledged Vogtle’s cost overruns and delays. “My personal preference as a regulator is the least regulation is the best regulation. But we do have to intervene sometimes when a project gets out of hand. We’ll have to spank somebody a little bit and straighten it back up.”

Presley, a Mississippi Public Service Commissioner, acknowledged his state has trailed in renewable energy development but said the PSC will be issuing “forward-looking” rulemakings soon on net metering rules and community solar in a bid to attract new generation.

“Money, it completely votes with its feet. … The Fortune 100 [companies], the Fortune 50s — in any economic development project — one of the biggest questions on the map is whether or not you have a renewable source of power,” he said. “We know that [other] states are ahead of us on [that], and we’re working like the dickens to catch up.”

He said the PSC is to blame. “For a long time, they did pretty much what Mississippi Power and Entergy and others wanted done, and that has really led over time to things like the Kemper County power plant,” he said. Initially estimated at $2.4 billion, the cost of the carbon capture and sequestration plant more than tripled to $7.5 billion before the project was canceled.

“Imagine if we had invested those dollars at that time in renewable energy research, renewable energy projects, where we would be on the rankings today,” Presley said. “If the South is going … to pull forward out of the economic morass that we find ourselves in … we’ve got to attract this development.”

Presley said the state’s utilities should take full advantage of federal infrastructure funding for upgrading transmission and hardening assets. “There’s going to be some dollars in this infrastructure bill that can go to offset that. The utilities are going to have to be aggressive. I really don’t want to hear them come in before me and tell me about how laborsome and awful it is to go through and apply for this federal money,” he said. “We’ve got to get this work done. And God forbid that we look back 10 years from now, 15 years from now, and we sat on our hands and did not take advantage of what’s on the table today.”

Build Back Better Impact

Democrats’ Build Back Better act, approved by the U.S. House of Representatives and pending before the Senate, was also a subject of discussion.

Akin Gump partner Shariff Barakat said the law’s direct pay provisions won’t eliminate the need for tax equity investors because of the volume of extended and expanded tax credits and “timing issues,” including the inability to offset estimated tax payments. He also said depreciation may be more valuable with a tax equity investor and that projects beginning construction after 2023 will need to satisfy domestic content requirements to use direct pay without penalties.

Solar Panels Increase Resilience in Hurricanes?

PosiGen Solar, which develops rooftop solar for low- and moderate-income residents, has 12,000 systems in Louisiana, many of them along Interstate 55 — coincidentally the path that Hurricane Ida took in August. More than 3,000 houses suffered storm damage, but less than 50 systems had to be replaced, CEO Thomas Neyhart said.

“The solar systems reinforced the roof; the solar systems help harden it,” he said, displaying an aerial photo showing blue tarps over damaged roofs beside undamaged roofs with solar.

“We’re having a study done right now by [Louisiana State University] on how to harden roofs, not just by putting solar on but then also using the right types of shingles and the right types of construction to allow them to sustain direct winds of 130 to 150 mph. We think there’s a great future in our ability to help harden roofs in some of these hardest hit areas,” he added. “More importantly, though, as you think about the future, we start to think about batteries. … We’re working right now with the governor’s office and the incoming [City] Council members to try and put together a battery program for the hardest hit people in Louisiana, which is down in New Orleans.”