Work on the Democrats’ $2 trillion Build Back Better Act came to a screeching halt Sunday morning as Sen. Joe Manchin (D-W.Va.) stated unequivocally that he could not vote for the bill in its current form.

“I have always said if I can’t go home and explain it to the people of West Virginia, I can’t vote for it,” Manchin said on “Fox News Sunday.” “And I cannot vote to continue with this piece of legislation. I just can’t. … This is a no.”

President Joe Biden “has worked diligently; he’s been wonderful to work with,” Manchin said of his negotiations with the White House. But he said the government should focus on inflation and the new surge in COVID-19 cases, driven by the fast-spreading Omicron variant.

White House Press Secretary Jen Psaki said the administration was blindsided, labeling Manchin’s statements “a sudden and inexplicable reversal in his position and a breach of his commitments to the president and the senator’s colleagues in the House and Senate.”

Manchin had repeatedly told Biden he was committed to working on the bill, Psaki said. “On Tuesday of this week, Sen. Manchin came to the White House and submitted — to the president, in person, directly — a written outline for a Build Back Better bill that was the same size and scope as the president’s framework and covered many of the same priorities. While that framework was missing key priorities, we believed it could lead to a compromise acceptable to all. Sen. Manchin promised to continue conversations in the days ahead and to work with us to reach that common ground.”

In his own statement, released following his appearance on Fox, Manchin said that the bill represented efforts by Democrats to “dramatically reshape our society in a way that leaves our country even more vulnerable to the threats we face.”

He also reiterated his longstanding argument that U.S. energy policy should be driven by innovation and markets, rather than regulation.

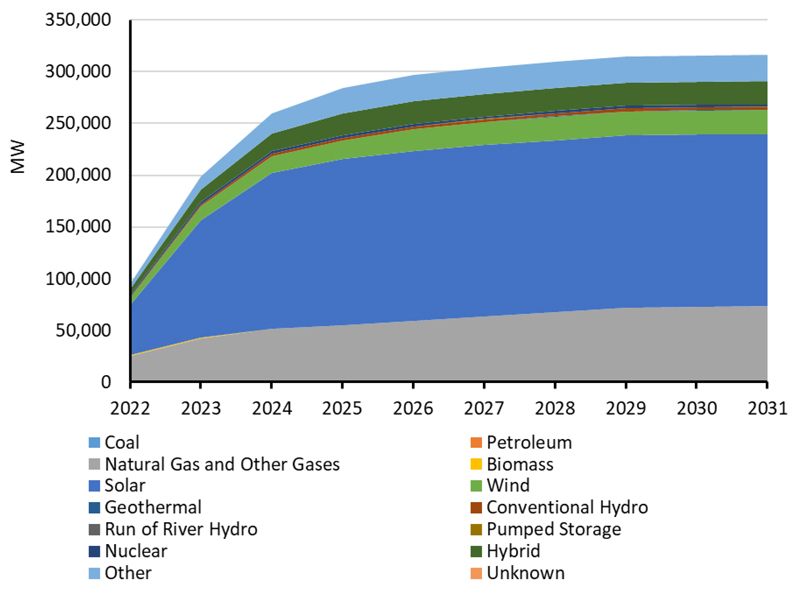

“If enacted, the bill will also risk the reliability of our electric grid and increase our dependence of foreign supply chains. The energy transition my colleagues seek is already well under way in the United States of America,” he said. “We have invested billions of dollars into clean energy technologies so we can continue to lead the world in reducing emissions through innovation. But to do so at a rate that is faster than technology or the markets allow will have catastrophic consequences for the American people like we have seen in both Texas and California in the last two years.”

‘This is not Over’

Clean energy advocates have lobbied hard for the bill, which contains $555 billion in funding for renewable energy tax credits and other programs aimed at achieving Biden’s goals of decarbonizing the U.S. electric grid by 2035 and cutting the nation’s carbon emissions to net zero by 2050. Supporters pledged to continue their efforts despite Manchin’s announcement.

Speaking on CNN’s “State of the Nation,” Sen. Bernie Sanders (I-Vt.) said Manchin is “going to have to tell the people in West Virginia why he’s rejecting what the scientists of the world are telling us, that we have to act boldly and transform our energy system to protect future generations from the devastation of climate change.”

Sanders also called for Democrats to “bring a strong bill to the Senate as soon as we can and let Mr. Manchin explain to the people of West Virginia why he doesn’t have the guts to stand up to powerful special interests.”

“This is not over,” said Gregory Wetstone, CEO of the American Council on Renewable Energy. “The clean energy tax platform and grid infrastructure provisions in the Build Back Better Act are our last, best chance to tackle climate change. We will be working with Congress to find a way forward and deliver the clean energy future Americans want and deserve. Failure is not an option.”

Erin Duncan, vice president of congressional affairs for the Solar Energy Industries Association, also signaled the organization’s determination to keep fighting for the bill.

“There have been many twists and turns in this legislation, but the need for jobs, particularly domestic manufacturing jobs, that help address the climate crisis is unrelenting,” she said. “This is not the end of the road. We will continue to advocate aggressively for policies that deliver jobs and clean energy to every state across America.”

The debate also exploded on Twitter, where Robert Reich, who served as secretary of Labor for former President Bill Clinton, said Congress’s adjournment at 4 a.m. Saturday ended any hope for passing Build Back Better this year. “Biden’s agenda is now at the mercy of the midterm election year,” Reich said.

Calling Manchin “the new Mitch McConnell,” Rep. Jamaal Bowman (D-N.Y.) questioned whether Manchin’s opposition to the bill was influenced by special interests. “When you say you’re a no on Build Back Better — is it you? Or is it the special interest that powers you?” Bowman tweeted. “I’m inviting you to my district to see just how badly we need this bill. Will you tell my community ‘No’ to our face?”

On the other side of the aisle, Rep. Dan Crenshaw (R-Texas) was jubilant, tweeting that Manchin’s no means that “America has dodged a serious bullet. BBB is dead. Merry Christmas!”

ClearView Partners, a D.C.-based research firm, anticipates the new year could bring a revised Build Back Better Act (BBBA) with trimmed down energy spending.

“Democrats could face a Hobson’s Choice on a next bill (i.e., a significantly smaller bill or nothing at all),” ClearView said in a note to clients. “A future draft therefore would seem unlikely to retain the breadth and depth of clean energy spending in the House-passed BBBA. … We would not yet bet against long-term green power tax credit extensions in some form, albeit for shorter durations and/or with less generous provisions.”

Keeping Coal in the Picture

As chair of the Senate Energy and Natural Resource Committee and one of two critical swing votes in the evenly divided Senate, Manchin, along with Sen. Kyrsten Sinema (D-Ariz.), has had an outsized ability to shape key legislation, especially anything related to energy policy.

His opposition had already cut key provisions from the bill, most prominently Biden’s Clean Electricity Performance Program, which would have provided incentives for utilities to accelerate their switch to carbon-free power.

Manchin describes himself as a “conservative Democrat,” but his opposition to aggressive clean energy programs reflects his strong ties to the coal industry in his home state of West Virginia. He earns hundreds of thousands of dollars annually from Enersystems, the coal company he started, which is now run by his son, Joseph Manchin IV.

Manchin has long maintained the family business does not constitute a conflict of interest because he put his investments in a blind trust.

But The Washington Post reported last week that his most recent financial disclosure showed the company paid him $492,000 in interest, dividends and other income in 2020 and was worth between $1 million and $5 million. The blind trust Manchin created with $350,000 in cash in 2012 generated no more than $15,000 last year, the Post reported.

Manchin regularly speaks in favor of bipartisan legislation, especially when it contains dollars for his home state of West Virginia and the coal industry. For example, the $1.2 trillion bipartisan infrastructure bill, which he helped shepherd through the Senate, includes billions for the development and deployment of carbon capture, storage and sequestration projects.

Similarly, on Thursday, Manchin and Sen. John Barrasso (R-Wyo.), ranking member on the Energy and Natural Resources Committee, introduced a bill that would establish a program to provide federal dollars for building advanced nuclear reactors and related supply chain facilities on or near retired coal plants.

“Advanced nuclear technologies provide an opportunity to repurpose shuttered coal and fossil generating plants,” Manchin said in the press announcement of the bill. Such projects “could bring new high-paying jobs and economic opportunities to communities throughout West Virginia and the nation while expanding our domestic nuclear supply chain.”