By Devin Hartman

Devin Hartman, R Street Institute | R Street Institute

Devin Hartman, R Street Institute | R Street Institute

The Midwest has become ground zero for the future of transmission policy. Reliance on incumbent transmission owners to dictate state policy and regional transmission practices in MISO has led to higher costs, stifled innovation and a backlash to grid expansion. By extension, the reliability and environmental benefits of grid expansion hang in the balance. Implications for state legislatures, utility commissions and FERC are clear: inject more independence into transmission practices and enable competition to flourish.

The Midwest’s economy has succeeded when good governance and fair competition prevail. Transmission is no different. Upon the national introduction of transmission competition, competitive projects averaged 40% below initial cost estimates, whereas non-competitive projects averaged 34% above initial estimates.[1] An independent assessment found a 22 to 42% cost savings from competition in MISO specifically.[2] The problem is that competition and advanced technologies are hardly used because incumbents evade an incomplete regulatory framework that they helped design.

Methods and technologies that expand grid capacity and lower costs are sternly opposed by cost-of-service utilities eager to maximize rate base. For example, an upper Midwest pilot on topology optimization, which reroutes grid congestion, could scale up to save regional consumers hundreds of millions of dollars annually, improve grid resilience and increase wind integration.[3],[4] Unsurprisingly, expanding this technology is attracting interest from consumers, clean energy interests, the Organization of MISO states and the MISO independent market monitor (IMM).[5],[6] Yet one obstacle remains: incumbent utilities, which actively suppress efforts to use existing rate base more efficiently.

FERC issued a rule last December to address a similar problem: utilities were failing to implement best practices in transmission line ratings. A key motivator of the decision was analysis by MISO’s IMM saying that such practices would have saved MISO customers over $100 million in 2019 and 2020 alone.[7] Such analyses are the exception, not the rule, and speak to the imperative of more robust independent transmission oversight.

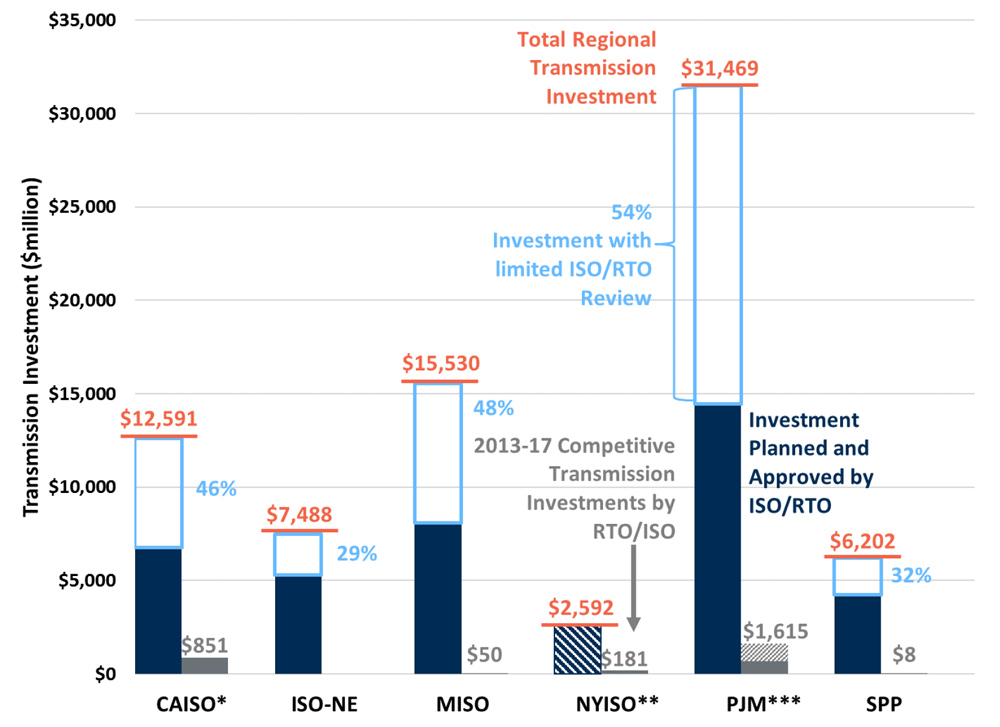

IMMs are also noting that incumbent TOs hold outsized influence in transmission planning processes, such as shaping planning inputs to their advantage, not actual values.[8] This contributes to planning processes that are short-sighted and do not reflect future generation.[9] Incumbents’ influence is further evident in the technical exclusions of transmission projects from competition solicitations. This has enabled incumbents to evade regional planning processes subjected to competition and build local projects instead, where they face neither competition nor economic regulatory scrutiny.

FERC-jurisdictional transmission investments with full and limited stakeholder review within ISO/RTO regional planning processes (2013-2017) | The Brattle Group

FERC-jurisdictional transmission investments with full and limited stakeholder review within ISO/RTO regional planning processes (2013-2017) | The Brattle Group

Unfortunately, this has led some to blame competition for the lack of regional transmission development, rather than the faulty regulatory framework that encourages problematic incumbent behavior. Make no mistake, reverting to exclusive incumbent control will undermine transmission expansion. Those tempted to believe that incumbents streamline transmission development need only examine MISO South, where incumbent utilities obstructed plans to build transmission that would boost severe weather resilience and enable cleaner, lower-cost energy access.[10]

Given the advantage of competition, it may seem paradoxical that some Midwest legislatures have passed anti-competitive “right of first refusal” (ROFR) laws to grant incumbents exclusive rights to build, own and operate transmission assets. But the recipe for this is no surprise; the concentrated interests of incumbent utilities exert a lobbying effort that overwhelms the voices of dispersed interests, namely consumers. In Michigan, the most recent state to pass a ROFR, incumbents overrode opposition from the Michigan Chemistry Council and conservative Mackinac Center for Public Policy.[11] Incumbent utilities are also behind new proposed ROFR legislation in Wisconsin, which the Wisconsin Industrial Energy Group has called “really terrible public policy” with billions at stake for customers.[12] As noted by Americans for Tax Reform, ROFR is effectively “a regressive tax hike on individuals, families and employers” in the Midwest.[13]

States have the right to shoot themselves in the foot. But they cannot harm their neighbor. ROFR for regional transmission projects unquestionably harms interstate commerce. The Wisconsin chapter of Americans for Prosperity remarked that state ROFR likely violates the Dormant Commerce Clause of the Constitution.[14]

Tellingly, out-of-state groups resist other states’ ROFRs. For example, the Iowa Department of Justice Consumer Advocate filed a legal brief challenging Minnesota’s ROFR.[15] Given the recency of most ROFRs, few developments have transpired to demonstrate the harm it causes, which limits court challenges under the Dormant Commerce Clause. But MISO’s new transmission cost sharing filing before FERC may illuminate ROFR’s premium.[16] This will amplify the legal case against ROFR and seed stakeholder resistance to anti-competitive grid expansion.

As resistance mounts, it is clear that ROFR increasingly undermines the interstate cooperation needed for regional projects. States like Illinois have resisted paying for the burdens of other states’ anti-competitive transmission laws.[17] Left unresolved, more litigation and controversy is unavoidable. And it is about to get a whole lot worse: MISO’s new Long Range Transmission Planning process is poised to unveil over $10 billion in transmission expansion, which may verifiably place ROFRs’ price tag in the billions.[18]

As the clock ticks, MISO stakeholders and FERC should call for a more independent planning process and robust Monitor oversight while dramatically narrowing the technical exclusions for competitive projects. What exclusions remain, such as a voltage exemption for local projects, should be subjected to regulatory scrutiny under demonstrated prudence reviews with equivalent rate treatment for incumbent and non-incumbent suppliers.[19] This will improve the quality of local projects and reduce incumbents’ use of regulatory arbitrage between regional and local project selection.

State legislatures should prevent and repeal ROFR laws to benefit themselves and their neighbors. If this does not eradicate ROFRs outright, FERC will have to step in to prevent interstate harm. The law is straightforward. The politics are not. Yet state commissions have already broken the ice by calling on FERC to encourage transmission competition.[20] FERC need only ask them how.

Devin Hartman is director of energy and environmental policy for the R Street Institute.

[1] https://www.brattle.com/wp-content/uploads/2021/05/16726_cost_savings_offered_by_competition_in_electric_transmission.pdf

[2] https://www.ofgem.gov.uk/sites/default/files/2021-08/Transmission_Early_Competition_IA_Final.pdf

[4] https://www.potomaceconomics.com/wp-content/uploads/2021/05/2020-MISO-SOM_Report_Body_Compiled_Final_rev-6-1-21.pdf.

[5] https://www.misostates.org/images/stories/Filings/Board_comments/2021/OMS_Letter_to_MISO_

Leadership_LR_10.4.21.pdf.

[6] https://cdn.misoenergy.org/20220127%20MSC%20Item%2006%20IMM%20Seasonal%20Review%

20of%20Markets620906.pdf.

[12] https://www.kenoshanews.com/news/state-and-regional/govt-and-politics/with-billions-at-stake-wisconsin-lawmakers-seek-to-block-power-line-competition/article_bee7cfcb-4a8a-5d93-858b-6f407bf32f3f.html

[13] https://www.forbes.com/sites/patrickgleason/2022/02/09/governor-gretchen-whitmer-enacted-a-law-expected-to-inflate-electric-bills-in-michigan-now-some-in-wisconsin-want-to-follow-her-lead/?sh=6b8df7d2489e

[14] https://www.kenoshanews.com/news/state-and-regional/govt-and-politics/with-billions-at-stake-wisconsin-lawmakers-seek-to-block-power-line-competition/article_bee7cfcb-4a8a-5d93-858b-6f407bf32f3f.html