Fifteen Western utilities plan to support SPP’s efforts to develop a regional day-ahead energy market so they can evaluate it against CAISO’s proposed day-ahead market, according to a joint letter provided to RTO Insider by one of the effort’s organizers.

“Over the past several months, it has become increasingly clear that two leading options are forming for an integrated day-ahead and real-time organized market platform in the West,” the letter says. Those options are CAISO’s proposal to establish an extended day-ahead market (EDAM) for its real-time Western Energy Imbalance Market (WEIM) and SPP’s planned Markets+ offering, which would include real-time and day-ahead components.

“Given the importance of a full day-ahead and real-time integrated market to the future of Western wholesale electricity markets, the Joint Entities believe that both options should be further advanced and subsequently evaluated before any commitment decision can be made,” the letter says. “Although each of us will decide on the best path forward for our customers, we believe the governance models and market design for both of these options must be sufficiently complete in order to enable each of us to make an informed decision.”

The letter says that to evaluate “two fully-formed alternatives,” the joint entities will commit to “support the further development” of the Markets+ effort by “dedicating key staff” to participate in the initiative over the next year and “working collaboratively with SPP and other stakeholders towards the design of a governance framework and conceptual market design proposal,” slated to be completed by the end of 2022.

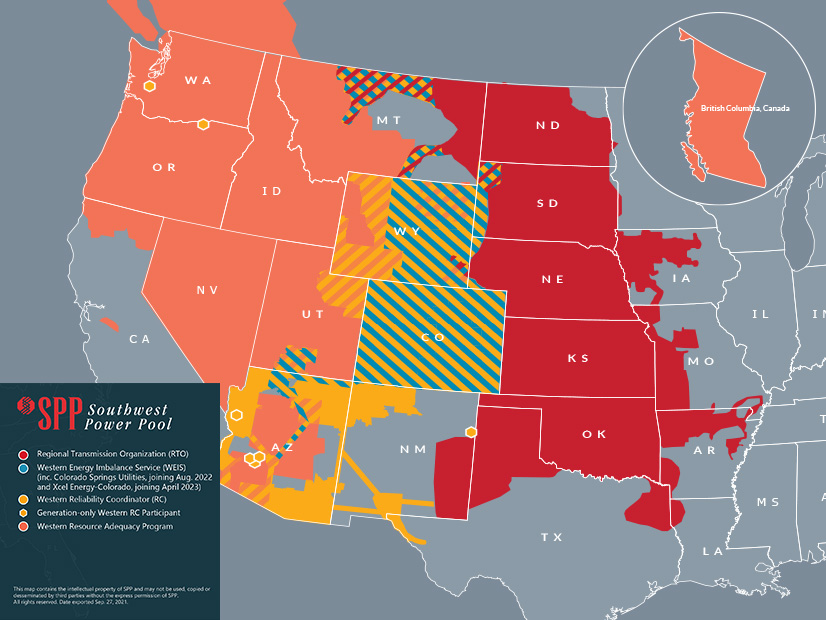

SPP plans a range of services in the Western Interconnection to compete with CAISO. | SPP

SPP plans a range of services in the Western Interconnection to compete with CAISO. | SPP

Two of the letter’s listed participants, Arizona Public Service and Powerex, already participate in the Markets+ design team.

The letter was sent to RTO Insider by Shawn Smith, managing director of energy resources at Chelan County Public Utility District in Washington.

In addition to APS, Chelan and Powerex, the joint entities listed in the letter include Avista Corp., Douglas County PUD, Eugene Water & Electric Board, Grant County PUD, NorthWestern Energy, NV Energy, Public Service Company of Colorado, Puget Sound Energy, Salt River Project, Snohomish PUD, Tacoma Power and Tucson Electric Power.

Arizona’s Salt River Project confirmed it is participating; other utilities contacted for this story did not respond.

In an email, Smith said the letter was provided to the 15 named entities on April 22 to distribute more widely to the Western electric industry as they see fit.

Real-time transactions in the West account for 5% of the market, while day-ahead transactions make up 40% of all sales, Smith said in the email.

“This is an important decision,” he said. “The impacts to our utility may last decades. We want to see both markets developed to a point we can evaluate [them] before selecting which one is best for Chelan PUD customer-owners. This shouldn’t be a race of which option is developed first or attracts commitments first, but rather which option is better for our customers from a governance and market-design perspective.”

Chelan and at least 13 of the other joint entities are participants in the Western Power Pool’s Western Resource Adequacy Program (WRAP), which SPP is administering. Most of the joint entities also participate in the WEIM, although Chelan is not a member.

Arkansas-based SPP has been making inroads in the West lately, competing with CAISO to attract members to its real-time Western Energy Imbalance Service (WEIS) and proposing the Markets+ platform, a combination of services that stops short of full RTO membership. It also hopes to launch a Western version of its Eastern RTO, called RTO West.

SPP said April 12 that it plans to phase out the WEIS after the 14 active participants join either Markets+ or RTO West. (See SPP to Phase Out WEIS as New Market Offerings Expand.)

CAISO is planning to release an EDAM straw proposal April 28. It has fast-tracked the effort this year, trying to get a jump on SPP and draw many of its current and expected WEIM participants to the planned day-ahead market. The WEIM now has 17 participants with five more scheduled to join through 2023, eventually representing more than 80% of the West’s electric load.

CAISO cannot yet form a Western RTO because of its one-state governance, but it offers interstate market services through the WEIM and its reliability coordinator RC West, which serves 42 balancing authorities and transmission owners in the Western Interconnection.