Start-up Cost Offer Development Endorsed

PJM Market Implementation Committee members last week unanimously endorsed a revised proposal from the RTO and its Independent Market Monitor to address start-up cost offer development.

At the MIC’s April 13 meeting, Tom Hauske, principal engineer in PJM’s performance compliance department, reviewed the joint proposal to revise Manual 15: Cost Development Guidelines that came out of discussions at the Cost Development Subcommittee (CDS).

The CDS initially brought two proposals for first reads to the October MIC meeting. (See “Start-up Cost Offer Development,” PJM MIC Briefs: Oct. 6, 2021.) But a vote on the proposals was postponed to allow more discussions and have stakeholders reach consensus on a single proposal.

Manual 15 currently allows the start-up costs for combined cycle units to include fuel costs after generator breaker closure and synchronization to the grid, a feature not available to other unit types, such as steam and nuclear plants. The revisions align start-up costs for all units with a soak process, or units that use steam turbines.

PJM’s revised steam unit start-up cost offer procedure. | PJM

PJM’s revised steam unit start-up cost offer procedure. | PJM

For units with a soak process, including steam, combined cycle and nuclear units, some of the soak costs are included in the start-up costs from PJM’s notification to the “dispatchable output” and from the last breaker open to the shutdown process.

Units that don’t have a soak process, like combustion turbines and reciprocating engines, maintain the status quo, with start-up costs that include costs from the time of PJM’s notification to the first breaker close and from the last breaker open to the conclusion of the shutdown process.

“We’re not implementing soak time at this point,” Hauske said. “We’re just allowing generators that have a soak process to include those costs in the startup cost.”

The revisions feature several other changes to Manual 15 to provide additional guidance and clarification, Hauske said, including equations to calculate start-up costs, station service calculations for units with and without a soak process and unit-specific parameter limits on includable costs.

Manual 15 currently allows generators to include an additional labor cost in their start-up costs, Hauske said, but generators already are permitted to include the labor cost in the unit’s capacity offer through its avoidable cost rate (ACR). The proposal calls for eliminating the labor cost language in the tariff and Operating Agreement offer cap sections and the start-up cost calculation so all the operating labor is includable in the ACR.

Hauske said PJM will provide a six-month window for implementation to allow market sellers the opportunity to have their fuel costs or net generation used for the offset to be reviewed by the Monitor prior to the proposal going into effect.

The proposal will be presented as a first read at the April 27 Markets and Reliability Committee meeting.

Stability Limit Changes

Zhenyu Fan, senior engineer in PJM’s real-time market operations, provided education and a first read of conforming updates to Manual 11: Energy & Ancillary Services Market Operations and Manual 28: Operating Agreement Accounting regarding stability limits in markets and operations.

In early 2021, stakeholders endorsed PJM’s proposal on stability limits capacity constraints that included language limiting lost opportunity cost (LOC) credits for any generation reduction required to honor the stability limit in the RTO. The limiting of LOC compensation led to debates among PJM members. (See “Stability Limits Endorsed,” PJM MRC/MC Briefs: Jan. 27, 2021.)

FERC ruled in February that PJM is within its rights to refuse (LOC) payments to generators that are temporarily required to limit output to prevent loss of synchronization and additional strain on the system during transmission outages. (See FERC: PJM Right to Block Gen Stability Limit Payments.) The tariff changes take effect June 1.

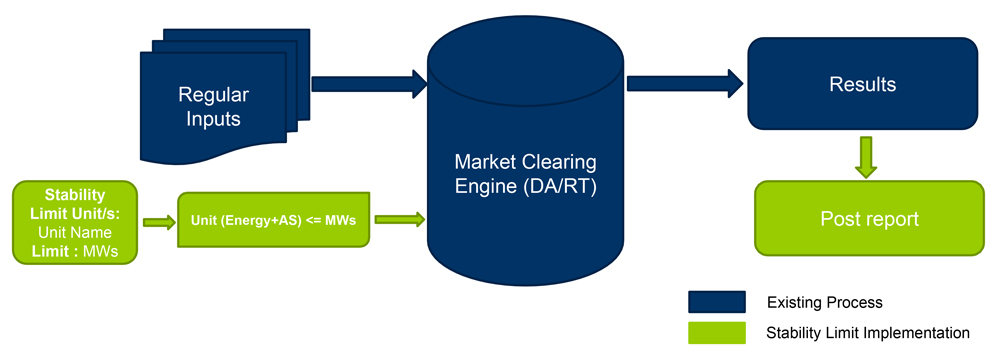

Zhenyu said PJM will use a new generator output constraint to enforce the stability limit for real power megawatt-only limits. He said the shadow price of the constraint will not be included or reflected in locational marginal pricing (LMP).

To provide greater transparency, Zhenyu said PJM added a new section to Manual 11 related to stability limits that describes the modeling, clearing and reporting process on the stability limit in the market. Updated language related to stability limits in Manual 28 included additional clarification that LOC credits are not paid for megawatts associated with a stability limit reduction.

PJM’s proposed stability limits modeling and market clearing process. | PJM

PJM’s proposed stability limits modeling and market clearing process. | PJM

Paul Sotkiewicz of E-Cubed Policy Associates said he disagreed with FERC’s decision on LOC payments. Sotkiewicz also disagreed with the proposed manual language, saying the changes don’t provide for “workarounds or a reconfiguration change” between PJM and the transmission owners to find ways to eliminate a stability problem.

“There’s a very easy workaround that eliminates the transient stability problem, and what I find alarming here is that there’s not going to be any effort made to do that,” Sotkiewicz said.

Phil D’Antonio of PJM asked Sotkiewicz to elaborate on a possible solution in the manual language. D’Antonio said his perspective has been that adjusting the system in an outage situation resulting from instability and limitations can end up “pulling the system apart even more.”

Sotkiewicz said he would want to look for “easy switching options” that are available to “eliminate the transient stability limit.”

“We’ve actually been in conversations with PJM operations, and we have found those solutions in the past,” Sotkiewicz said.

D’Antonio said he’ll take the suggestion back to PJM’s operations group for additional discussions before the next MIC meeting.

The committee will be asked to endorse the manual revisions at the May MIC meeting.

Intelligent Reserve Deployment Changes

Damon Fereshetian, senior engineer in PJM’s real-time market operations, provided a first read of additional updates to Manual 11 and Manual 28 related to intelligent reserve deployment (IRD).

Stakeholders in December endorsed a PJM proposal to improve the deployment of synchronized reserves during a spin event. (See “Synchronous Reserve Endorsed,” PJM MRC/MC Briefs: Dec. 15, 2021.)

The proposal created an IRD, which is a security-constrained economic dispatch (SCED) case simulating the loss of the largest generation contingency on the system and for which approval of the case will trigger a spin event. The proposal included taking the megawatts of the largest generator contingency and adding them to the RTO forecast to simulate the unit loss. PJM can then flip condensers and other inflexible synchronized resources cleared for reserves to energy megawatts and procure additional reserves to meet the next largest contingency.

Fereshetian said Manual 11 changes include the addition of new language that an approved IRD case “supersedes” any other approved real-time SCED cases for the same target time to be used as the reference case for the locational pricing calculator (LPC). In the verification section, PJM added clarifying language that the response to a synchronized reserve event is “based on the resource following dispatch instructions and is capped at the expected response.”

Manual 28 included minor clarifying changes.

The MIC will be asked to endorse the revisions at its May meeting.

Manual 29 Revisions

Natasha Holter, manager of PJM’s market settlement operations, provided a first read of revisions to Manual 29: Billing as part of the periodic review.

Holter said there were no “substantive changes” in the manual language and mostly included updates to terminology and reference materials.

Several new subsections were added to the manual, Holter said, including one called “Billing Notifications” that features language providing guidance on how to obtain notifications for billing statements. Another subsection, “Billing Adjustments,” added language to describe what a billing adjustment is and how to identify one.

Stakeholders will be asked to endorse the revisions at the May MIC meeting.