NYISO analysts continue to recommend a two-hour battery electric storage system (BESS) resource as the proxy unit for the ISO’s capacity market demand curve.

“Based upon our review of the comments and the results developed to date, we continue to recommend the two-hour battery storage system as the peaking plant technology,” Paul Hibbard, vice president of Analysis Group, told the Installed Capacity Working Group on July 23.

This was the second-to-last working group meeting focused on its quadrennial demand curve reset for 2025-2029, and the first since stakeholders submitted comments on the recommendation earlier this month. (See Stakeholders Battle over Battery as Proxy in NYISO Demand Curve Reset.)

“There are no established minimum thresholds regarding the quantity or duration of energy a peaking plant must be capable of producing during peak periods to be considered a viable technology option for the purposes of the demand curve reset,” said Hibbard, responding directly to comments in opposition to the recommendation.

When asked if Analysis Group had done any reliability analysis to determine whether a two-hour duration was sufficient for maintaining reliability, Hibbard said that his group did not do reliability modeling.

“We’re not trying to model a system that’s operating entirely on two-hour batteries; the two-hour batteries are the peaking technology for the purpose of setting the demand curve,” Hibbard said.

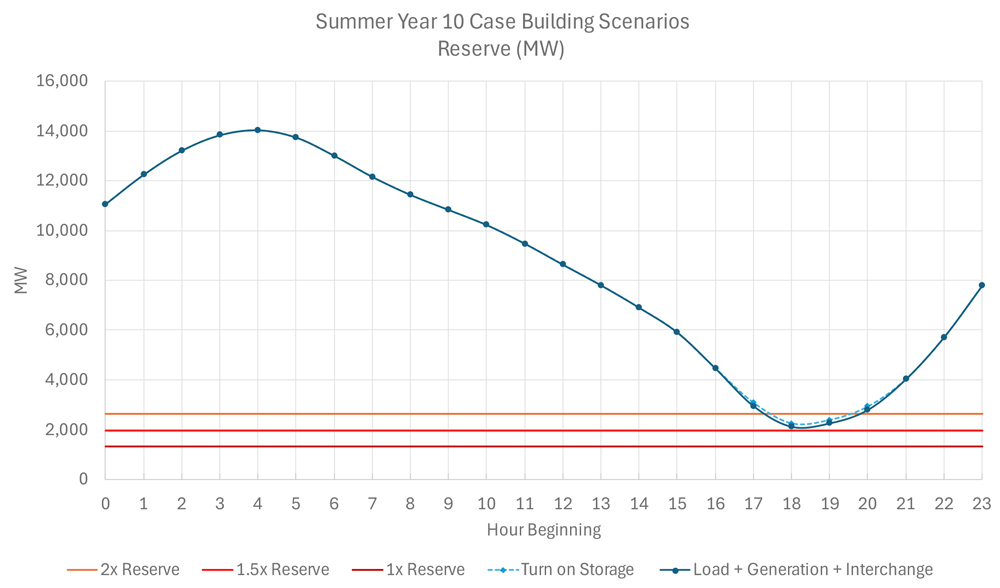

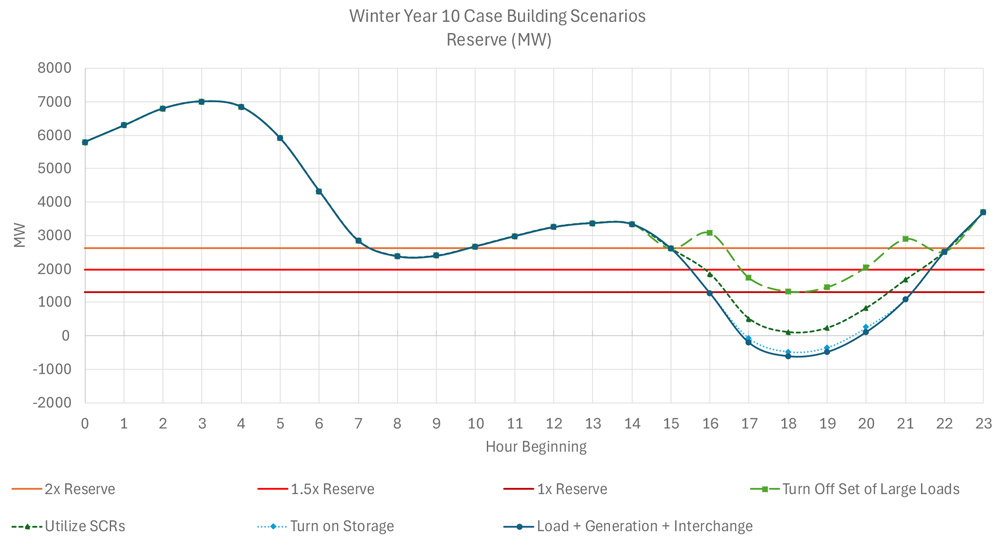

“Another risk of the two-hour BESS is that it is very heavily reliant on reserve revenues, and it’s a reserve provider for 95% of the intervals,” said Mark Younger, of Hudson Energy Economics. “Did you at all consider if there is a risk, say, if the reserve price dropped in half, or if the reserve price dropped by three-quarters?”

“We haven’t tried to forecast reserve prices,” answered Todd Schatzki, principal of Analysis Group. “Ultimately that gets reflected in the net EAS [energy and ancillary services offset] calculation over time.”

One stakeholder noted that commenters had expressed concern with a battery’s capacity accreditation factors (CAFS) diminishing very rapidly.

“We don’t really feel we have a sufficient quantitative basis to assume the CAFs will decline over time,” Schatzki said. “We recognize that a lot of commenters believe that is going to be the case.”

Schatzki said that there were a lot of uncertainties with respect to calculating future CAFs for any technology and that final financial parameters had not yet been set.

1898 and Co., a consulting and analysis firm brought in by Analysis Group, presented some modifications to their calculations for capital and equipment costs for two-hour batteries. Based on feedback from stakeholders, real estate and land-lease costs in New York City were adjusted upward.

Discussion of how 1898 had calculated the costs of battery construction dominated the second presentation.

“Essentially it’s the supply and demand of electric vehicles that drives what happens in the lithium carbonate market,” said Kieran McInerney, a consultant with 1898. “If you look at the numbers for stationary storage verses EV demand for the raw material, it’s like 95% to 5%.”

McInerney said that currently the lithium carbonate market is relatively stable and that the numbers had returned to pre-COVID pandemic prices.

“I do not intend to predict the future; anything could change at any time,” he said. “But we do think that the costs that we are going to include in the final report are indicative of where the market is right now. … There’s a decent amount of stability in the raw material price.”

There was some discussion of how to properly account for inflation, which one stakeholder said is “crushing everything.” McInerney said that he wanted the inflation indices to reliably track costs.

“We believe it’s settling. It’s been a crazy last nine months, [or] year, with the reductions,” he said. “There’s cost increases and reductions that are due to materials; there’s technology changing. I can’t sit here today and tell you anything. Four years ago, we all thought the price was going to be lower today.”