SAN DIEGO — The West’s potential to regionalize transmission planning and participate in organized markets occupied much of the discussion at the three-day meeting of the Committee on Regional Electric Power Cooperation and the Western Interconnection Regional Advisory Body (CREPC-WIRAB) in San Diego last week.

A prime topic was FERC’s recent Notice of Proposed Rulemaking (NOPR) on transmission, which, if adopted, would require long-term regional transmission planning and increased state involvement in transmission cost allocation, among many other changes.

Western utility commissioners also discussed the work of the Joint Federal-State Task Force on Electric Transmission, convened by FERC and the National Association of Regulatory Utility Commissioners (NARUC) to spur transmission development as a means to deliver renewable power, reduce congestion and improve reliability. (The task force met virtually on Friday to discuss challenges related to clogged generator interconnection queues and cost allocation for transmission network upgrades.) (See FERC-State Task Force Considers Clustering and ‘Fast Track’ to Clear Queues and Task Force Seeks ‘Right Balance’ in Spreading Tx Upgrade Costs.)

Utah Public Service Commission Chair Thad LeVar told the audience of state regulators and others that two questions guide his work on the task force.

“The first question is, ‘Will any specific proposal or rulemaking either encourage or chill development of regional transmission coordination in the West?’” LeVar said. The second question is whether any proposal will fail to “respect and recognize the diverse carbon policies” of Western states, he said.

“To me, those are the two most important things because everybody agrees we need to move toward more regional transmission coordination … but we need to do that in a way that respects and recognizes” state policies, he said.

Those policies range from California’s drive to supply retail customers with 100% clean energy by 2045 to the plans of states of the interior West to continue relying on a mix of renewable energy and fossil fuels for the foreseeable future.

The uneasy relationship between more progressive and more conservative states in the West is likely to remain a sticking point to greater grid integration, stakeholders at the meeting said.

Even so, “there’s a lot of momentum toward regional coordination,” LeVar said.

Moves Toward Western Markets

The push toward Western coordination now extends to a major resource planning program and the possibility of participation in organized markets.

The Western Power Pool’s Western Resource Adequacy Program (WRAP), which WPP President Sarah Edmonds described in a presentation, is poised to be a West-wide effort to ensure reliable energy supply as coal plants retire and weather-dependent wind and solar resources proliferate during a time of climate change and extreme weather events. (See Western Power Pool Names New CEO.)

“This planning framework establishes a common planning reserve margin for the entire footprint … and it arrives at common counting rules across the entire footprint for the resources that we use,” Edmonds said on the meeting’s first day, May 2.

“The region has never had a West-wide view of what it needs to meet the needs of the future and how to count resources consistently across the footprint,” she said. “There’s a real value proposition in what we can do when we work together and … [leverage] our community as a whole.”

The WRAP, scheduled to enter a nonbinding phase later this year, has attracted participants in an area that stretches from British Columbia to Arizona and east to South Dakota. Stage 1 of the WRAP will include 26 participants that together represent a summer peak load of about 67,000 MW and a winter peak of more than 65,000 MW.

CAISO’s Western Energy Imbalance Market (WEIM), an interstate real-time trading platform, recently surpassed $2 billion in cumulative benefits for its participants since its founding in 2014. The WEIM has 17 members and is expected to grow to 22 participants by 2023, its benefits keeping pace with participation. (See Western EIM Tops $2B in Benefits.)

The ISO issued a straw proposal April 28 to add an extended day-ahead market (EDAM) to WEIM’s real-time market, potentially attracting even more of the Western market to its regional offerings. (See CAISO Issues EDAM Straw Proposal for the West.)

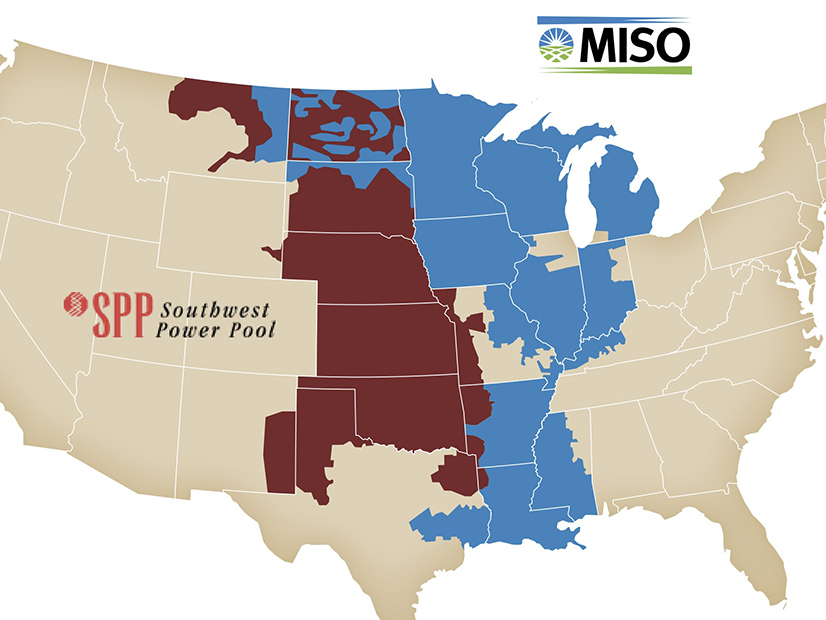

In addition, several Western entities have joined SPP’s Western Energy Imbalance Service and could eventually become members of SPP’s planned RTO West or its Markets+ program, which offers an array of RTO-like services but stops short of a full RTO.

Scott Kinney, Avista Corp. | © RTO Insider LLC

Scott Kinney, Avista Corp. | © RTO Insider LLCA panel of stakeholders discussed the challenges of day-ahead market design on day two of the CREPC-WIRAB meeting.

“When you think about how unique a day-ahead market will be, especially in the West — where we have different [open access transmission tariffs] that we have to deal with, with regards to transmission utilization in the market, as well as potentially different resource adequacy programs — we have to think about how we create equity with those different constructs, and so that’ll be important as these designs continue to evolve,” Scott Kinney, director of power supply with Avista Corp., said.

Avista, based in Spokane, Wash., is a new participant in the WEIM and recently signed a letter with 14 other Western utilities saying it plans to support SPP’s efforts to develop a regional day-ahead energy market to evaluate against CAISO’s proposed day-ahead market. (See Western Utilities to Support SPP Market Development.)

A day-ahead market is “something that I think we should pursue as a region, but there’s no crisis behind it,” Kinney said. “So, let’s take the time to make sure that we fully flesh out all the options that are in front of us from a day-ahead market construct so that we can compare them equitably and make sure that they’re providing benefits to our customers.”

In the past year, FERC commissioners have urged the formation of one or more RTOs in the West, which remains balkanized with 38 separate balancing authority areas, while much of the rest of the nation is organized into RTOs or ISOs. (See Glick Says West Should ‘Finish the Job’ on RTO.)

In all the regionalization efforts, “the one area that hasn’t been tackled is transmission operation, transmission planning and transmission cost allocation,” LeVar said. The joint task force is intended to further regional transmission cooperation, he said.

FERC Transmission NOPR

FERC’s transmission NOPR (RM21-17) is separate from the work of the task force but shares its aims.

In one of its more controversial provisions, however, the NOPR would retreat from Order 1000’s effort to open transmission development to competition by giving incumbent transmission owners a federal right of first refusal (ROFR) on regional projects, provided they partner with an unaffiliated company with a “meaningful level of participation and investment” in the project.

The commission found in Order 1000 that federal ROFRs create “a barrier to entry,” discouraging nonincumbent transmission developers from proposing alternative solutions that could be more efficient or cost-effective. But the commission said it was changing course in its April 21 NOPR because it feared that Order 1000’s removal of the federal ROFR may be “inadvertently discouraging investment” in regional transmission.

Incumbent transmission providers “may be presented with perverse investment incentives” to instead engineer local transmission projects for which they retain development control, FERC said.

The NOPR troubles independent transmission developers.

Sharon Segner, LS Power | © RTO Insider LLC

Sharon Segner, LS Power | © RTO Insider LLCSharon Segner, senior vice president for transmission policy at developer LS Power, said the NOPR raised concerns about transmission competition in the Western Interconnection. She spoke as part of a panel on barriers to transmission development in the West, which largely focused on the NOPR’s pros and cons.

“As we look at the NOPR from a Western perspective, the first question that has to be asked is, ‘Does the rule usher in a cost-effective, clean energy transition?’” she said. “And while there are certainly areas of progress from a Western standpoint, in my company’s view we certainly see some yellow lights and red lights in terms of the proposals.”

Among the problems is that the NOPR “took meaningful steps backward on the notion of transmission competition across the country,” Segner said. “It’s a proposal that my company will rigorously object to.”

The proposal runs counter to President Biden’s July 2021 executive order aimed at promoting competition in the American economy,” she said. The order names FERC as a federal entity responsible for administering statutes protecting fair competition.

If an incumbent transmission provider has a partner, “then the competitive process could go away,” Segner said. “Having a partner in a transmission line does not necessarily mean that the consumers will have lower rates, and that doesn’t provide the benefits of a competitive process.”

“We don’t believe that FERC can substitute competition for cartels, and that’s essentially what we believe the end result of FERC’s proposal is — that if the transmission owner finds one partner then they have the ability to shut out competitive pressures and have the ability to stop competition,” she said.

Some panelists and audience members supported FERC’s goal of enhancing regional transmission planning to incorporate renewable resources.

Rob Gramlich, Grid Strategies | © RTO Insider LLC

Rob Gramlich, Grid Strategies | © RTO Insider LLC“I was very pleased to see it,” Rob Gramlich, president of consulting firm Grid Strategies said.

An “open, transparent regional planning process,” will be more likely to get transmission built, Gramlich said. The NOPR could require planners to proactively examine the future resource mix and take a more holistic approach to balancing costs and benefits, he said.

Fred Heutte, senior policy associate with the Northwest Energy Coalition, said the co-optimization of new generation and transmission, rare in the West, is “implicit in where the NOPR is going.”

Gramlich agreed “that co-optimization is extremely important for consumers to save on generation costs and [to see an] overall delivered cost of generation plus transmission.”

A big question, he said, is who will coordinate those activities.

“I think the NOPR, first of all, requires a mindset shift” in the West toward regional generation and transmission planning, more like processes followed by Eastern RTOs and ISOs, Gramlich said.

“You can clearly envision a role for WECC and for [regional planners] WestConnect and Northern Tier [Transmission Group] and CAISO,” Gramlich said.

In January, CAISO published a first-of-its-kind 20-year transmission outlook intended to promote regional efforts to move renewable energy across the West. (See CAISO Sees $30B Need for Tx Development.)

“I don’t know exactly where the boundaries should fall, but I think that somebody needs to proactively [coordinate transmission planning], and I agree with Sharon [Segner] that, to some extent, this shouldn’t just be utility driven,” he said.

“I think there’s a lot of deference to just sort of taking what the individual utilities put together in this region … rather than an actual ‘let’s take the data and come up with an optimal configuration and then work with policymakers on an acceptable regional plan,’ Gramlich said. “I’d love to see a shift toward that latter framework.”