VALLEY FORGE, Pa. —American Electric Power (NASDAQ:AEP) has identified vegetation as a likely cause of the transmission line failures that left more than 240,000 customers in Ohio without power for up to two days following violent storms in June, PJM officials said last week.

PJM ordered load sheds on three of AEP’s 138-kV lines to prevent overloads and cascading outages June 14 after a storm identified as a derecho downed power lines. (See AEP Under Fire as Load Sheds Persist in Ohio.)

Although the cause of the line tripping remains under investigation, AEP said vegetation was a contributing factor, Paul McGlynn, PJM executive director of system operations, told the Markets and Reliability Committee on Wednesday. “Whether vegetation was blown into the lines or whether there were encroachment issues, we don’t have the answers yet,” he said.

Monday, June 13: Load Forecast Falls Short

McGlynn and other PJM officials gave the MRC an in-depth briefing on the RTO’s challenges in mid-June, which began Monday, June 13, when load peaked around 136 GW, well above the forecasted 128 GW. McGlynn said PJM’s under-forecast was 1,800 MW during the “valley” overnight, rising to 8,000 MW by noon.

The load forecast fell short because of weather that was warmer and more humid than expected, and storms expected to provide cooling did not arrive until after the evening peak. “If we had perfect weather knowledge, [the load forecast] would have been spot on,” McGlynn said, citing backcasts the RTO did after the event.

The RTO also saw generation losses of about 1,150 MW and a constraint, followed by an overload, on the 500-kV Peach Bottom-Conastone line that impacted what resources the RTO could bring online. It responded by taking transmission loading relief procedures, “something we don’t do all that frequently,” said McGlynn.

It also called on little-used combustion turbines to maintain reliability. The RTO activated almost 26,000 MW of CTs, versus the 16,000 MW it had expected to use.

“It was tighter than we anticipated, but we were reliable through the whole operating day,” McGlynn said. The result was “some fairly high prices through the peak period.” LMPs peaked at $2,643/MWh in the 4-5 p.m. ET hour.

Independent Market Monitor Joe Bowring said PJM exported about 4,000 MW to MISO “when it was economically illogical.”

“We will investigate the reasons,” he said in an email after the meeting.

PJM dispatch also approved 35 shortage intervals between 2:55 and 6:05 p.m., said Phil D’Antonio, director of energy market operations.

“I’m surprised we would dispatch so tight to the timing of a thunderstorm,” said Public Service Enterprise Group’s Gary Greiner.

“Storms are sometimes a challenge to predict as to when they will occur” and where, McGlynn responded.

Tuesday, June 14: Storms Down Lines, Poles

When the storms finally arrived late Monday night and continued into Tuesday morning, they were violent and set off tornadoes in Ohio, McGlynn said. AEP Ohio reported wind gusts as high as 95 mph, which downed poles and lines across its service territory.

Between 1 and 2 p.m. June 14, nine 138-kV facilities tripped in the AEP zone, with loads on several facilities above their load dump rating.

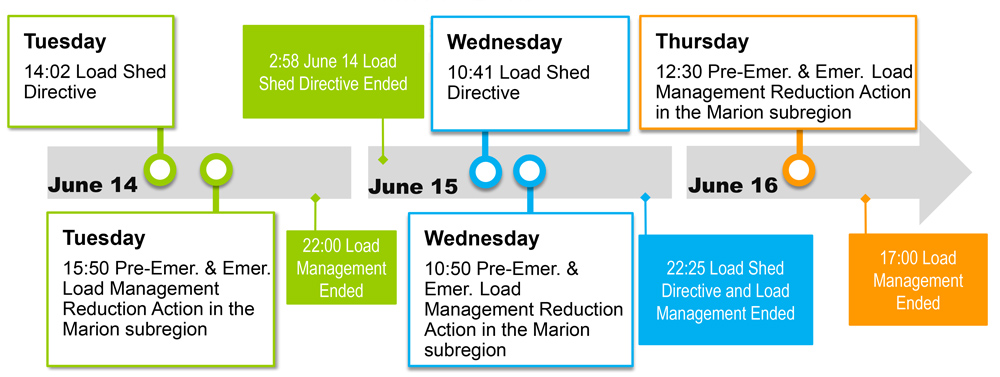

Beginning at 2:02 p.m., PJM issued the first of several load-shed directives to AEP, triggering performance assessment intervals (PAIs), in which capacity resources face penalties for shortfalls in output.

Fearing multiple cascading overloads, the RTO also called on pre-emergency and emergency demand response in the Marion area of AEP at 3:50, followed at 7:21 by an additional load-shed directive to prevent a potential N-5 cascading outage on the 138-kV Beatty-Bolton line.

Wednesday June 15: More Line Failures

In the early morning hours of June 15, AEP returned to service several lines that had tripped the previous day. PJM cancelled its load-shed directive at 3 a.m.

But over a 10-minute period ending at 10:40 a.m., three 138-kV lines in AEP tripped. PJM issued a load-shed directive to relieve an overload on the 138-kV Gahanna-Hap Cremean line at 10:41, just a minute before that line also tripped, triggering another PAI.

At virtually the same time, AEP restored service to the 345-kV HyattCS-Hayden line, which had been recalled on Tuesday from a maintenance outage. McGlynn said the timing of the restoration was a coincidence and that officials don’t know whether an earlier restoration might have prevented the Gahanna-Hap Cremean overload. “It’s certainly something we’re looking at,” he said.

At 10:50, PJM again called for pre-emergency and emergency DR in the Marion area, followed 50 minutes later by another load-shed directive issued to prevent a potential N-5 cascading outage for the 138-kV Kenney-Roberts line.

It wasn’t until 10:25 p.m. that several lines returned to service and load decreased enough to end the load-shed directives and the PAI.

Thursday June 16: Hot Weather Alert

On Thursday, June 16, PJM issued a hot weather alert for the western part of the RTO. At 10:36 a.m. the 138-kV Corridor-Blendon line, which had tripped the previous day, tripped again, but there was sufficient generation to control the constraint.

PJM used contingency switching where it was able to manage thermal loading. But as load continued to increase, PJM — with no generation or switching available — issued several post-contingency local load relief warnings.

After the 138-kV Corridor-Morse line tripped about 12:18 p.m., PJM again called on DR for the Marion area about 12:30, initiating another PAI. The DR was canceled about four and a half hours later, following the return to service of the 138-kV Bexley-St. Clair and Morse-Spring Rd-Genoa lines.

In total, about 100 MW of DR was called to reduce load, but because operators had not defined a closed-loop interface, DR did not set LMPs. Instead, price was set by the worst contingency in PJM’s security-constrained economic dispatch.

McGlynn said the load sheds began with 160 MW and grew to “several hundred” megawatts.

Rebecca Carroll, senior director of market design, said there were 345 PAIs over about 11 hours during the week — the first PAIs since 2019, when 24 occurred.

Under PJM’s confidentiality rules, officials said, balancing ratios will not be posted for the PAIs because there were a small number of generation owners with capacity resources in areas affected by the emergency actions.

Mike Bryson, senior vice president of operations, said AEP, PJM, NERC and ReliabilityFirst are investigating and will produce “lessons learned” in four to 10 weeks, with updates at monthly Operating Committee meetings.