Solar developers embraced a new report by the New Jersey Board of Public Utilities (BPU) on how to modernize and upgrade the state’s power grid to handle the expected dramatic rise in energy from wind and solar projects, but they told a public hearing Monday that the state needs to act faster.

The 102-page report, compiled for the BPU by consultant Guidehouse, of Lawrenceville, offers nine recommendations on how to improve what solar developers see as an aging grid that has limited capacity on the grid, which in some areas of the state can’t accept new interconnections. (See Solar Developers: NJ’s Aging Grid Can’t Accept New Projects.)

The suggestions in the report, which was released Friday, include streamlining the interconnection process and improving the state’s hosting capacity maps, which report how much generation can be added to a circuit. The report also suggested enabling developers to get a “pre-application study” that would allow them to see the available connection capacity in advance, rather than late in the development cycle.

Speakers from the solar industry, while welcoming the report, said the gravity of the situation requires additional moves.

“You’ve identified all the right things. We’re with you; we want to work and collaborate on this and move forward,” Fred DeSanti, executive director of the New Jersey Solar Energy Coalition, told the hearing. “Obviously, time is of the essence.

“My only comment would be is if we could have some kind of a parallel track where we could, as a triage measure, put money into opening some of the existing circuits that have been closed, where it’s obvious, cost effective,” he added. That would enable the industry to “open up some of these markets and will take a lot of pressure off the situation.”

Lyle Rawlings, a solar developer and founder of the Mid-Atlantic Solar Energy Industries Association, echoed the call for the BPU to move quickly.

“We urgently need ventures near-term that will keep circuits open and reopen ones that are currently restricted,” he said.

Clean Energy Surge

The hearing, the fourth to collect stakeholder input on current distribution grid interconnection policies and processes and potential improvements, was the last in the fact collection stage, which began in October. While stakeholders can submit written comments until July 19, the release date of the final report has not yet been set.

The effort is one of several New Jersey initiatives underway aimed at preparing, upgrading and improving the grid for the capacity expansion expected from the state’s advancing solar and wind sectors. New Jersey’s first community solar projects came online last year, and the state reshaped its solar incentive program. (See New Jersey Shoots for Key East Coast Wind Role.)

The state has so far approved three offshore wind projects — the 1,100-MW Ocean Wind 1, 1,148-MW Ocean Wind 2 and 1,510-MW Atlantic Shores — in two solicitations, and expects the first project to be operating in 2024. A third solicitation is planned for early 2023, and the state expects to approve further projects that will increase the state’s wind capacity to 7,500 MW by 2035.

The BPU is close to finishing a solicitation process for suggestions on how to best connect the offshore wind projects to the grid, which attracted 80 proposals. (See FERC Approves PJM-NJ Transmission Agreement.)

And the state legislature is considering a bill that would levy a fee to generate millions of dollars to modernize the grid. At a hearing of the Senate Energy and Environment Committee in May, developers said they wait for months, even years, to get projects connected, and sometimes the connection never happens.

Yet those delays are not unique to New Jersey. The U.S. Department of Energy this month launched an initiative, Interconnection Innovation eXchange (I2X), designed to identify and develop solutions to speed up the interconnection of clean energy projects. (See DOE Initiative Aims to Make Interconnection ‘Simpler, Faster, Fairer’.)

In April, PJM stakeholders overwhelmingly endorsed a plan for a new interconnection queue process amid concern over delays and heavy volume.

Abraham Silverman, strategic policy counsel for the BPU, opened Monday’s hearing by saying that addressing the grid issue is “absolutely critical.” He added that the PJM queue problems show what happens when the sector doesn’t get “the interconnection right.”

“Projects get delayed. … The energy transition slows down,” Silverman said.

Plans to Streamline, Fast Track

The BPU report, and its presentation at the hearing, said there are a variety of opportunities to streamline the application process through which new interconnections are sought, including updating the forms and resolving the fact that each utility has a different system.

The report also suggested that the industry adopt a new, uniform application software and platform system, and introduce new fees on Level 1 projects — smaller projects that are not currently required to pay fees — to pay for the upgrades.

Other proposals in the report include a recommendation that utilities adopt a uniform system of hosting capacity maps, which report how much spare capacity is available in different areas of the state. The current maps are “inconsistent,” resulting in the “quantity of closed circuits potentially being overestimated by stakeholders,” the presentation said.

“Stakeholder support for capacity hosting maps is strong in New Jersey,” the presentation said. “But the maps provide value only when updated with current data and relevant information regarding equipment costs.”

The report also concluded that that “there is no way to accelerate interconnection projects” under the state’s current system and no “fast track” process to speed up simpler projects. There is also no pre-application process that would enable a developer to learn in advance the availability of grid capacity and likely upfront costs, according to the report, which recommended such a process be implemented.

The report also suggested the state use the updated version of the recommended rules and regulations drafted by the Institute of Electrical and Electronics Engineers that govern interconnection and operability systems. And the report suggested that the state implement a systematic process that would “establish numerical cost and capacity thresholds” that would evaluate and determine, for example, whether an upgrade simply benefits certain distributed energy resources or has a benefit to all customers.

Reaching Energy Goals

Scott Elias, director of Mid-Atlantic state affairs for the Solar Energy Industries Association (SEIA), said the report reflects the feedback that his members have presented to the consultant. But he added that the “key consideration is not just identifying opportunities to improve interconnection, but moving forward with these types of reforms with the pace and scale necessary for New Jersey to achieve its goals.”

“If we don’t make major strides on interconnection reforms in the next few years, it will be impossible to achieve New Jersey’s aggressive clean energy goals,” Elias said. He added that “there’s plenty of evidence that the status quo is not tenable.”

Elias also called for the BPU to create “a clear timetable for how [it] will evaluate how grid modernization costs can be spread over a broader set of beneficiaries.”

“I think moving to a system where developers pay an appropriate portion of upgrade costs and the remaining costs are socialized among all customer classes benefiting from that upgrade would help bring online much more clean energy on New Jersey’s grid,” he said.

Eric Miller, director of New Jersey energy policy for the Natural Resources Defense Council, said addressing interconnection issues will be key to reaching the goals in the state Energy Master Plan, and said the organization is “pleased” with the way the report is going.

“We recognize the significant importance of kind of tackling interconnection first, and we think, you know, the recommendations so far … make significant progress on this front,” he said.

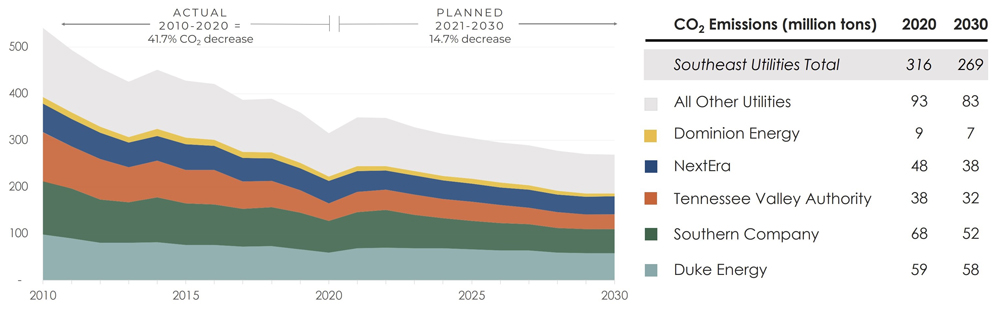

SACE emissions forecast of Southeastern utilities | SACE

SACE emissions forecast of Southeastern utilities | SACE