The U.S. House of Representatives passed the Inflation Reduction Act (H.R. 5376) on Friday, sending the $740 billion package of tax, health and climate provisions to the White House for President Biden’s signature.

House Speaker Nancy Pelosi announces the passage of the Inflation Reduction Act. | CSPAN

House Speaker Nancy Pelosi announces the passage of the Inflation Reduction Act. | CSPAN

Democratic representatives standing before the speaker’s dais broke out in cheers and high-fives as Speaker Nancy Pelosi (D-Calif.) announced the final vote of 220-207, with four Republicans not voting.

Earlier in the day, Pelosi had vowed that once passed, the bill would head straight to Biden’s desk. “It will be ready in a matter of minutes for me to enroll it, and it will go directly to the president for his signature,” she said.

Biden, who watched the vote at the White House, quickly tweeted he would sign the bill in the coming week and also announced a celebration of the soon-to-be law on Sept. 6.

Passing the IRA “required many compromises. Doing important things almost always does,” Biden said.

National Climate Adviser Gina McCarthy was among other administration officials hailing the vote on Twitter, calling the IRA’s $369.75 billion in clean energy funding “our biggest climate investment ever, by far. This will save so many lives and create so many opportunities,” McCarthy said, crediting the bill’s success to “a broad, steadfast movement demanding a clean energy future.”

Senate Majority Leader Chuck Schumer (D-N.Y.), who negotiated the compromise version of the IRA with Sen. Joe Manchin (D-W.Va.), also took to social media, calling the IRA “the boldest climate package in U.S. history. … The Democrats got it done!” he said.

The party-line vote followed more than three hours of heated debate with Democrats and Republicans exchanging familiar arguments — and mid-term election talking points — about the bill’s impacts, mostly in one-minute speeches on the floor. Republicans hammered away on claims that the bill on would increase taxes and inflation, and set IRA agents on working Americans, while Democrats hit back with bill provisions that would cap prescription drug costs for seniors on Medicare and accelerate the country’s shift to clean energy while lowering utility bills.

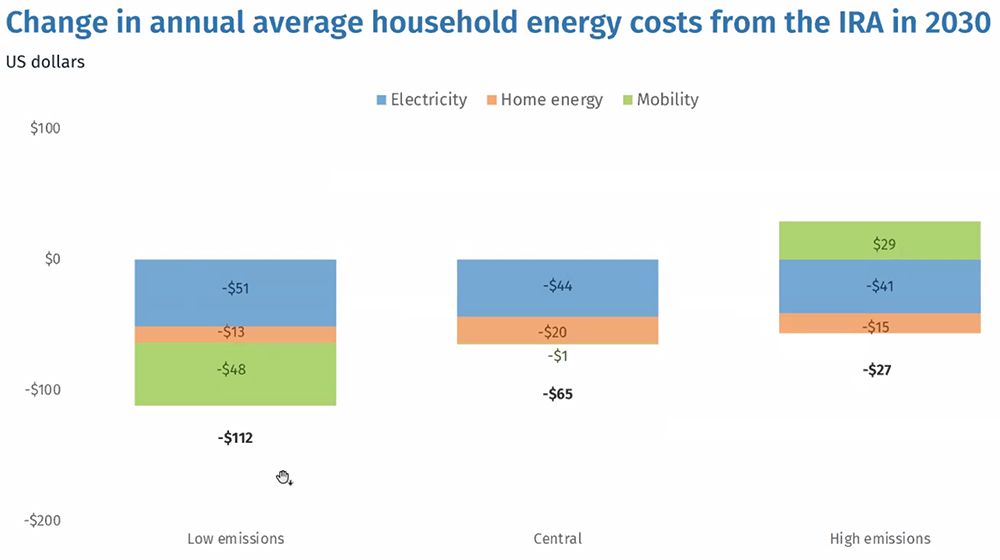

House Minority Leader Kevin McCarthy argued that under the IRA, “your energy prices will now go through the roof. I look forward to every Democrat who votes for this bill … [explaining it] to their constituents when they’re making a choice about whether they pay [for] the energy to heat their homes, or they cut back on the gas to fill their tank.”

“We have a climate crisis, and the deniers have undermined our ability to respond,” countered Majority Leader Steny Hoyer (D-Md.). “This bill responds and … consistent with the desires of the American people, will bring down the cost of energy for Americans by investing in developing and deploying cleaner, more sustainable energy technologies like electric vehicles and solar panels.”

Rocky Path to Passage

The version of the IRA that passed Friday has traveled a rocky path since September 2021, when Democrats first unveiled it as the $3.5 billion Build Back Better Act, a filibuster-proof budget reconciliation package with a range of social spending and clean energy incentives. Faced with opposition from the Senate’s centrist Democrats, Manchin and Sen. Krysten Sinema (D-Ariz.), Biden in October negotiated a trimmed-down BBB framework set at $1.75 trillion.

The House passed its version of BBB on Nov. 19, with a $2.2 trillion price tag, adding spending on progressive priorities such as four weeks of paid family and medical leave. BBB then went to the Senate, where negotiations hit a wall in December when Manchin walked away from further discussions.

“I have always said if I can’t go home and explain it to the people of West Virginia, I can’t vote for it,” Manchin said on Dec. 19 on “Fox News Sunday.” “And I cannot vote to continue with this piece of legislation. I just can’t. … This is a no.”

At the time, Manchin said the government should focus on inflation and the year-end surge in COVID-19 cases, driven by the fast-spreading Omicron variant. (See Manchin Says ‘No’ on Build Back Better.)

Manchin and Schumer resumed negotiations on the bill earlier this year, but Manchin balked at rising inflation figures in July, and once again appeared to close down talks on the legislation. (See Biden: ‘I Will not Back Down’ on Climate Action.)

The surprise announcement of a deal on the renamed Inflation Reduction Act came on July 27, followed by passage in the evenly split Senate on Aug. 7 — 51 to 50 — with Vice President Kamala Harris casting the tie-breaking vote. (See Senate Passes Inflation Reduction Act.)

Senate Republicans offered dozens of amendments during the Senate debate, two of which passed. A $35 per month cap on insulin prices for consumers with private insurance was stripped from the bill but was retained for Medicare patients. A second amendment revised the bill’s 15% corporate minimum income tax, exempting companies owned by private equity from the provision.

Prior to Friday’s debate, House Democrats also passed a resolution setting out the rules for the debate, which specifically closed off any attempts to further amend the bill. Under the rules for budget reconciliation, any changes in the House would have required the IRA to go back to the Senate for a second vote and possibly more Republican amendments.

‘Fully Unleashed’

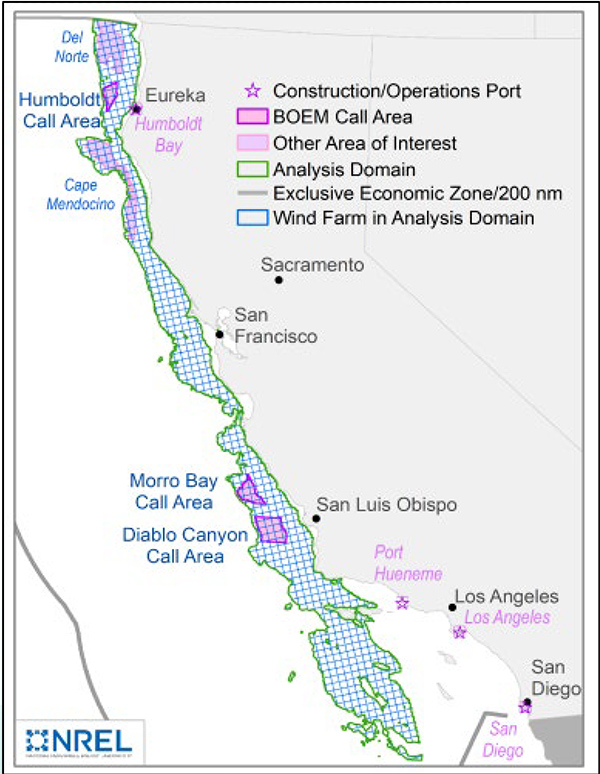

For clean energy advocates and industry groups, the IRA’s expansion and extension of renewable energy production and investment tax credits was a big win. The bill extends existing wind and solar tax credits through the end of 2024 and then transitions them to technology neutral clean energy tax credits that continue through 2032. A direct-pay provision also allows nonprofit organizations, including electric cooperatives, to access the tax credits, which they have been unable to do. (See What’s in the Inflation Reduction Act, Part 1.)

“Electric cooperatives are leading the charge to reliably meet America’s future energy needs amid an energy transition that increasingly depends on electricity to power the U.S. economy,” National Rural Electric Cooperative Association CEO Jim Matheson said. “As co-ops continue to innovate, access to tax incentives and funding for investments in new energy technologies are crucial new tools that will help reduce costs and keep electricity affordable for consumers.”

Tom Kuhn, CEO of the Edison Electric Institute, the trade association for investor-owned utilities, said the 10-year time horizon for the credits will provide “much needed certainty to America’s electric companies over the next decade as they work to deploy clean energy and carbon free technologies. … This legislation firmly places the United States at the forefront of global efforts to drive down carbon emissions, especially when paired with the historic [research, development and deployment] funding” in the Infrastructure Investment and Jobs Act, he said.

CEO of Advanced Energy Economy Nat Kreamer called out the bill’s tax credits for solar, storage and other clean energy manufacturers. “Clean energy technologies will be fully unleashed,” Kreamer said. “Clean energy manufacturers and developers alike will now have the right financial tools and the policy certainty they need to produce and buy the components that power these innovative technologies here in America.”

Other provisions of the IRA expand the 45Q tax credit, which had been a particular focus for the carbon capture industry. The bill ups the per ton incentives for carbon and direct air capture, for example, from $50 to $85 per ton for carbon sequestered in geologic saline formations, and also provides a direct pay option.

Madelyn Morrison, external affairs manager for the Carbon Capture Coalition, said the IRA “reinforces the essential role carbon management must play in achieving midcentury climate goals while providing a critical pathway to creating and retaining the high-wage jobs base communities and families depend upon, and positioning our nation’s industrial, energy and manufacturing sectors as leaders in technology innovation.” (See What’s in the Inflation Reduction Act, Part 2.)