ALBANY, N.Y. — Development of potential fossil fuel replacements was a recurring focus of the 2024 New York Energy Summit.

Presentations at the Infocast event April 8-10 focused on alternate energy sources individually and collectively.

Offshore Wind

Offshore wind is potentially one of the largest components of New York’s energy transition, with multiple wind farms envisioned to provide several hundred megawatts each of emissions-free electricity.

But it is also the most problematic, relying on limited or nonexistent domestic manufacturing capacity and infrastructure and getting buffeted by macroeconomic trends. The state’s roster of contracted offshore projects was all but erased as rising costs rendered the contracts untenable in 2023, guaranteeing that already huge costs will jump even higher.

The most recent provisional contract awards carry a weighted average all-in lifetime development cost of $150.15/MWh. (See Sunrise Wind, Empire Wind Tapped for New OSW Contracts.)

However, with each project carrying a budget in the billions, and billions more in ecosystem investments expected, industry interest is keen. New York’s offshore wind reset was a topic through multiple presentations at the summit.

Gregory Lampman, offshore wind director for the New York State Energy Research and Development Authority, reaffirmed what is widely known: New York remains fully committed to offshore wind, not just as a source of carbon-free electricity, but as a new industry with its own ecosystem. It just may take longer than expected to come to fruition.

“I think we’re all realizing that our aspirations and the goals and timelines that we had in mind were pretty exceptional,” he said. “The goals are still really massive, and we’re on track to do some really great things over the next couple of years.”

Adaptation will be key, Lampman said. The state cannot just write contracts for projects; it must work with industry to move projects forward.

Peter Lion of NYSERDA and David Whipple of Empire State Development said the state’s willingness to provide seed money — with more than $1 billion in grants — has helped advance the new sector.

“Private industry is unable to do this on their own, from what we’ve seen, and New York is happy to be a public investor,” Lion said.

Rubiao Song, managing director of energy investments at JPMorgan, said that from a tax equity perspective, the top concerns for investors are supply chain constraints, shortage of vessels and lack of a robust insurance market.

“Hurricane risk is a real issue here,” he said. “We need a significant presence from the insurers.”

Sergio Garcia, executive director of project finance in the Americas for Rabobank, said he believes the wind energy projects proposed off the New York coast will obtain their needed financing.

“I think the expectations have to change a little bit. They’re not going to be financed the same as Vineyard Wind,” he said, referring to the 800-MW facility being built off Massachusetts, which in 2023 became the first major U.S. offshore wind project to put “steel in the water.”

“I think at that point, banks were overly excited [and] extremely optimistic, and we saw what happened.”

Yet the willingness to finance these projects endures, Garcia said, despite the slow pace of development and dearth of critical infrastructure such as ports and ships. “It’s not as fast as we would like it to be, but yes, there is appetite for those types of assets.”

Aude Schwarzkopf, Equinor’s East Coast head of commercial development, said an important piece of infrastructure began to take shape in April as construction started on an offshore wind operations and maintenance port at the South Brooklyn Marine Terminal. Equinor is developing the site for its Empire Wind project but intends it to be a resource for other projects as well.

“From the developer perspective, 2023 was hell, so it can only get better from here,” Schwarzkopf said. “At least that’s what I hope.”

Equinor started 2023 with three contracted New York projects and ended the year with none, she explained. But in late 2023, Empire Wind was greenlit by federal regulators, and in early 2024, it won a conditional new contract from New York state.

“I think that this more stable time is the time that the industry needs to focus on building the supply chain,” Schwarzkopf said.

Brian O’Boyle, director of transmission development at National Grid Ventures, spoke of Community Wind, his company’s joint venture with RWE. It’s in a much earlier stage than Empire Wind, so it has a long road ahead.

“I think we’re holding the course” in the face of the industry’s challenges, O’Boyle said. “A lot of it is building the supply chain up more than it is building the individual project, which in itself is a herculean undertaking.”

Fred Zalcman, director of the New York Offshore Wind Alliance, said some momentum has been lost: Almost every East Coast state with offshore wind contracts saw cancellations in 2023.

“Is it fatal? No. Absolutely not. And I think in large measure the credit goes to state policymakers,” Zalcman said, noting that NYSERDA took just three months to issue a rush solicitation for offshore wind proposals after existing contracts became untenable in 2023.

New York’s three previous solicitations had taken 14 months on average to prepare.

Solar

Discussion of solar energy development at the summit veered between appreciation for New York’s support of community solar projects and dismay at increasing local opposition to construction.

Nicola Armacost, mayor of Hastings-on-Hudson in Westchester County, discussed the village’s success streamlining its solar permitting process. It is hardly a microcosm of New York state — a small, progressive-minded village with many preservationists among its populace — but the process has helped it gain recognition as a clean-energy community.

“There isn’t a lot of resistance on either the residential side or on the municipal side, and I think that makes it much easier,” Armacost said.

Not so in other parts of the state. Resistance to solar and other renewable energy installations is firm, and it is spreading.

Noah Ginsburg, executive director of the New York Solar Energy Industries Association, said he asked his members to identify municipalities that have enacted restrictions, then had to send out another email telling them to stop because he had enough names to make his point.

“Mayor Armacost, please come and run for mayor in many other towns across New York state that are banning solar,” he said. “It’s easier in many parts of New York state to get a permit for a 100-MW solar facility than a 5-MW solar permit.”

Solar installations of less than 5 MW have been the majority of those installed in the state and are the majority of those proposed, he said, but they do not qualify for the expedited review the state Office of Renewable Energy Siting provides to larger projects.

A subset of small solar installations — community solar — has done very well in New York thanks to supportive state policies. In 2023, the state surpassed 2 GW of installed community solar, the most of any state.

Max Joel, director of NY-Sun at NYSERDA, said the state is on track to meet its distributed solar targets: 6 GW by the end of 2025 and 10 GW by 2030.

“The residential solar space has been a mainstay,” he said. “I think like everywhere in the country, we do have that doughnut hole in large rooftop commercial and industrial. Not that we don’t have plenty of that, but it hasn’t grown in proportion to the other sectors.”

Storage

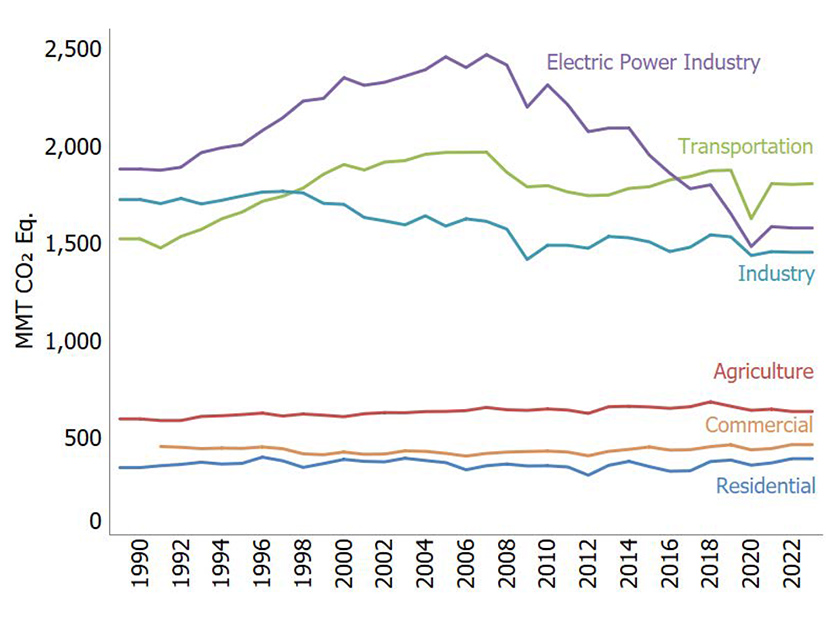

Energy storage is a necessary complement to the intermittent offshore wind, onshore wind and solar generation New York envisions.

Solar is particularly fickle, with a capacity factor that shrivels to the single digits during the short, cloudy days that mark a New York winter. But wind lulls can be problematic as well.

State leaders have appropriately ambitious goals for storage, but buildout is off to a slow start.

Long-duration storage is not available at scale; the present market structure is not favorable for short-term storage; the industry is waiting for the state to finalize a revised roadmap for deployment; and a spate of highly publicized fires has galvanized local resistance to siting.

William Acker, executive director of the New York Battery and Energy Storage Technology Consortium, said the need and opportunity for intraday energy storage is pressing and the need for longer-duration storage is looming.

“We’ve got to get going on those things,” he said. “Getting projects built [faces] a number of barriers in New York state, and the roadmap identifies those barriers, creates programs to knock them down and to develop projects. To us this is one of the most important things that needs to happen right now.”

David Sandbank, NYSERDA’s vice president of distributed energy and transportation, said there is about 12 GW of storage in interconnection queues. NYSERDA itself has contracted 1.3 GW, but less than 300 MW of that is operating or under construction.

“It’s not a lot. And the 1.3 is about 1.1 right now because of some bulk storage projects canceling,” he said. “I think what you’re going to see in the very near future is a lot of retail 5-MW, four-hour battery storage projects getting built in New York City. There’s about 150 MW right now that are shovel ready.”

MD Sakib, National Grid’s director of future of electric, repeated that New York now has 250 MW of the 6 GW that the revised roadmap calls for by 2030.

“Let that sink in,” he said. “There’s a lot that we need to do, and I think there’s a lot of outreach and education that needs to happen.”

Projects are stalling in the application and review phases, and costs have soared, Sakib said.

“I think we have the right roadmap in place. … It’s just a matter of getting down to it and making sure we execute those things.”

Hydrogen

Haiyan Sun, hydrogen and clean fuels program manager at NYSERDA, said hydrogen remains a key part of the state’s decarbonization strategy, even after the U.S. Department of Energy did not award New York and its New England partners the hydrogen hub they were seeking.

“It will play an instrumental role,” Sun said. “What New York needs to do for hydrogen long term is not going to be affected by whether we have a DOE hub or not. It affected the short-term momentum, certainly, but we respect DOE’s decision. We did not get an answer [on] why we were not selected.”

Hydrogen will help decarbonize hard-to-electrify sectors, Sun continued. “Hydrogen will also play a critical role in [stability and reliability] of the New York grid while we march along to 70-by-30 and especially when we try to reach zero emissions by 2040.”

Plug Power Chief Technology Officer Tim Cortes said New York’s support for manufacturing has been an important part of the growth enjoyed by the company, which is headquartered only a few miles north of the capital.

The proposed federal 45V tax credit rules have given the company pause, however. Much of the hydrogen industry is gnashing its teeth over the draft guidance, Cortes said.

Jeffrey Goldmeer, director of the global hydrogen value chain for GE Vernova, said technology is not likely to be the sticking point for hydrogen adoption. A greater challenge is likely to be the infrastructure supporting it, he said, recalling a 2021-2022 hydrogen combustion demonstration project at a New York Power Authority peaker plant that was dictated by the availability of green hydrogen, several tanks of which were trucked in each day.

There is a potential geographic split between where hydrogen is generated and used, Sun said, as well as a seasonal split between the greatest need for green hydrogen and the greatest availability of renewable energy to generate it.