An American Council on Renewable Energy (ACORE) panel last week largely agreed that MISO’s current transmission benefits process could serve as a blueprint for the country.

Industry experts analyzed the RTO’s business case behind its recently approved long-range transmission plan (LRTP) as FERC prepares to issue a rule on regional transmission planning and cost allocation (RM21-17). (See FERC Issues 1st Proposal out of Transmission Proceeding.)

“I usually say cost allocation is the biggest barrier to long-term transmission development, and, of course, the key to cost allocation is to find transmission plans where the benefits outweigh the costs,” Grid Strategies President Rob Gramlich, said. “This is really important, to measure these benefits and get it right.”

Gramlich said during the Aug. 9 webinar that the country could use a standardized method for quantifying transmission benefits.

“There isn’t really a standard of how to do this. Even the categories themselves differ,” he said, adding it would be helpful if FERC created consensus on benefits categories and their metrics.

Gramlich said MISO has been a leader in proactive, multi-benefit planning beginning with its 2011 Multi-Value Project (MVP) portfolio — lines now delivering wind power from the Upper Midwest — and its recently approved LRTP. (See MISO Board Approves $10B in Long-range Tx Projects.)

He said beyond MISO’s recent success, there’s a widespread absence of effective transmission planning. Regions aren’t planning using scenarios or a portfolio approach, he said.

Gramlich said transmission planning has been in decline since 2013, when about 4,000 miles of 345-kV and higher lines were added.

“We did a whole lot of successful transmission planning a decade ago,” he said. “But since then, unfortunately, it’s been sort of going down to a trickle because of the lack of effective transmission planning. Hopefully, we’re in the process of reversing that.”

Gramlich called on grid operators to do “at least an initial screening” of the 12 transmission benefits FERC identified in its notice of proposed rulemaking and pursue the ones that show significant benefits.

He said MISO arrived at a set of benefits that seemed to make sense for its LRTP planning. Other regions can take a similar approach to come up with different menus of benefit categories, he said.

While the LRTP benefit-cost analysis included congestion savings, resource adequacy savings and avoided risk of load shed and transmission and generation investment, it didn’t include seven other benefits FERC suggested in the NOPR. MISO did include decarbonization as a benefit, something the commission hasn’t called for.

The NOPR asks regions to consider the transmission benefits of avoided reliability and aging infrastructure projects, production cost savings, lower transmission energy losses, reduced chances of load shed or lowered reserve margins, diminished congestion, mitigation of extreme events and system contingencies, tempering of weather and load uncertainty, capacity cost benefits from reduced peak energy losses, deferred generation investments, access to lower cost generation, increased competition and increased market liquidity.

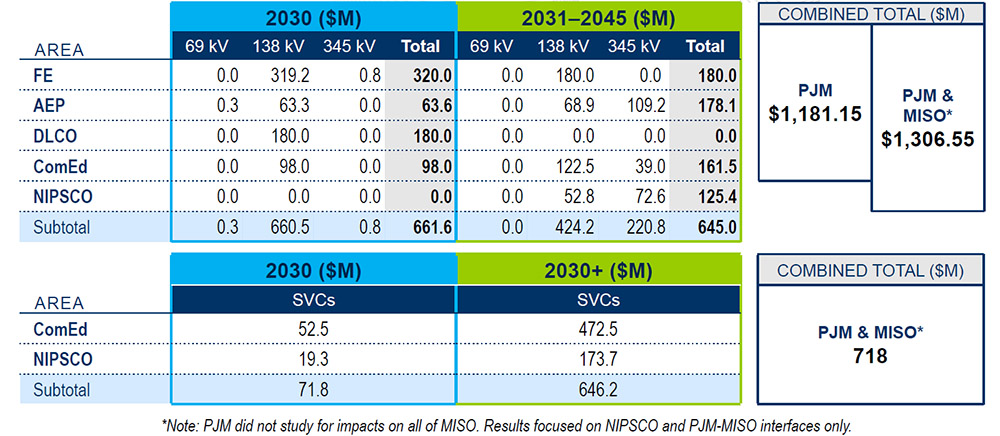

MISO’s first LRTP portfolio is expected to deliver $37.3 billion from its defined benefits to ratepayers from 2030 to 2050. The grid operator also estimates that the plan will help facilitate the 56 GW of new renewables it anticipates adding over the next 20 years in its most conservative planning scenario.

MISO’s Jeremiah Doner | ACORE

MISO’s Jeremiah Doner | ACOREJeremiah Doner, MISO’s director of cost allocation and competitive transmission, said it’s “not an easy endeavor” to build a business case for a long-term transmission portfolio.

“There really isn’t a playbook to take from,” he said.

Doner said the LRTP business case has a lot of commonalities with FERC’s categories. He said planners considered how much time it would take to incorporate benefit categories versus how much value they would demonstrate. For example, Doner said the LRTP’s savings from transmission energy losses weren’t promising enough to quantify.

He said it’s important to allow grid planners flexibility in what benefits they choose to quantify. He noted that MISO used different benefit metrics between its multi-value projects and its LRTP portfolio.

ITC Holdings’ manager of federal affairs, Devin McMackin, said his company believes MISO’s business case can be held up as a model for the nation.

“The important thing is that we can now repeat this and double down on these types of regional planning efforts, especially now that we have a climate bill that has passed Congress,” he said.

McMackin said it seemed that FERC’s NOPR was “taking cues” from regional planning MISO performed under its MVP and the LRTP portfolios.

“What we don’t want to see are these 10-year lulls in between regional planning efforts because these needs are only accelerating and it’ll start to get away from us if we don’t keep at it,” he said.

It makes sense for FERC to prescribe a minimum set of benefit metrics and leave some flexibility between regions, McMackin said. MISO’s benefit metrics represent a good starting point for the commission to consider, he said, adding that having planners on the same page is crucial for interregional projects.

“If we want interregional planning to work, there has to be some level of common benefits basis,” he said, “so not only would FERC be aiding the regional planning process, but it would also set the stage for the ability to then move forward and do some interregional planning.”

Michigan Public Service Commission Chairman Dan Scripps said he considers the first set of LRTP projects as above other benefits and key to the future system’s reliability. He characterized long-range planning as a shift from “reactive, near-term” reliability planning to a “forward-looking, proactive” approach to addressing reliability.

“The challenge with the value of lost load is you sort of know the value when you don’t have it,” Scripps said. “Winter Storm Uri was very clear evidence of that, not just in the loss of life, but also in the bills that folks saw after the fact.”

Scripps said there’s a risk with undervaluing transmission reliability benefits. He said the public needs a prepared system with extreme weather becoming more common and severe.

Jennifer Easler, an attorney with the Iowa Department of Justice’s Office of the Consumer Advocate, said regional transmission planners should allow stakeholders access to modeling and planning assumptions early in the process so there’s a broad understanding of benefit analyses.

She said MISO’s set of benefits are appropriate for its backbone transmission buildout.

Gramlich said in a perfect world, all transmission benefits should be compared against all costs.

“It’s almost an obvious point … You have to consider all the benefits and all of the costs,” he said. “It’s a little weird that we’re even arguing about whether one should consider all the benefits and that we have a FERC NOPR that says, ‘Yeah, here are 12 benefits but feel free to ignore a bunch of them.’ That’s obviously inconsistent with good public policy.”

Gramlich also said it’s clear that FERC’s list is limited to its jurisdiction under the Federal Power Act and cannot include a full array of benefits like economic development or local emissions reduction.

“At this point, I like the FERC list of 12,” he said later during the discussion.