Two former FERC chairmen and a state commissioner are pessimistic that MISO will be able to rein in shortages or high capacity prices anytime soon and said demand-side management would assuage the situation.

Former FERC chair and Voltus Chief Regulatory Officer Jon Wellinghoff said during a Nov. 21 webinar, sponsored by his company, that today’s grid fragility in the Midwest can be traced to an increased amount of renewable energy and extreme weather conditions.

“We’ve got a situation now in which our grid is being increasingly tested by extreme weather events that are being driven by climate change, but the steps that we need to take to combat climate change and mitigate our emissions include increased dependency on weather-dependent resources,” former FERC chairman Neil Chatterjee said. “This is a challenging conundrum, and it’s one that policymakers and grid operators have really been wrestling with.”

Voltus CEO Gregg Dixon said an ongoing transition to renewable resources and increased electrification demand alongside severe weather are “putting an even greater strain on an already antiquated grid.”

“We are a month away from winter, and the headline is: ‘It does not look good’ … And summer of 2023 does not look a whole lot better,” Dixon said, referencing NERC’s recent reliability assessment.

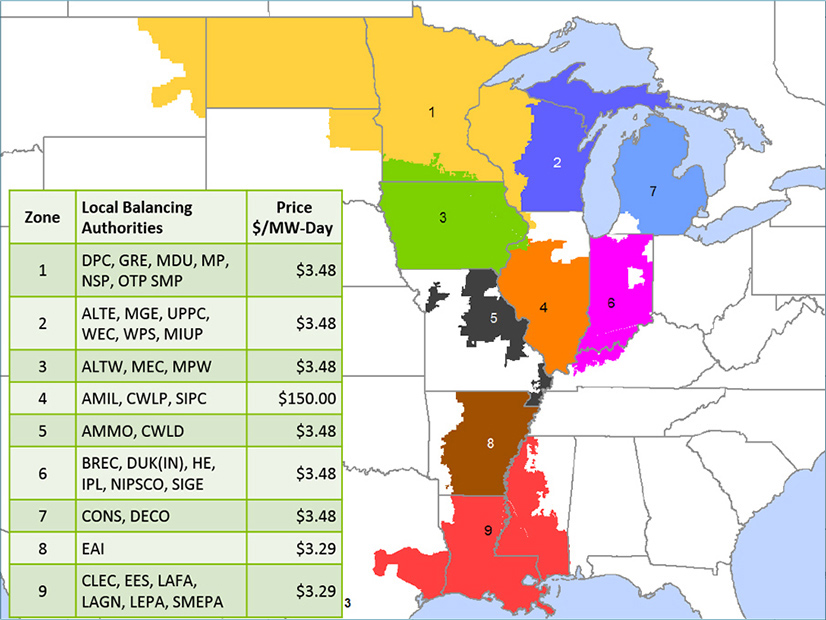

The agency has warned that MISO risks winter blackouts after its most recent capacity auction uncovered a 1.2-GW deficit heading into the June 1, 2023, planning year. The Independent Market Monitor has said the footprint’s real risk lies in summer 2023.

Chatterjee said with “the absence of federal legislative guidance” on decarbonization, states must devise their own strategies to cut carbon while ensuring resource adequacy.

Former Arkansas PSC Chairman Ted Thomas | © RTO Insider LLC

Former Arkansas PSC Chairman Ted Thomas | © RTO Insider LLCFormer Arkansas Public Service Commission chairman Ted Thomas said MISO’s role as reliability coordinator and states’ obligation to ensure resource adequacy can never be “cleanly” separated.

“So, there’s always this tension that plays out with all of these policy issues,” he said.

Thomas said until now, state regulators have always resisted the downward-sloping demand curve in the MISO capacity auctions, viewing it as a “slippery slope” to a mandatory, PJM-style auction.

He said that when the price “shot up” during the 2021-22 planning year auction, regulators’ response was, “MISO, what are you going to do about it?” Thomas said a few years ago, changing the demand curve’s slope would have been viewed by regulators as an overstep.

He said a sloped demand curve will produce gradually increasing capacity prices, instead of extremely low prices one year that skyrocket the next.

“To me, the issues we’re seeing in MISO are simple: There’s just not enough generation,” Chatterjee said. “States have made it clear that they are primarily responsible for resource adequacy … Yet for years, merchant generators have been sounding the alarm that they couldn’t continue to lose money year-over year and that market revenues were not sufficient.”

Chatterjee said some states and load-serving entities believed they could continue to buy capacity from the MISO auction at rock-bottom prices.

“Why pay to build or contract for generation when it’s available for a fraction of the cost in the MISO auction?” he said. “And the end result of that is that badly needed generation has retired, and now the entire region is going to be at an elevated risk of load loss for the foreseeable future.”

Dixon said Voltus expects that MISO Midwest capacity prices will continue to “cap out” at the cost of new generation entry, making Midwestern capacity “perhaps the most expensive in the world.”

“Which is really ironic because it used to essentially be for free,” Dixon said.

Thomas said MISO is better preparing for “oddball weather any time of the year” by shifting focus from a summer peak and switching to capacity accreditation based on unit availability.

He also said MISO South members’ continuing resistance to adding more transfer capability between MISO Midwest and the South regions “balkanizes the RTO footprint” to the detriment of resource adequacy.

Thomas prescribed large customer aggregation to leverage demand response to address reliability crises. He said residential and commercial customers need a combination of renewable energy, demand response and energy efficiency measures “to escape the hit of these commodity prices.” Third-party aggregators can apply competitive pressure to utilities to “up their game,” he said.

“I think utilities are going to have to recognize that they’re going to have to compete and evolve their business models or continue to face pressure. Pressure from regulators, pressure from consumers,” Chatterjee said.

Wellinghoff said customers in states that have opted out of demand response and are unable to participate in a wholesale market’s aggregation should register their displeasure with FERC. He said the commission should revoke the ability for states to opt-out, especially considering the flexible load that tomorrow’s electric vehicle fleets can supply.

Chatterjee agreed that FERC should remove the demand response opt out, saying that tight supply conditions are not going to resolve themselves.

“We tend to only react after bad things happen. And to me right now, we’re seeing FERC drag its heels on the DR opt out; we’re seeing resistance at the state level,” Chatterjee said. “To me, it’s going to take something negative to trigger change, to trigger movement.”

He added that there’s “real risk in MISO right now of not having enough capacity on one or two very, very hot days.”

“To me, it seems like a few factories turning off could make a real difference. Sadly, it will probably take an event like that to, in my view, lead to policy changes that are necessary,” Chatterjee said.

Thomas said the Midwest could use universal access to advanced metering infrastructure and aggregation alongside a faster roll out of MISO’s proposed 2030 compliance with Order 2222, which allows aggregators of distributed resources into the wholesale energy markets. (See MISO Stakeholders Protest RTO’s Order 2222 Implementation Timeline.)

After that, Thomas said, the grid operator could probably “have a cold one and lean back and watch entrepreneurs and business looking out for their own interests” help decarbonize the grid, reduce costs and bolster system reliability.

“If you’re going to have scale-variable resources, you’ve got to have scale-variable load,” he said. “That’s the cheapest option, and we need to make that happen.”