Stakeholders Endorse Prohibiting Gas Infrastructure Participation in DR

VALLEY FORGE, Pa. — The Market Implementation Committee endorsed a PJM effort to prohibit critical gas infrastructure from participating in demand response programs that could jeopardize the reliability of gas-fired generators. The endorsed language revises sections of manuals 11 and 18 to add language excluding “critical gas infrastructure” from being eligible as price responsive demand programs.

The changes are being considered as NERC and FERC work on their own efforts to address concerns raised by the impact of February 2021’s winter storm — that a spike in load could lead to gas infrastructure being curtailed and causing a cascading failure as downstream gas generators have their fuel interrupted. The PJM language would stand until the federal regulatory bodies finalize their own standards. (See “Critical Gas Infrastructure Approved,” PJM MIC Briefs: March 9, 2022.)

Much of the lengthy discussion on the topic focused on how PJM is considering defining critical gas infrastructure in its tariff: “as electric loads, which if curtailed, will significantly impact the delivery of natural gas to bulk-power system natural gas-fired generation.” The tariff language is not part of the package endorsed Thursday and is still being fine-tuned by PJM staff with input from Thursday’s meeting.

At issue was the definition of “significant impact.” Calpine’s David “Scarp” Scarpignato questioned how PJM would classify a curtailment causing a drop in pipeline pressure causing a downstream gas plant to run at less than full capacity, or a curtailment that doesn’t cause a direct drop in a plant’s ability to generate but has that effect when combined with other contingencies.

“A significant impact is a difficult measure. That’s going to be difficult to implement those rules. … I wonder if we can substitute ‘direct’ for ‘significant,’” he said.

Joe Bowring, PJM’s independent market monitor, said he believes the language is “fuzzy” and therefore not enforceable. He also questioned whether there’s a risk of gas infrastructure being enrolled in DR programs this winter (2022/23) as PJM considers the revisions, which will not be applied until the winter of 2023/24. Bowring also questioned why PJM has not done its own assessment of the facilities rather than relying on the sellers of demand response for the information.

PJM’s Peter Langbein said curtailment service providers have told staff that there are not currently any gas infrastructure facilities enrolled in their programs that would meet the general definition under consideration.

Paul Sotkiewicz, of E-Cubed Policy Associates representing J Power USA, said he’d prefer to see an explicit prohibition against electric-driven gas compression stations participating in DR in any form.

“We’re setting ourselves up for a cascading failure without addressing compression,” he said.

Elimination of ‘CT Rule’ Receives Endorsement

Stakeholders also endorsed manual revisions being sought by PJM to eliminate the “CT Rule,” which grants combustion turbines an exception from rules requiring that generators follow dispatch signals. Currently CTs can recover the costs of their full generation regardless of their load signal, while other generators receive the lesser of their actual generator or their dispatch.

PJM’s Lisa Morelli, director of market settlements initiatives, said the rule is a holdover from when CTs put out a fairly constant rate of power. Now that they have a wider dispatchable range, it makes sense to require them to conform to dispatch, she said. The elimination of the exception can be made by removing a single line in Manual 28.

“CTs will now be treated as all other resources in balancing of operating reserve credits,” she said.

During the Sept. 21 Markets and Reliability Committee meeting, Morelli said simulations show that uplift payments to CTs were about $1.3 million lower when recalculated without the exception over the eight highest CT uplift days in summer 2021, a 10% drop. (See: “PJM Staff Seek Removal of CT Exception on Load Signaling,” PJM MRC/MC Briefs: Sept. 21, 2022.)

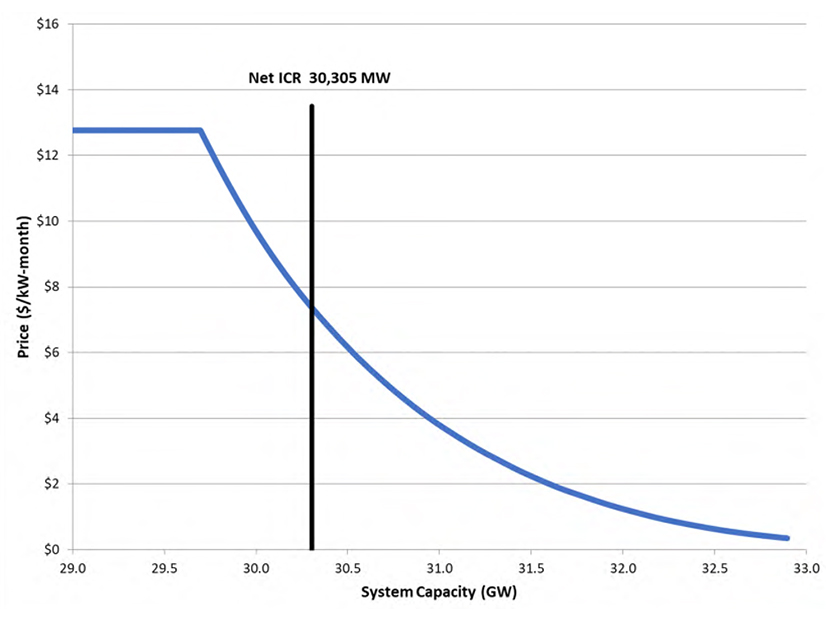

Impact of State and Local Regulations on Net CONE Discussed

PJM staff provided a first read on an issue charge and problem statement exploring how local considerations, such as state and local regulations, might affect the development of the net cost of new entry (CONE). The topic will return to the MIC for possible endorsement at its next meeting.

James Wilson, a consultant to state consumer advocates, recommended broadening the issue charge and potential solutions to include other possible changes beyond net CONE, such as to the shape of the variable resource requirement curve.

Gary Helm of PJM said the RTO’s intent was to stick with addressing CONE and net CONE, as opposed to weighing the outcomes.

Four-year Review of Default CONE and ACR Underway

PJM’s Skyler Marzewski and consultants from The Brattle Group presented an overview of the first four-year review of the default CONE and avoidable cost rates and the timeline for drafting the new values.

PJM’s tariff requires the RTO to update default gross CONE and default gross ACR values for minimum offer price rule purposes every four delivery years beginning with 2022/23.

The methodology would use public national sources for the installed capital costs and fixed operating and maintenance costs, as well as using the same financial assumptions as in the quadrennial review.

“It will be a very similar process to what we did last time,” Marzewski said.

Stakeholders questioned if there’s sufficient geographic variability to justify using data specific to the PJM region, instead of national data. Marzewski said this was explored; however, it was found that there’s limited local data available. The largest variations in the cost of development tend to be the size and configuration of generators, according to Brattle’s presentation.

Default values for offshore wind were not explored in the analysis thus far as the focus was on existing generation. Instead, unit-specific analysis would be undertaken for OSW, as well as other generators with highly variable costs.

PJM Reviews Proposed VOM Language

PJM staff reviewed a set of proposed manual revisions that would codify a PJM package creating standardized variable operating and maintenance costs. The RTO’s package was the preferred solution coming out of the MIC’s Sept. 7 meeting, receiving more than 70% support over a competing package from Constellation Energy, which received 54%. (See “Two Alternatives on VOM Advance to MRC,” PJM Market Implementation Committee Briefs: Sept. 7, 2022.)

Constellation’s Jason Barker questioned PJM’s classification of nuclear major maintenance costs as variable costs that are directly related to electric production based on starts and run hours and thus must be reflected in a unit cost-based offer, rather than in a capacity market offer. Barker said there is an apparent contradiction in PJM’s proposed Operating Agreement and manual provisions that define nuclear refueling and other major maintenance projects as “variable” while also excluding time-based or preventative maintenance from classification as a variable cost. Barker said that Constellation and other nuclear operators consider costs incurred during planned nuclear outages as “fixed” costs. He also highlighted that all nuclear planned outages are scheduled years in advances, suggesting that projects undertaken during those outages are time-based. The company’s package would exclude nuclear planned outage costs from PJM’s definition of major maintenance.

The manual changes will go to the MRC on Oct. 24 for a first read with a vote anticipated on Nov. 16.

Other MIC Topics

- A first read was presented on a proposal to merge the DER & Inverter-Based Resources Subcommittee and Demand Response Subcommittee into a new subcommittee, given the similarity of the subjects they cover and the composition of their stakeholder participation. PJM staff said doing so would simplify scheduling internally and for stakeholders, although there were some concerns that doing so could conflate their charges and the issues they aim to address.

- PJM’s Andrew Levitt gave a first read of a proposal to expand the RTO’s current hybrid resource provisions to include installations with multiple types of generation paired with storage. The current hybrid definition allows for only one type of generation, for example solar paired with storage, while the Hybrid Resources Phase II solution would allow for “any number of different types of [generation].” The proposal would also create a detailed energy market model for inverter-based resources paired with storage, such as wind and solar combinations.

- PJM provided an explanation on the impact of negative day-ahead and real-time LMPs in the calculation of the balancing operating reserve credits. Negative DA or RT LMPs can result in unnecessary BOR credits caused by the treatment of day-ahead or balancing revenues, the RTO says. PJM plans to present potential solutions during future special sessions.