Energy officials from California and across the West weighed the potential benefits of Western electricity system integration for cost savings, transmission and resource adequacy in an all-day workshop Friday hosted by the California Energy Commission.

The workshop was meant to brief a broader audience, including state lawmakers, on regional market developments. In the past year, CAISO and some California lawmakers have advanced the idea that California should play a larger role in regional markets as it faces competition from challengers such as SPP.

Friday’s session was part of the commission’s Integrated Energy Policy Report (IEPR), a biennial assessment of energy issues and policy recommendations in which the CEC tries “to elevate important topics to make sure … the state Legislature is aware of what is happening in the energy space,” Commission Vice Chair Siva Gunda said.

“So, with that spirit, we have included the Western integration topic as an important element of this year’s IEPR,” Gunda said. “A lot has been happening over the last couple of years, and we thought it’s extremely important to provide a transparent, high-level update on what’s happening in the West as it pertains to Western integration and the markets.”

CAISO, for instance, began a stakeholder process in mid-October to explore the benefits of greater regional cooperation and a Western RTO, as California lawmakers had requested in Assembly Concurrent Resolution 188 in August. The resolution’s goals were limited, requiring only that CAISO report to the Legislature on recent studies of RTO benefits, but some saw ACR 188 as a cautious opening gambit in another regionalization effort. (See CAISO, NREL Start to Study Western Cooperation.)

Several prior attempts at turning CAISO into an RTO fizzled in 2016-2018, as most lawmakers balked at broadening its governance to include other states. CAISO is a public benefit corporation created via state statute in 1998; the California governor appoints the five members of its Board of Governors.

However, circumstances have changed substantially since the last legislative attempt to broaden CAISO’s governance in 2018.

SPP is making inroads in the West with its Markets+ day-ahead offering and a plan to expand its Eastern RTO into the Western Interconnection. Utilities in Colorado and Wyoming have indicated they plan to join both. (See SPP Issues Final Markets+ Proposal.)

The Western Power Pool (formerly the Northwest Power Pool) will soon launch its Western Resource Adequacy Program, which could cover much of the Western Interconnection. WPP hired SPP to administer the program, and some observers have speculated that the WRAP might be a logical precursor to another Western RTO.

Workshop participants met in a hybrid in-person and online gathering to weigh these and other developments. They included members of the California Public Utilities Commission, CAISO CEO Elliot Mainzer, Air Resources Board Chair Liane Randolph and Gov. Gavin Newsom’s senior energy adviser Karen Douglas.

Participants from other states included utility commissioners from Colorado and Oregon and representatives of SPP, the Western Interstate Energy Board, the Western Electricity Coordinating Council, the Western Power Pool and the Northwest & Intermountain Power Producers Coalition.

“The attendance here today is indicative of the importance of this conversation,” Gunda said.

Role of Markets

A panel exploring the role of regional markets began the substantive discussions.

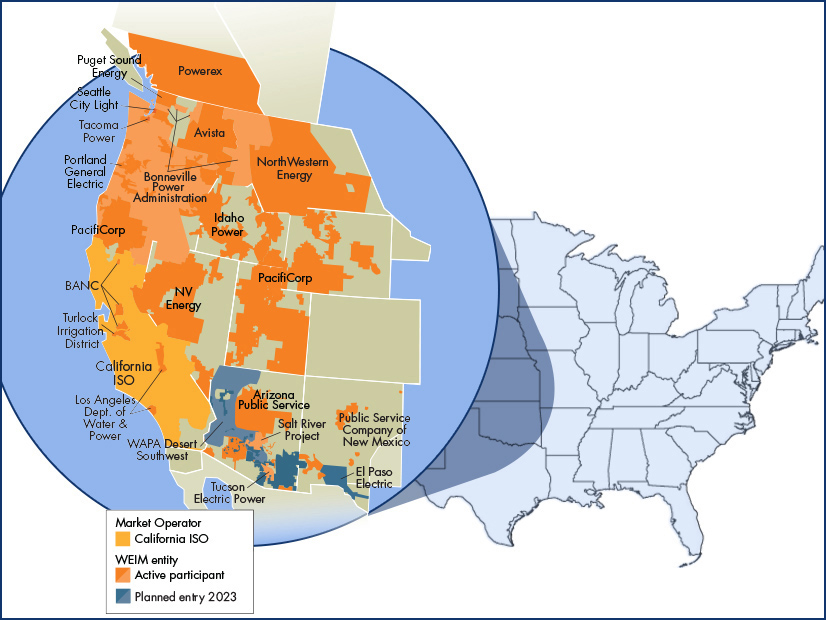

This year CAISO fast-tracked its extended day-ahead market (EDAM) proposal for its Western Energy Imbalance Market, a real-time interstate trading forum that has saved participants more than $3 billion in the past eight years. The real-time market, however, involves only a small amount of the transactions that occur in day-ahead trading.

“The success of the WEIM demonstrates that there’s a potential for a lot more,” said Anna McKenna, CAISO vice president of market policy and performance.

A recent study by consulting firm Energy Strategies found the EDAM could generate $1.2 billion a year in benefits, or 60% of the savings of a West-wide RTO, if it encompassed the entire U.S. portion of the Western Interconnection.

Energy Strategies Principal Keegan Moyer said a full Western RTO would generate even greater benefits. His firm estimated the benefits at $2 billion a year in electricity costs in test-year 2030 in a study prepared for state energy offices in Colorado, Idaho, Montana and Utah. (See Study Shows RTO Could Save West $2B Yearly by 2030.)

“The EIM was an excellent first step, and the $3 billion number is impressive,” Moyer said. “But every data point that we’ve seen from our work and others is that there’s still a lot of opportunity out there, which is why you see so much effort, I think, put into this by the industry.”

CAISO has scheduled a stakeholder meeting for Dec. 7 to discuss its final EDAM design and plans to seek approval from its board and the WEIM Governing Body in February.

Eric Blank, chair of the Colorado Public Utilities Commission, said a study performed by his commission found increased regional coordination could save the state’s electric utilities up to $300 million a year, or about 5% of their costs. State law requires Colorado transmission owners to join an RTO by 2030.

“These benefits were roughly the same whether we went west to CAISO, east to SPP or did something [in between],” the hypothetical study results showed, Blank said.

CAISO’s one-state governance is a potential roadblock to expanding it into a Western RTO unless state lawmakers broaden its governance structure. SPP would maintain its inclusive governance structure in the West, Carrie Simpson, the RTO’s director of Western services development, said in the workshop.

The expectation is that participants in SPP’s existing Western Energy Imbalance Service will eventually join Markets+ and that many Markets+ participants will become members of SPP’s planned RTO West, she said.

One diagram in her presentation showed a larger RTO West and Markets+ transacting business with CAISO and WEIM. Another used a map showing SPP and WPP dominating the Western landscape, with CAISO relatively isolated. (A comparable CAISO map would show the WEIM covering much of the Western Interconnection.)

Seams between RTOs and ISOs are common in the Eastern Interconnection and would work in the West, including between CAISO and SPP, Simpson said.

“You can have many markets next to each other, optimizing efficiently through seams. We have it in the East. It’s very common. MISO, PJM and SPP coordinate regularly together,” Simpson said. “And so, to the extent that we have seams [in the West], absolutely we will want to work with all of our neighbors to make sure we’re optimizing systems as efficiently as possible to bring the greatest benefits to customers.”

Whether California will again seek to form a Western RTO to compete with SPP remains doubtful.

CAISO’s ACR 188 report, performed by the National Renewable Energy Laboratories, is being conducted in partnership with Western entities such as NV Energy, PacifiCorp and the Western Area Power Administration. A draft is expected later this month, and CAISO hopes to deliver the report to the Legislature during the first weeks of its 2022 session, which begins Jan. 3.