CARMEL, Ind. — MISO is releasing preliminary design details of a sloped demand curve in its capacity auction. Staff plans to use its planning reserve margin requirement as a middle point and adding and subtracting incremental amounts of capacity, measured by expected unserved energy.

“It’s going to be convex shaped,” Mike Robinson, principal adviser of market design, told the Resource Adequacy Subcommittee Wednesday.

Robinson said MISO doesn’t yet have exact values associated with the demand curve.

“We have preliminary numbers, and we’re assessing them to make sure they pass the smell test and that they’re reasonable,” he said.

Mike Robinson, MISO | © RTO Insider LLC

Mike Robinson, MISO | © RTO Insider LLCReliability will be “foremost” in designing the curve’s shape, Robinson said. He noted MISO wants a demand curve that encourages reliability while valuing capacity at market prices. A capacity glut would render sloped curve prices nil, Robinson said.

Independent Market Monitor David Patton said a sloped curve can prevent premature resource retirements and will raise revenues for most utilities. He said the curve will also “reduce financial risk and the volatility associated with overbuilding and underbuilding of capacity.”

“You’ve all heard me talk about this for a decade or more,” Patton told stakeholders.

The Organization of MISO States has largely endorsed MISO revising the vertical demand curve currently used in MISO’s planning resource auction (PRA). (See State Regulators Endorse New Demand Curve in MISO Capacity Auction.)

OMS Executive Director Marcus Hawkins said support was “near unanimous.”

Some stakeholders have said that setting a demand curve is challenging because utilities place differing value on additional capacity.

MISO said that to formulate a sloped demand curve, it will need to run analyses using the net cost of new entry (CONE), or an approximated revenue from capacity payments. To do this, the grid operator is proposing to use three years’ worth of historical data to calculate inframarginal rents, the money used to cover generators’ fixed costs. Net CONE will be calculated by subtracting inframarginal rents from CONE and using them to inform the curve’s final shape.

Robinson said staff is trying to bend the curve in a way that supports net CONE over the long run.

Multiple stakeholders cautioned that inframarginal rents are rooted in market ambiguity and could set off lengthy stakeholder disagreements over what amount is appropriate.

A sloped curve will also have MISO adding what it calls an “advanced” fixed resource adequacy plan (FRAP) option.

Robinson said MISO isn’t planning on changing any existing participation options for market participants; they can still opt out of the auction, make a FRAP, self-schedule resources, or purchase from the PRA.

“This is just another option here we want to make available,” he said.

An advanced FRAP will require market participants to get their relevant regulator’s approval, make a showing that they can meet their load obligations a month ahead of the auction, and commit to not taking offers in in the auction for a minimum of three consecutive years. Under an advanced FRAP, load-serving entities could sell their excess capacity provided it they have a certain, yet-undetermined percentage of capacity beyond their requirement.

Robinson said MISO won’t allow partial advanced FRAPs as it does with run-of-the-mill FRAPs. “You’re either fully in or fully out,” he said.

Robinson said allowing a partial advanced FRAP would complicate the auction’s algorithm. He also said a minimum commitment will discourage load-serving entities from “toggling in and out of the auction.”

MISO will take stakeholder opinions on its early proposal through the end of the year.

A sloped demand curve in the capacity auction was top of mind during a late summer stakeholder idea exchange.

Bill Booth, a consultant to the Mississippi Public Service Commission, said he didn’t see why a downward sloping demand curve is en vogue again. He said MISO’s circumstances — being overwhelmingly comprised of vertically integrated utilities — haven’t changed since a sloped demand curve was last contemplated and shot down five years ago. He said the RTO’s excess capacity drying up is the only thing that’s different.

“There’s plenty of renewable generation trying to tie into the system, so I don’t think we need to promote that,” Booth said. “That’s clear from the interconnection queue … but it might not be the generation we need for our circumstances.”

He said decisions on fuel mixes are made at the state level and its naïve to hope that a demand curve’s prices will spur more dispatchable resources. Booth suggested MISO’s planning reserve margin requirement could be tailored to require a certain amount of dispatchable generation.

Hawkins argued that a capacity shortage isn’t MISO’s only issue. He said clearing prices in recent resource auctions have become increasingly volatile.

Julie Fedorchak, the North Dakota Public Service Commission’s chair, said the RTO’s capacity market “desperately” needs better market signals, and the demand curve is a tool toward improving them. She said that, candidly, she was “sick and tired” of some MISO members freeriding at the expense of her ratepayers.

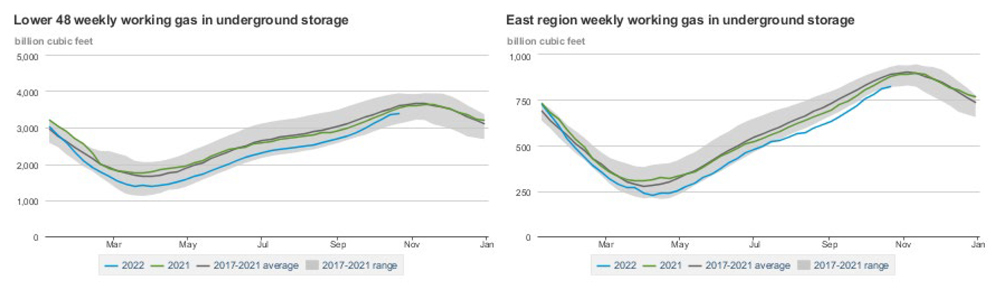

MISO has committed to more frequent postings of preliminary capacity auction data. The grid operator will standardize the schedule of seasonal reserve requirements in zones to twice per month in mid-January.

The more frequent data shares are a response to stakeholders’ asking staff to publish more regular updates ahead of the auction on its supply estimates and requirements. (See “Stakeholders Ask for Data Improvements,” MISO Promises Stakeholder Discussions on Capacity Auction Reform.)