RENSSELAER, N.Y. — NYISO’s Management Committee on Wednesday approved tariff revisions on credit rules for virtual transactions, the deliverability of “internal controllable” lines and transmission owners’ right of first refusal. The committee also received briefings on the ISO’s winter supply outlook and its updated Strategic Plan.

Credit Requirements on Virtual Transactions

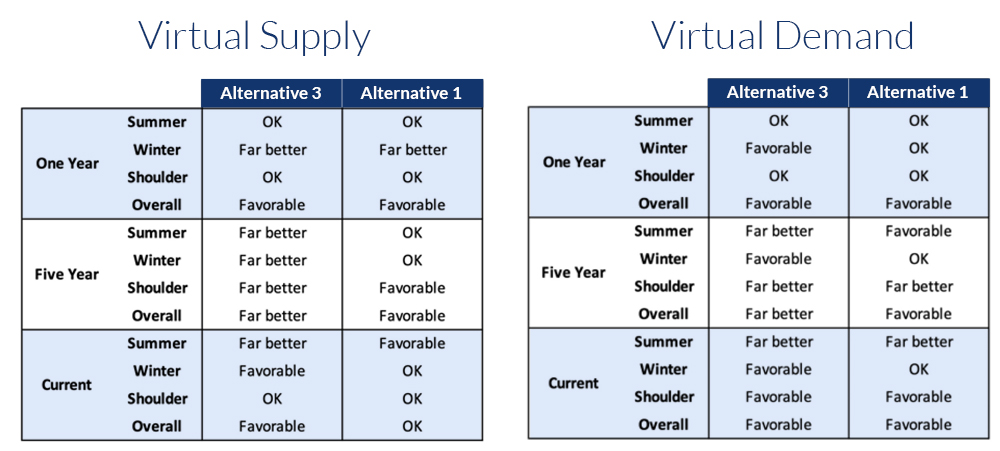

The MC approved the first changes since 2009 to the ISO’s credit requirements for virtual transactions — bets on the price spread between the day-ahead-market (DAM) and the real-time market.

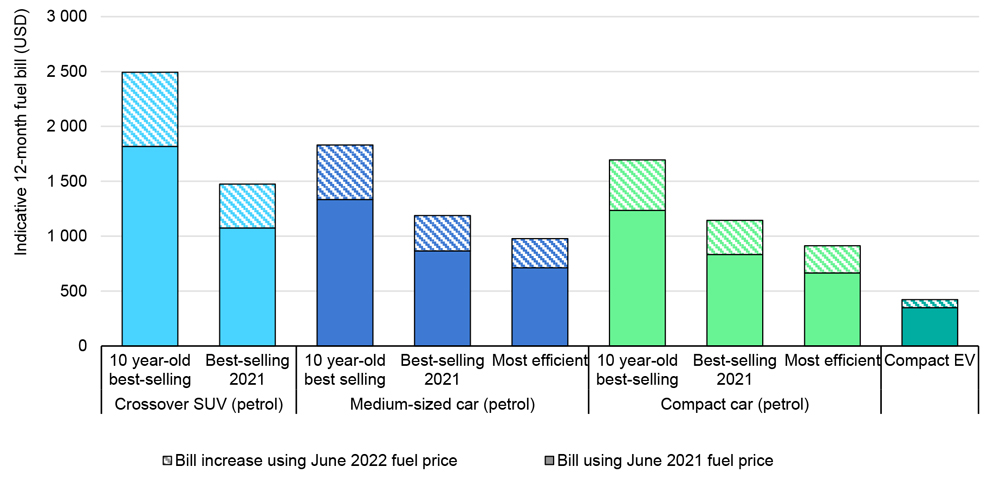

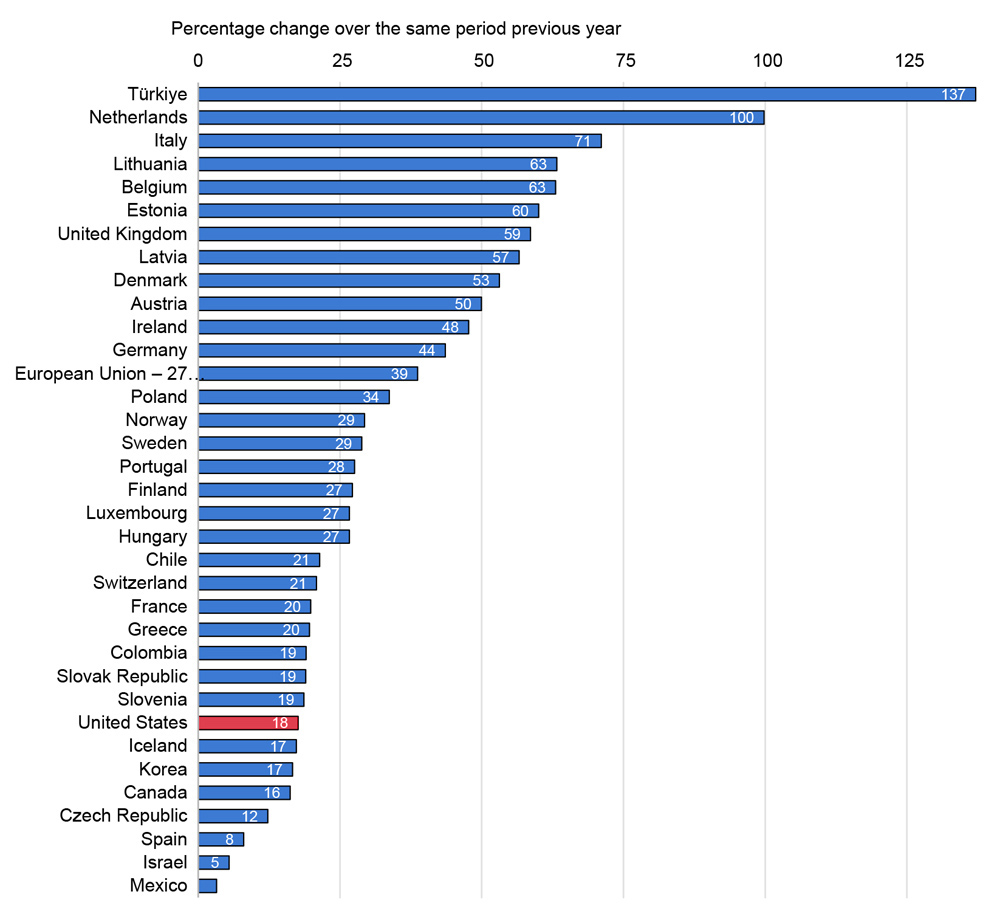

The 2009 changes distinguished for the first time between virtual load — offers to acquire energy in the DAM — and virtual supply, offers to provide energy. The rules varied credit requirements based on seasonal, time of day and zonal groupings to reflect their risk characteristics, using data from April 2005 forward.

The current rules break supply and demand credit requirements into four periods for weekday peak hours (HB7-22), and one each for nights and weekends/holidays. Under the proposed changes, virtual demand bids will have different requirements for summer, winter and shoulder months, with 28 distinct groupings. Virtual supply bids will be broken into 33 groupings, also reflecting the seasonal differences.

The proposal also would change the lookback period, giving one-third weight to data from the last year and two-thirds to the last five years.

NYISO said expected changes to its transmission system and resource mix over the next decade “provide support for shift to a shorter lookback period so that changes in real-time price variability are reflected in credit requirements without a long delay.”

The ISO settled on the weighting to balance accuracy with responsiveness, said John Jucha, senior credit risk analyst. Longer lookback periods provide more data points and more accurate estimates but result in slower changes to credit requirements when system conditions and price volatility are changing rapidly. Shorter lookback periods allow quicker adjustments to credit requirements but can also result in dramatic changes not warranted by underlying conditions.

The proposed rules also would treat the ISO’s transmission zones and proxy buses individually rather than the current practice, which sets one requirement for zones A to F and another for zones G to I. The ISO said it expected “significant benefits” immediately for zones A and F, with potential benefits for other zones in the future.

Also changed was the threshold for virtual supply positions, which will increase to the 98th percentile. The threshold remains unchanged at the 97th percentile for virtual demand positions.

The new rules will also apply to external transactions.

Pending approval by the Board of Directors, the ISO hopes to file the changes with FERC by April 2023 and deploy them in June.

NYISO Strategic Plan

NYISO shared its 2022 Strategic Plan, which highlighted its responsibilities, accomplishments and future goals, as well as how state and federal policies help drive the ISO’s strategic objectives.

Executive Vice President Emilie Nelson said offshore wind represents the largest potential shift in New York’s resource mix and that the state Climate Action Council’s forthcoming final scoping plan will inform much of the ISO’s future work. Energy security has become a growing concern as geopolitics impact global supplies, she added.

Nelson told stakeholders that NYISO has taken on more responsibilities, such as developing a reliability needs assessment, increasing stakeholder communications and tackling multifaceted issues like cybersecurity.

Bruce Bleiweis of DC Energy asked Nelson what letter grade the ISO would give itself as a “leader in the application of technology.”

Nelson responded that NYISO performs at an “A” level.

Bleiweis disagreed, saying he and other stakeholders focused on the financial markets have been frustrated with their inability to win ISO backing for “relatively minor changes” to the transmission congestion contracts (TCC) market.

“We’ve been asking for certain changes to the TCC markets for six or eight years,” he said, saying a “simple posting of data” calculated by the ISO “seems to become a [$500,000] project.”

Bleiweis said his company doesn’t face such “roadblocks” in the other organized markets. “Once a project is approved by stakeholders and the ISO, they seem to move forward relatively quickly.”

Nelson said the ISO must make “difficult” tradeoffs between competing budget priorities.

Deliverability Rules

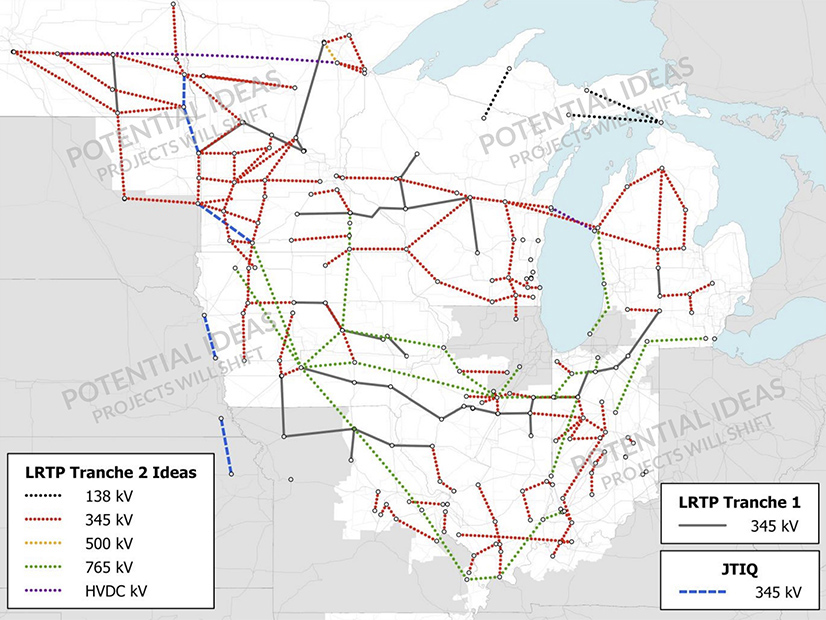

The MC approved proposed tariff language governing the deliverability of internal controllable lines (ICLs) such as Clean Path New York.

The rules would require a class year transmission project requesting capacity resource interconnection service for unforced capacity (UCAP) deliverability rights to be deliverable throughout the capacity region to which it proposes to inject energy and throughout the capacity region from which it proposes to withdraw energy.

Amanda Myott, NYISO market design specialist, said the ISO was proceeding with tariff revisions on the deliverability of ICLs before the rest of the ICL market design to ensure the changes apply to the class year 2023 deliverability analyses. (See “Ramp Limits on ‘Internal Controllable’ Lines,” NYISO Installed Capacity Working Group/Market Issues Working Group Briefs: Sept. 30, 2022.)

The changes approved by the MC also affect tariff Attachment S regarding the calculation of UCAP deration factors in the class year deliverability studies and expedited studies.

Pending board approval, the ISO intends to submit the revisions to FERC in January.

ROFR ‘Upgrades’ Clarification

The MC approved tariff changes to codify TOs’ right of first refusal (ROFR) on public policy transmission (PPT) projects, building on changes approved by FERC in March. (See FERC Approves ROFR for NY Transmission Upgrades.)

The March order only addressed upgrades that are part of a developer’s proposed PPT project. The new proposal, presented by Stuart Caplan of Troutman Pepper, would extend the ROFR provisions to “network upgrade facilities” that are required as a result of the transmission interconnection process. (See NY TOs Seek Clarification on ROFR for Upgrades.)

Without the changes, TOs must engage in case-by-case bilateral negotiations and FERC filings, resulting in a more time consuming and less transparent process, Caplan said.

Subject to board and FERC approval, the changes would be effective for the Long Island offshore wind transmission project.

Winter Capacity Assessment

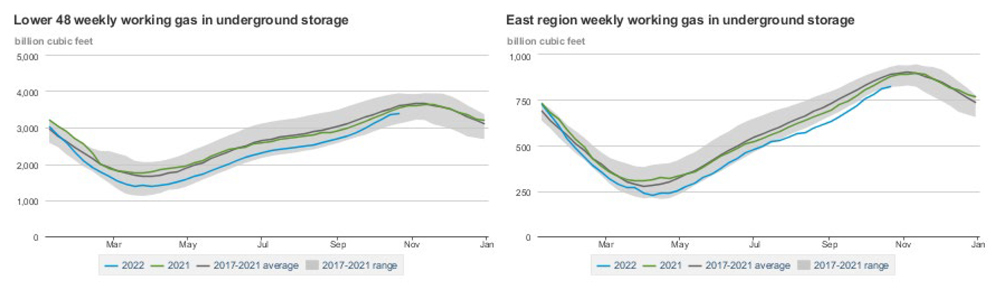

Natural gas storage levels are higher than anticipated thanks to a mild fall, but they are still lower than previous years, according to the ISO’s winter capacity assessment.

Distillate fuel inventories are well below the five-year average capacity, but generating units are still receiving deliveries, and inventories are approximately 95% of last year’s capacity, according to NYISO Vice President of Operations Aaron Markham.

Markham also shared that both the Sprainbrook-East Garden City Y49 line in Long Island and the Moses-Willis MW1 line would be taken out service this season for repairs.