CARMEL, Ind. — MISO sparked strong reactions from stakeholders Tuesday when it fired up the second phase of its long-range transmission plan (LRTP) by debuting a theoretical map of projects.

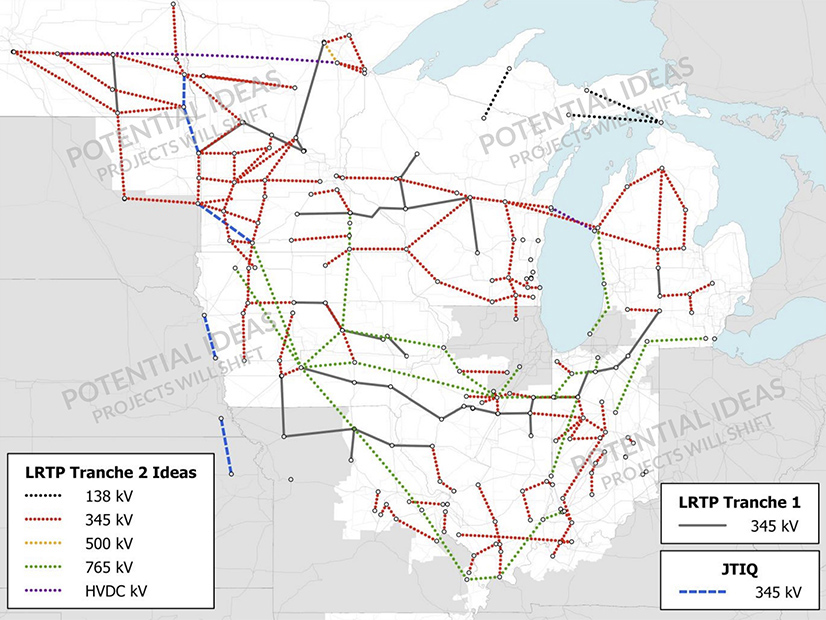

In a presentation to MISO’s Planning Advisory Committee, the RTO’s Senior Director of Transmission Planning Laura Rauch revealed a “conceptual map” of possible projects that may arise from a second attempt at a long-range analysis.

Some members were startled by the potential scope of the RTO’s ambitions.

The possibilities for MISO Midwest include a crisscrossing system of new 345-kV lines, a network of 765-kV lines, a handful of 138-kV lines and even one HVDC line across Lake Michigan and another spanning North Dakota and Minnesota.

MISO’s first $10 billion LRTP portfolio was also confined to MISO Midwest. The RTO doesn’t plan to address MISO South needs until the third leg of its long-range transmission planning. (See MISO Board Approves $10B in Long-range Tx Projects.)

Rauch cautioned that MISO’s conceptual map does not represent what a final portfolio would look like.

“This is a starting point, not an ending point,” she said, adding that the line routes are educated guesses because MISO doesn’t yet know how siting will play out.

“I’m sure there are things on this map that we will not want to analyze. I’m sure there are some substations that cannot handle … the magnitude of transmission,” she said.

Rauch said it’s still an open question whether the second LRTP cycle should include 765-kV and dispatchable HVDC lines.

Some stakeholders said they were taken aback by the scale of MISO’s envisioned second LRTP.

“When you throw this slide up, this is very expensive, what’s on here. Much more expensive than tranche one,” said Jim Dauphinais, an attorney for the Coalition of Midwest Transmission Customers.

Rauch said the map could potentially be the “size of the answer,” but added that the resulting portfolio could be smaller.

WEC Energy Group’s Chris Plante called the map “uncharted territory” and said it was premature for MISO to publish the map before it ran analyses. Plante also said that the map doesn’t include some lines utilities deemed necessary. He cautioned against sharing the map with MISO’s Board of Directors next week at its quarterly meeting in Orlando, Fla.

Other stakeholders said MISO’s release of the map might preclude consideration of other necessary transmission solutions that should be included in the second LRTP.

“I understand where you’re coming from. At the end of the day, the analysis will win out,” Rauch said. “This is going to be a long ride based on analysis. … Our intention was not to say we must do everything.”

While acknowledging that the release of the map may have been a “messy” way of broaching the issue, Rauch said it’s necessary to prepare stakeholders for MISO’s future system needs. She added that stakeholder LRTP workshops in 2023 will cover the RTO’s reasoning behind the hypothetical map of lines.

Rauch said MISO is building models to prepare for the second portfolio recommendation in 2023.

“We’re seeing member plans accelerating. We’ll continue to work through the futures and reflect that,” she told stakeholders.

The RTO is updating the data behind its three, 20-year transmission planning futures in time for more long-range transmission planning and work on the 2023 Transmission Expansion Plan (MTEP 23).

Changes will include revised state and member decarbonization goals, resource retirements, resource additions based on its interconnection queue, accredited capacity amounts, and capital, operating and fuel costs. MISO did not alter the 20-year load forecast behind the three planning futures.

So far, MISO has only shared preliminary information on its moderate, second future. The RTO said it foresees 270 GW of new resources and has 115 GW of resource retirements. It also anticipates a 90% reduction in emissions by 2042, faster than it previously projected.

The grid operator plans to share estimates from its conservative Future 1 and aggressive Future 3 next spring.

The second planning future will serve as the “focal point” for the lines MISO will plan under the second LRTP, Rauch said.

Zeroing in on Cost Allocation

A day before stakeholders got a glimpse of MISO’s controversial planning map, they heard how MISO continues to assess how to develop a more targeted cost sharing methodology for LRTP projects.

Speaking at a stakeholder meeting on Nov. 28, cost allocation specialist Milica Geissler said the RTO will analyze whether it can allocate transmission costs by relying on more granular measures of identifying who benefits — and what the benefits are.

Geissler said MISO will examine the subregional benefits of preventing load shed, meeting NERC criteria, weathering extreme events, furthering state decarbonization goals and increasing transfer capability.

At the local zonal level, the RTO will test the benefits of avoided transmission investment, congestion and fuel savings, improved operating reserves and savings associated with resource adequacy. It will not test for any benefits on a footprint-wide basis because of its Midwest-South transfer constraint.

Some stakeholders argued that there’s too much overlap among the factors being considered to identify standalone benefits.

Plante said projecting some of the benefits into the future is akin “to throwing a dart in a blackened room” because benefits change over time and MISO lacks insight into future resource siting and expansion.

Clean Grid Alliance’s Natalie McIntire said MISO shouldn’t assume that the Midwest and South regions are unable to help each other during extreme events. The RTO’s Director of Cost Allocation and Competitive Transmission Jeremiah Doner said that while such benefits aren’t “zero,” they’re not enough to measure on a footprint-wide basis.

Mississippi Public Service Commission attorney David Carr encouraged MISO to consider that including decarbonization benefits might make it more difficult for some projects to get approval from certain utility commissions.

Geissler said MISO is at this point only pondering the benefits and hasn’t determined which ones will make the final cut. She added that the RTO isn’t willing to apply any proposed changes to projects already in progress, saying it “finds a lot of value” in current allocations.

MISO is using a 100% postage stamp to load rate for the first two cycles of projects coming out of its LRTP studies, with those costs confined to MISO Midwest. (See FERC OKs MISO’s Bifurcated Cost-allocation Tx Design.) But a new cost allocation approach that considers more beneficiaries could be applied to upcoming planning for the South region.

Carr said MISO should re-examine the assumption that load bear the “entirety” of long-range transmission costs. He made the argument in light of Montana-Dakota Utilities’ suggestion that new intermittent generation, in addition to load, should bear a portion of LRTP costs. (See MISO Gathering Stakeholder Input on LRTP Cost Allocation.)

“Transmission costs are a much larger share of customers’ bills. This situation is untenable,” Carr said.

Carr also pointed out that years ago, MISO South didn’t have any input in the postage stamp cost allocation.

Some stakeholders have voiced concerns about disparate treatment between LRTP portfolios, saying a different cost allocation for projects concerning MISO South will violate FERC’s requirement that the same class of projects should not be subject to different allocations.

In October, Geissler said planners were wrestling with how to assign an evolving cost allocation when beneficiaries of a line change over time. Some stakeholders have requested that MISO find a way to identify and mete out costs to new beneficiaries over time.

“I’m very thankful for the 2011 portfolio of projects,” Geissler said, referring to MISO’s Multi-Value Projects approved a decade ago. She said those projects show how benefit-to-cost ratios either increased or decreased over time depending on the transmission pricing zone.

“They change in a pattern that isn’t necessarily obvious,” Geissler said of benefits. She said those fluctuations mean that future beneficiaries might be difficult to predict over time.

However, stakeholders said the zones that over time realized the most benefits from the 2011 portfolio contained the most wind generation.