Limited Support for Co-located Load Proposals

A poll by the Market Implementation Committee last month found little support for two competing proposals on capacity offer opportunities for co-located load — one from the Independent Market Monitor and the other a joint package from Constellation Energy and Brookfield Renewable Partners.

Given the opposition, which comments from the poll suggest cut to the core of the packages, stakeholders last week agreed it would be best to focus on finetuning and clarifying how co-located load not directly interconnected with the grid is treated under the status quo rules. (See PJM Opens Poll on Co-Located Load Proposals)

Currently, generators serving customers who are solely connected to their supply must relinquish a portion of their capacity interconnection rights (CIRs) equal to the amount being provided to the co-located load.

The Constellation/Brookfield proposal, which received 16% support overall, would have allowed generators serving such customers to retain their CIRs in exchange for the generation capacity remaining available to the grid when called upon — essentially turning the portion of generator serving the co-located load into a peaking unit. Constellation’s Jason Barker said during last month’s special session that the imagined arrangement under the proposal would be a nuclear facility supplying power for highly interruptible load, namely hydrogen electrolyzers.

Poll respondents said they believed that not requiring co-located load to pay for benefits received from the grid — such as synchronized reserve and scheduling — would leave other interconnection customers with having to pick up the cost. Commenters also said the arrangement would effectively allow generators to sell their capacity twice. Those in favor of the proposal said it could prevent generator retirements and the resulting increase in capacity prices and decrease in reliability.

The IMM package would have followed the existing practice of requiring generators to reduce their capacity offer equal to the power draw from the co-located load, while also levying additional charges on the load and administrative requirements on the generator. The proposal received 8% support overall and 9% against the status quo.

Commenters on that plan said they wanted additional details on cost allocation and answers to jurisdictional questions on how the provisions could be implemented. They also expressed concerns about potential overreach into areas addressed by reliability studies. Some respondents said they preferred the package’s stronger accounting for benefits received by co-located load.

Monitor Joe Bowring said the poll results suggest PJM should discontinue discussion of the two proposals and instead focus on clarifying the existing rules. Stakeholders largely agreed Wednesday that co-located loads will continue to exist and that the rules governing their relation to the grid should be clarified.

“While Exelon and other stakeholders are not supportive of the two options on the table, we do think that there would be value in potentially clarifying the status quo rules,” Exelon’s Sharon Midgley said.

Manual Revisions for Day-ahead Zonal Load Bus Distribution Factors Endorsed

The MIC endorsed by acclamation a package modifying how PJM conducts its day-ahead load bus distribution factor analysis and associated manual revisions. The changes still require approval by the Markets and Reliability and Members committees, which will likely vote on them during their January and February meetings.

Under current practice, the RTO calculates the hourly distribution factor for an individual node based on the percentage of state estimator load for that node as of 8 a.m. the prior week. For example, when building estimates for the July 14 market day, data from July 7 at 8 a.m. is currently used for every hour throughout the day.

Under the proposal, distribution factors would be calculated based on real-time data from each hour of the respective weekday of the previous week. So, when looking at 5 p.m. on July 14, data from the corresponding real-time interval on July 7 would be pulled.

The lookback period would use the most recently available day of the week where all 24 hours of data are available, meaning if one hour of data was unavailable for a day in the previous week, data would be drawn from the week before that.

Feedback on Issue Charge, Problem Statement for Combined Cycle Modeling

PJM will be revisiting a proposed issue charge and problem statement on modeling combined cycle units in the market clearing engine to incorporate stakeholder concerns about potentially making market design changes to resolve issues with the scale of the computational challenges.

Concerns raised during the first read of the documents include whether it’s more appropriate and feasible to find a hardware or software solution to the issue, the potential for market power rules to be watered down by switching from multiple schedules per facility to one, and the broad scope of the issue charge.

The current design of the market clearing engine looks at each schedule a generator offers into the energy market as a separate logical resource. While most resources have either one or two, it’s possible for the number to be much higher — particularly for combined cycle units — which exponentially increases the solution time. The problem statement says that a typical 2×1 combined cycle unit would have at least six configurations, meaning that if it offers two schedules into the market, it would be represented by 12 logical resources.

“Based on the last several years of experience with a multi-schedule model in the current MCE and discussions with GE, it is apparent that the multi-schedule model in the MCE with the ECC model will have a significant performance impact that will jeopardize the clearing of the day-ahead and real-time energy markets in the approved clearing timeframe with sufficient accuracy,” the document says.

Paul Sotkiewicz, of E-Cubed Policy Associates, questioned why PJM could not increase its computational capabilities with additional hardware or by using algorithms that can cut down on the number of branches the engine has to compute.

“I don’t think PJM has exhausted nearly all the venues and possibilities, including talking to others who may be more up to date on the more advanced algorithms that are out there,” he said.

Sotkiewicz was also “alarmed” that PJM is seeking to potentially make market design changes with an envisioned six-month timeframe to meet the requirements of a vendor hired without consulting stakeholders. PJM’s Keyur Patel said GE has been hired to develop a market engine product for combined cycle modeling — work it is engaging in concurrently with other RTOs — and aims to begin its PJM work by the end of next year, assuming associated rules have been approved by then.

Patel said PJM re-examines hardware requirements every three to four years and does not believe that hardware or algorithm changes would be enough to resolve the issue.

“There is no other technology available at this point that we can solve it in two hours or [a] two-and-a-half-hour time frame,” he said.

Bowring said the use of multiple schedules for each generator was implemented to provide greater market power protections and that it would be a mistake to revert that change to solve a technical issue at the expense of those protections.

“It’s important not to let a technical issue, as it’s presented, undercut market power mitigation,” he said.

While PJM has considered switching to a single schedule, Patel said other options are on the table as well.

PJM Considering Increasing FTR Bid Limit of 15,000 per Entity

PJM presented a problem statement and issue charge exploring the ability to increase the cap on the number of bids a single corporate entity can place in FTR auctions from 15,000 to 20,000 under quick fix rules, with an endorsement sought at next month’s committee meeting.

The RTO is considering the increase following the transition to weekend on-peak and daily off-peak class types, which has had the effect of requiring two bids to trade the same number of hours of an FTR as prior to the transition, according to the problem statement.

PJM senior engineer Emmy Messina said it may be necessary to delay the increase if the RTO finds that existing technology is insufficient to process the higher number of transactions; however, she does believe those upgrades are technically feasible.

“I do believe there are ways we can solve allowing for 20,000 bids if we find that the resources don’t look like they can support it today. Maybe it’s getting upgraded hardware,” she said.

Director of Market Operations Tim Horger said he believes PJM can handle the increase to 20,000 bids in a single auction. However, he cautioned against increasing the number too sharply beyond that.

“I do think we need to be careful with opening the floodgates and going [to] 50,000 [or] 100,000 bids. Let’s do this in baby steps,” he said.

DR Worried by Decline in Synchronized Reserve Prices

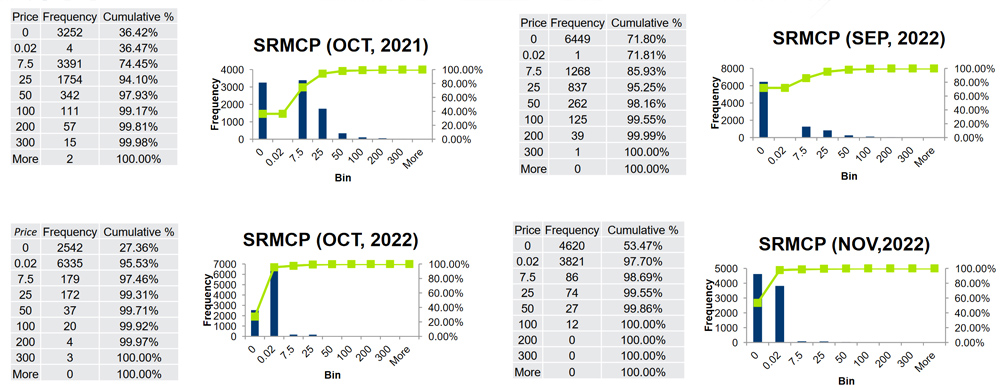

Synchronized reserve prices have dropped significantly since the start of October, when new market rules were implemented. Prices were at or below 2 cents/MWh for 95.53% of the hours in October and 97.7% in November, a sharp uptick from previous months. Prices were at those levels 71.81% of the time in September and 36.47% in October 2021. (See FERC Approves PJM Reserve Market Overhaul.)

Synchronized reserve prices have mostly been below the new offer cap of 2 cents/MWh, which was reduced from $7.50 when PJM overhauled its reserve markets, effective Oct. 1. | PJM

Synchronized reserve prices have mostly been below the new offer cap of 2 cents/MWh, which was reduced from $7.50 when PJM overhauled its reserve markets, effective Oct. 1. | PJM

“There’s a couple driving factors we believe to be there: One, the offer cap rule going from $7.50 down to the 2 cents, as well as impacts from the must-offer requirement expanding the pool, if you will, of resources that we can procure reserves from,” said Brian Chmielewski, manager of market simulation.

Bruce Campbell, of Campbell Energy Advisors, said that the low prices could push demand response resources out of the synchronized reserve market, which may result in them not being available when the system is tight, even if prices are high.

“There is a concern in the demand response community. … The community is interested in continuing to provide these services, but not interested in providing them for free,” he said.

Chmielewski said PJM is monitoring the price movements and will be providing updated statistics monthly. However, given that market changes are only two months old, it would like to see additional production data before making recommendations for potential changes.

Bowring said the lower prices reflected supply and demand fundamentals and that there is no evidence that eliminating the arbitrary $7.50 adder to offers had any significant impact on clearing prices.