Below is a summary of the agenda items scheduled to be brought to a vote at the PJM Markets and Reliability Committee and Members Committee meetings Wednesday. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage in RTO Insider.

RTO Insider will be covering the discussions and votes. See Jan. 3’s newsletter for a full report.

Markets and Reliability Committee

Consent Agenda (9:05-9:10)

B. Endorse proposed revisions to Manual 10: Pre-Scheduling Operations resulting from a periodic review.

C. Endorse proposed revisions to Manual 14D: Generator Operational Requirements resulting from a periodic review.

D. Endorse proposed revisions to Manual 27: Open Access Transmission Tariff Accounting resulting from a periodic review.

E. Endorse proposed clarifying tariff and Operating Agreement (OA) revisions as endorsed by the Governing Documents Enhancements and Clarifications Subcommittee (GDECS).

Endorsements (9:10-10:10)

1. Energy and Reserve Market Circuit Breaker (9:10-9:40)

Adrien Ford of Old Dominion Electric Cooperative will present the main motion for a proposed “circuit breaker”: a mechanism for limiting extremely high prices. David Scarpignato of Calpine will present an alternative motion for a proposal.

Stakeholders have expressed mixed opinions on the issue, with a poll conducted in the Energy Price Formation Senior Task Force yielding less than 50% support for each of the seven packages then under consideration. Discussion was tabled during the November MRC so that ODEC and Calpine could attempt to form a compromise package. (See “Support for Circuit Breaker Remains Mixed,” PJM MRC Briefs: Oct. 24, 2022.)

The committee will be asked to endorse a proposed solution.

Issue Tracking: Operating Reserve Demand Curve (ORDC) & Transmission Constraint Penalty Factors

2. Rules Related to Market Suspension (9:40-9:55)

PJM’s Stefan Starkov will review a proposal addressing the treatment of long-term market suspensions, meant to provide a solution for settling real-time market prices when they cannot be determined. (See “Market Suspension,” PJM Market Implementation Committee Briefs: June 8, 2022.)

The committee will be asked to endorse the proposed solution.

Issue Tracking: Rules Related to Market Suspension

3. Market Participant Default Flexibility (9:55-10:10)

PJM’s Colleen Hicks will present a proposal to allow the RTO flexibility to allow market participants to continue operating in markets after a default under certain circumstances. (See “1st Read on Proposal to Allow Flexibility for Market Participation During Defaults,” PJM MRC Briefs: Nov. 16, 2022.)

The committee will be asked to endorse a proposed solution and corresponding tariff and OA revisions.

Issue Tracking: Market Participant Default Flexibility

Members Committee

Consent Agenda (1:35-1:40)

B. Endorse proposed tariff and OA revisions supporting the transmission constraint penalty factor solutions package. (See “TCPF Adjustments Permitted for Issues with Ongoing Solution,” PJM MRC Briefs: Nov. 16, 2022.)

Issue Tracking: Operating Reserve Demand Curve (ORDC) & Transmission Constraint Penalty Factors

C. Endorse proposed revisions to Manual 15: Cost Development Guidelines and OA Schedule 2 addressing the development of variable operations and maintenance costs. (See “MRC Approves VOM Package,” PJM MRC Briefs: Nov. 16, 2022.)

Issue Tracking: Variable Operating and Maintenance Cost

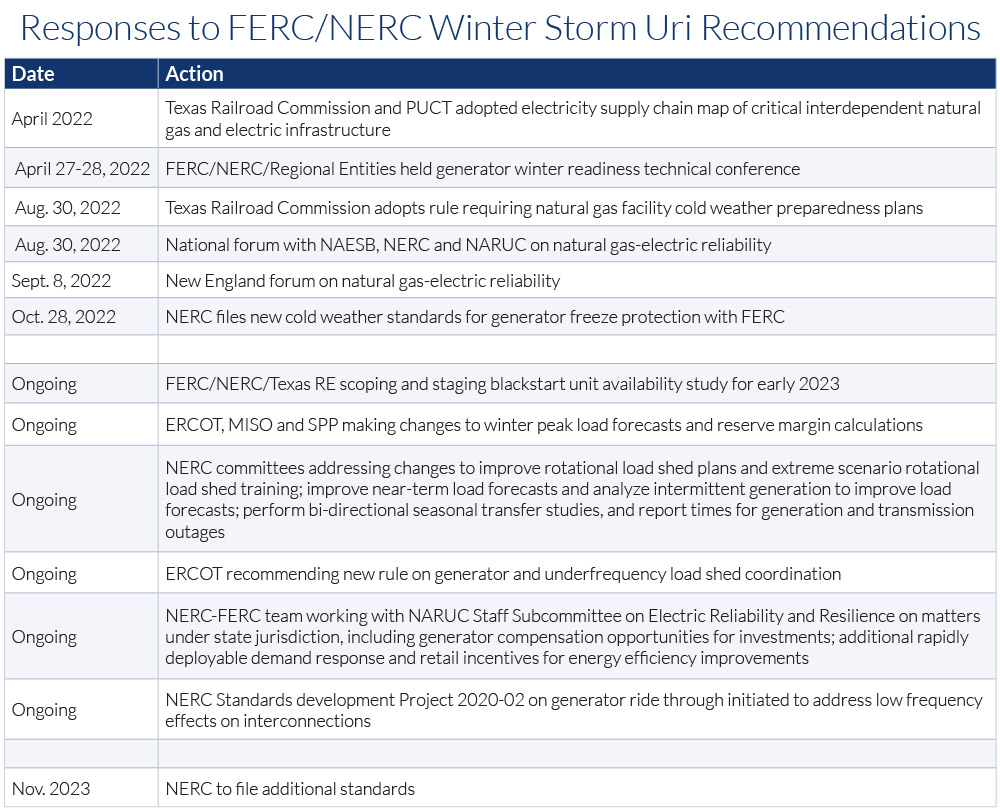

D. Endorse proposed revisions to the tariff, Reliability Assurance Agreement (RAA) and OA to prohibit critical natural gas infrastructure load from participating in demand response programs, pursuant to the recommendations included in the FERC/NERC report on the February 2021 winter storm in the south central US. (See “Reworked Language on Critical Gas Infrastructure Participation in Demand Response Presented,” PJM MRC Briefs: Oct. 24, 2022.)

Issue Tracking: Critical Gas Infrastructure – Demand Response Participation

E. Endorse proposed corresponding tariff and OA revisions supporting the financial transmission rights Bilateral Review and Reporting solution. The changes would require that FTR bilateral agreements be reported to PJM within 48 hours of their execution, accompanied by certain data, including FTR start/end, quantity, source and price. (See “Other Committee Actions,” PJM MRC Briefs: Nov. 16, 2022.)

Issue Tracking: FTR Bilateral Transactions Review and Reporting Requirements

Endorsements (1:40-1:55)

Elections (1:40-1:55)

Michele Greening will review the proposed next year’s sector representatives for the Finance Committee, sector whips and the vice chair of the committee. The MC will be asked to elect the proposed representatives.