FERC commissioners and stakeholders offered their views on requiring minimum interregional transfer capabilities in a workshop last week that examined the contentious issue (AD23-3).

Winter Storm Uri lent new urgency to the conversation, commissioners said. The February 2021 storm blacked out much of ERCOT and resulted in the death of more than 200 Texans, showing the dangers of having too few transmission connections to support grid reliability in a crisis.

ERCOT has only 820 MW of transfer capacity with its neighbor SPP, and 436 MW of connections to Mexico, primarily for emergencies.

“We’ve been talking a lot about interregional transmission and interregional transfer capability. There’s an enormous reliability value,” FERC Commissioner Allison Clements said in the workshop’s first session Monday.

Clements cited several recent reports, including last year’s North American Renewable Integration Study (NARIS) by the National Renewable Energy Laboratory, that found interregional transmission expansion could generate up to $180 billion in net benefits through 2050.

A report released in August by researchers at the Lawrence Berkeley National Laboratory, and discussed by its lead author at the FERC workshop, found that 50% of transmission congestion value comes from 5% of hours, with “extreme conditions and high-value periods play[ing] an outsized role,” Clements noted.

And a Grid Strategies study published in February “found that each additional gigawatt of transmission ties between the Texas power grid and the Southeastern U.S. could have saved nearly a billion dollars for every additional gigawatt while keeping the heat on for hundreds of thousands of Texans” during Winter Storm Uri, she said.

“I’ve heard support from a very broad range of stakeholders for a minimum interregional transfer requirement, including the majority of participants in our FERC-NARUC-state task force,” she said, referring to the Joint Federal-State Task Force on Electric Transmission. (See States Back FERC Interregional Transfer Requirement.)

“Part of the appeal of a minimum transfer capability requirement, in addition to its specific reliability benefits, is that it could prove to be a mechanism for aligning regions around a clear goal, and then for unifying processes to reach that goal … so on the merits, specifically and more broadly, I’m a fan of this concept,” Clements said. “Of course, it raises real questions.”

For instance, she asked, what legal basis does FERC have for requiring minimum interregional transfers? And, “assuming that basis exists, how should the minimum be set between regions?”

PJM transferred electricity to MISO and MISO to SPP during Winter Storm Uri, limiting blackouts in MISO and SPP, Commissioner Mark Christie said.

“Those transfers were essential to keeping the lights on during that extreme weather event,” Christie said. ERCOT, which has sparse transmission connections with other grids to avoid FERC oversight, suffered the most.

“We have interregional transfer capacity,” between regions such as PJM, MISO and SPP, Christie said. “The question is, is it enough? That’s the big question, and how can we get to that number of ‘what is enough?’”

Commissioner Willie Phillips said that in the months since FERC issued its Notice of Proposed Rulemaking on long-range transmission planning in April, “I have called for looking into whether the commission should require a minimum amount of interregional transfer capability.

“Interregional transmission picks from all of our big priorities,” Phillips said. “No. 1, reliability and resilience, because it strengthens the voltage and minimizes the likelihood of load shed. No. 2, affordability, because it allows ratepayers to access lower cost generation. And No. 3, sustainability, because it accommodates the demand for more clean energy.”

Many states and stakeholders have asked FERC to act on establishing interregional transfer requirements as they face the likelihood of more extreme weather events, he said.

Commissioner James Danly, who has expressed skepticism about FERC’s ability to impose transfer minimums, and Chairman Richard Glick, who has been supportive of the concept, did not attend Monday’s session.

Stakeholders Comment

Stakeholders took different positions on interregional transfers based largely on whether minimum requirements would benefit their regions or prove unnecessary and costly.

Neil Millar, CAISO’s vice president of transmission planning and infrastructure development, said the ISO depends on interregional transfers and sees the need for more transmission but believes its own transmission planning processes, including enhancements underway, will ensure CAISO has sufficient import capacity.

“Given our particular set of needs, the processes we have, as well as the issues that we’re trying to address by improving some of those processes, I’m afraid we’re not seeing a specific minimum interregional transmission capacity necessarily helping that conversation,” Millar said. “We would be prepared to put more emphasis on the existing processes and addressing the challenges within those processes.”

Georgia and other non-RTO states in the Southeast do not need FERC to impose a minimum interregional transfer capability, said Tricia Pridemore, chair of the state’s Public Service Commission.

“Georgia is an example to follow, not replace,” Pridemore said.

“Existing state and FERC processes and rules have already been established, and they work,” she said. “The Federal Power Act expressly reserves [integrated resource planning] to the states, including transmission. In Georgia, we have a robust IRP process driven by short- and long-term planning research, hearings and commission-driven decisions.”

Before transmission plans go before the PSC, the Georgia Integrated Transmission System (GITS) develops proposals and works through potential conflicts, keeping “nasty cost-allocation, load-balancing and citing disagreements at bay,” she said.

GITS includes investor-owned utility Georgia Power; the Municipal Electric Authority of Georgia, the system operator for 41 electric co-ops; and Dalton Utilities, the “action agency” for the state’s 49 municipal utilities, Pridemore said. The entities also are active in the Southeastern Regional Transmission Planning (SERTP) process, which provides intra- and interstate collaboration, she said.

“Our bottom-up approach maintains reliability and does not put upward pressure on rates by constructing unnecessary or duplicative transmission assets,” Pridemore said. “This level of collaboration is a hallmark of Southeastern utilities.

“Georgia is better for maintaining a safe, reliable, affordable system all while not being told to do so from a top-down governance structure,” she said. “A minimum [interregional transfer] requirement may be right for an RTO state, but the processes, rules and collaboration I’ve outlined demonstrate there isn’t a need in a non-RTO state such as Georgia.”

Liza Reed, research manager for electricity transmission at the Niskanen Center, said the Southeast and other regions remain vulnerable to crises because of their limited transfer capacity with neighbors.

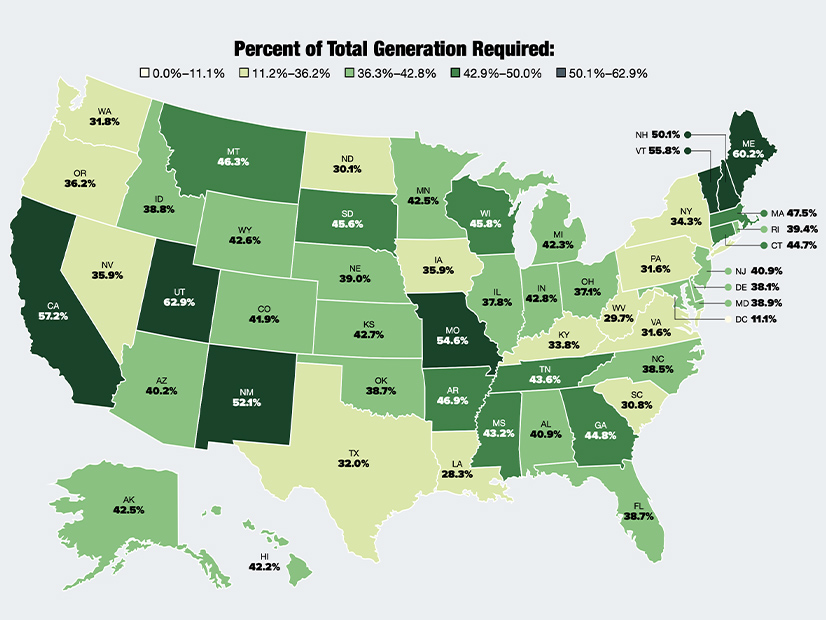

The Washington D.C.-based “open society” think tank conducted a study that found most neighboring transmission planning regions in the U.S. have less than 5 GW of transfer capacity and some less than 1 GW, Reed said.

“These small values represent less than 10% and often less than 5% of the peak load in each region,” she said.

Transfer capacity is 1% to 3% of peak load between SPP and ERCOT, PJM and NYISO, WestConnect and SPP, and between the non-RTO Southeast, including Florida, and adjoining regions, the study found.

Reed said that 15% is a “pretty standard resource planning margin” and recommended that 15% of peak load be used as a “starting level” for transfers between transmission planning regions.

“There’s ample evidence from the last few years alone that interregional transfer keeps the lights on and saves lives,” she said. “I encourage the commission to consider ways in which ERCOT can be consulted and involved in a minimum transfer requirement that does not leave the good people of Texas out in the cold again.”