[Editor’s Note: PJM filed the proposed tariff change on Dec. 23 (EL23-19).]

VALLEY FORGE, Pa. — PJM said Wednesday it will ask FERC to modify the rules of its 2024/25 capacity auction to avoid artificially high prices in one region of the RTO.

RTO officials told the Members Committee that they will make a Federal Power Act Section 205 filing asking to change the Base Residual Auction parameters for the DPL South locational deliverability area (LDA), essentially the Delmarva Peninsula.

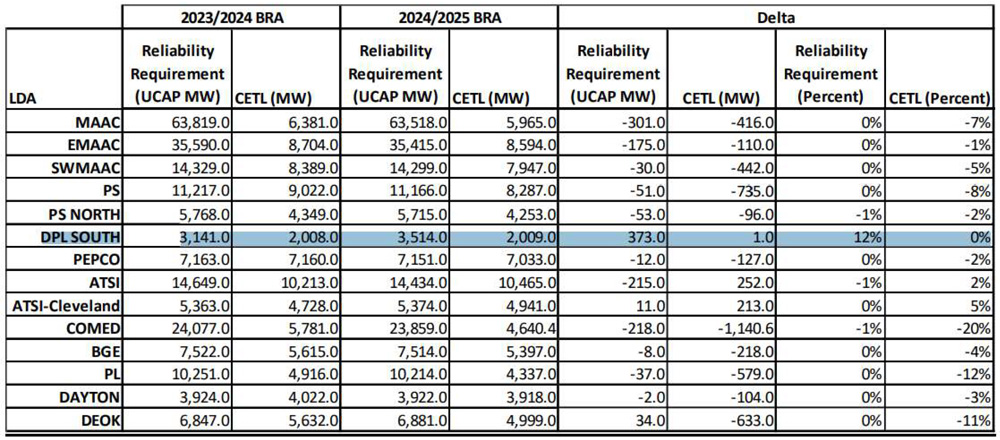

The reliability requirement for the DPL South locational deliverability area (highlighted) increased by 373 MW (12%) since the 2023/24 capacity auction. The requirements for other LDAs were flat or declined slightly. | PJM

The reliability requirement for the DPL South locational deliverability area (highlighted) increased by 373 MW (12%) since the 2023/24 capacity auction. The requirements for other LDAs were flat or declined slightly. | PJM

Senior Vice President of Market Services Stu Bresler said PJM will ask FERC to approve a tariff change to avoid an unjust and unreasonable clearing price resulting from a “mismatch” between the generation the RTO expected to offer into the auction and how much actually did.

The reliability requirement for DPL South increased by 373 MW (12%) since the 2023/24 capacity auction, while requirements for other LDAs were flat or declined slightly.

PJM’s disclosure, which came the day after it had planned to release the BRA results, resulted in almost three hours of discussion.

‘Mismatch’

The reliability requirement for each LDA is the sum of its internal generation and the capacity emergency transfer objective (CETO), the imports needed to maintain reliability based on the region’s load profile and anticipated outages.

Internal generation consists of existing units with must-offer obligations and planned generation with interconnection service agreements (ISAs) and commercial operation dates before the delivery year begins. PJM expected about 1,000 MW of new generation with ISAs to be in operation in DPL South by the beginning of the 2024/25 delivery year, June 1, 2024.

In small LDAs like DPL South, the additions of large or intermittent units can paradoxically cause an increase in the reliability requirement because capacity transfers are necessary to account for times when the resources are not available.

“What happened in this case is … we didn’t get offers from all planned resources in the resource model,” creating the appearance of a “shortage condition that doesn’t exist, [producing] much higher prices,” Bresler said. “If all the planned generation had offered into the auction, we would have posted the results yesterday.”

FERC Filing

Bresler said the RTO must model all eligible units in the reliability analysis, because if units excluded do offer into the auction and come online, the RTO could procure too little capacity for reliability needs.

As a result, Bresler said, PJM determined it needs to be able to adjust the reliability requirement downward if modeled units don’t offer.

PJM will seek FERC approval to allow the RTO, during the auction clearing process, to exclude resources from the LDA reliability requirement if they do not participate and the requirement would otherwise increase by more than 1%.

Bresler said the RTO plans to file “indicative” auction results Jan. 3 under the existing rules and under the proposed change to allow stakeholders to evaluate the impact of the proposal before filing comments on it. The only significant price change resulting from PJM’s proposal would be to DPL South, he said, although there “could be some impact” to its “parent” region.

With FERC Chair Richard Glick about to leave the commission, the remaining members could deadlock 2-2 on PJM’s request. By law, that would result in the filing automatically going into effect.

PJM officials said they may also make a filing under FPA Section 206 to establish a refund effective date and allow FERC to consider other options for solving the dilemma if it rejects the 205 filing.

Short Lead Time

Bresler said it was the first time the situation has occurred. He said it may have resulted because the RTO is running its capacity auctions under a compressed time schedule, with only 17 months until the 2024/25 delivery year, as opposed to the standard three years. That increases the risk that a generator may not go into operation in time to meet its obligations.

Another factor, he said, was that the winter risk for solar resources in DPL South is not much lower than the summer risk because the winter load is nearly equal to summer and “the peak occurs before the sun is up in the wintertime.” As a result, the capacity value of solar is smaller in the LDA than in the rest of the RTO.

Bresler told RTO Insider after the meeting that he could not disclose how many expected resources failed to offer because DPL South is a small LDA, and disclosure of the information could identify the resources in question. But he said during the meeting that they were “not solely intermittent resources.”

Stakeholders Worried About Precedent

Several stakeholders objected to PJM’s proposed fix.

Jeff Whitehead of GT Power Group said load interests should be wary of the proposal. “The next time this comes around, the shoe could be on the other foot and the prices could be moving in the other direction.”

“It’s really troubling that we could look to change the rules in the middle of an auction,” said Neal Fitch of NRG Energy. “That’s a really bad outcome.”

“We’re taking a leap on a solution where perhaps not all the implications have been thought out,” he added.

Bresler said PJM will conduct discussions on potential long-term fixes. “This is not a step we take lightly. It’s a fix to a hole in the rules that wasn’t previously identified.”

Arnie Quinn of Vistra said PJM was “opening a Pandora’s box by setting a precedent that market rules can change after offers have been submitted.” He warned the precedent “will become a quagmire for PJM and FERC.”

If the rules change, Quinn added, generators should be able to change their offers.

Michael Borgatti of Gabel Associates suggested PJM request the change for the 2024/25 auction only to avoid making a “snap decision” on a long-term change.

Michael Cocco, of Old Dominion Electric Cooperative, defended PJM’s decision as “appropriate.”

PJM’s proposed resolution was also supported by Independent Market Monitor Joe Bowring.

“The results do not reflect the fundamental economic facts. The results do not reflect the actual balance of supply and demand in the LDA,” Bowring said. “PJM’s actions are reasonable and rational and proportional to the problem.”

However, Bowring said he disagreed with PJM’s plan to publish the DPL South results under the current rules, because they are incorrect and not “relevant.”