MISO told stakeholders Tuesday that it is not yet able to make “quantifiable conclusions” about the amount of capacity available for the 2023-24 planning year after completing its first seasonal planning resource auction (PRA) in April.

“From the supply side, it’s very early in the process to begin making predictions,” Eric Thoms, senior manager of resource adequacy operations, said during a Resource Adequacy Subcommittee meeting. He said many load-modifying resources have not yet begun the registration process and some generators haven’t completed verification test capacity data.

Stakeholders asked the grid operator to publish more frequent and precise supply data before auctions are conducted, a result of a 1.2-GW shortfall across MISO Midwest in last year’s PRA. MISO leadership has said there will be more capacity shortfalls in future auctions unless members quickly bring more generation online. (See “Stakeholders Ask for Data Improvements,” MISO Promises Stakeholder Discussions on Capacity Auction Reform.)

Thoms said reserve requirements will likely look the same by the time the auction rolls around. Staff currently estimates the RTO will need 132 GW to meet summer load, 125 GW to cover the fall, 127 GW for the winter and 124 GW for the spring. MISO’s preliminary numbers show that several of its 10 local resource zones will require more reserves for non-summer seasons, a first for the footprint.

The grid operator’s 7.4% summer planning reserve margin is lower than the 8.7% margin used in last year’s PRA. Staff said the decrease was driven by switching to seasonal modeling and “changes in resource mix/performance and load factors.”

Thoms said MISO is in the process of evaluating load-serving entities’ load forecasts to find reasons behind the smaller forecasts. He said staff has yet to form a “narrative” on why system demand is expected to decline.

Monitor Revises Mitigation to Fit Seasonal Design

MISO’s Independent Market Monitor has been prepping for seasonal auction market mitigation.

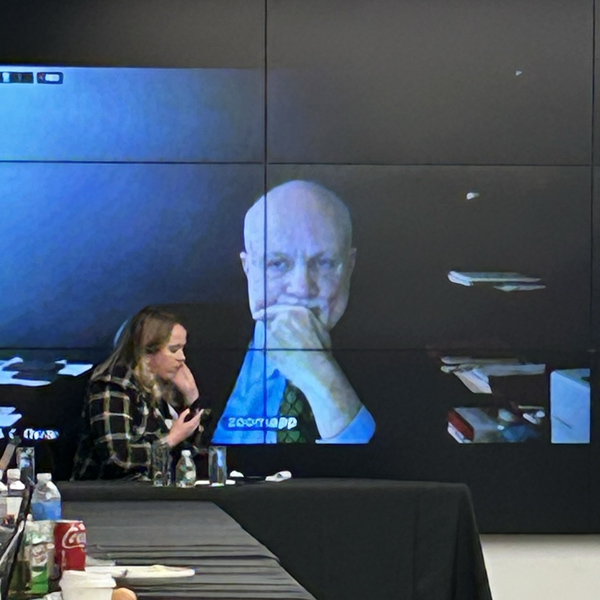

IMM David Patton has created a website for market participants to request reference levels and participation exclusions for those who don’t want to offer into the auction. He said the reference level and exclusion process will be revised to account for shorter seasonal capacity periods; it will also share the penalties for accreditation suppliers that enter generation outages.

Patton said he will consider when outage penalties and diminished accreditation make it uneconomic for a resource to offer into the seasonal auction. He said he will issue exclusions when a resource’s “expected penalties and accreditation costs in future planning years is likely greater than its forgone revenues.” He said that non-exempt generator outages render auction participation worthless when they last more than 45 days of a 90-day season and exempt outages render participation worthless at longer than 75 days.

MISO’s tariff does not allow the risk of penalties to be included in reference levels, Patton noted. He said he will not accept requests to address outage penalties in reference levels.

Patton asked market participants to submit lists by March 14 of deliverable resources they don’t intend to offer into the PRA or be included in fixed resource adequacy plans.

Stakeholders requested additional time with the monitor to better understand market mitigation under a seasonal auction construct.

When asked by stakeholders whether Patton supported MISO’s 2023 seasonal capacity auctions or thought they were rushed, he laughed and demurred from an answer.