PJM’s Independent Market Monitor has proposed a plan to eliminate performance assessment intervals (PAIs) and related penalties from the RTO’s capacity market, saying the non-performance charges stemming from the late-December cold snap have threatened the functioning of the market.

“Winter Storm Elliott provided the first real test of the [capacity performance] design. Elliott showed that the CP design does not provide effective incentives,” Monitor Joe Bowring said during the Jan. 31 meeting of PJM’s Resource Adequacy Senior Task Force.

Under the Monitor’s design concept, capacity resources would only be paid the capacity price when they are available in a given hour and would be required to have firm fuel, which entails access to dual fuel, multiple pipelines or a defined amount of onsite fuel storage, plus weekly testing to ensure that the resources can produce when called upon.

Capacity resources would also be subject to a must-offer requirement. When energy is valuable, resources that provide energy will be paid the high market prices for energy and reserves, as the energy market provides the correct energy pricing, Bowring said.

“If we can’t handle two days of cold weather without having a massive dislocation, we need to rethink how this market is designed,” Bowring said. “The penalties create potential threats to the incentives to invest in existing resources and to invest in the new resources that will be needed in the next three to five years.”

Bowring also said his design would replace the effective load carrying capability (ELCC) accreditation model for intermittent resources. By only paying such resources when they are delivering energy, he said the change would recognize that intermittent resources are not always available while still allowing them to be compensated for when they are online.

“ELCC is very quickly going to end up with a marginal value of zero for standalone solar and wind while continuing to have a performance obligation equal to its full capability. … What I’m proposing is something very different, which is paying capacity only when it’s available,” he said.

That tension between the reduced megawatts that qualify as capacity and the obligation to perform at the full megawatt value of the resource will make offering intermittent resources as capacity increasingly untenable under the ELCC approach.

The Monitor’s proposal would build on FERC’s 2021 rejection of the CP market seller offer cap (MSOC) and “would recognize that the capacity performance model was a failed experiment,” Bowring said. (See FERC Backs PJM IMM on Market Power Claim.)

“The only purpose of the capacity market is to make the energy market work. The fundamental mistake of the CP design was to attempt to recreate energy market incentives in the capacity market,” Bowring said. “The CP model was designed on the assumption that shortage prices in the energy market were not high enough and needed to be increased via the capacity market.”

Bowring noted that the CP design focuses on a small number of critical performance assessment hours, imposing large penalties on generators that fail to produce energy only during those hours. He said the use of capacity market penalties rather than energy market incentives created risk.

“While there are differences of opinion about how to value the risk, this CP risk is not risk that is fundamental to the operation of a wholesale power market. This is risk created by the CP design in order, in concept, to provide an incentive to produce energy during high demand hours that was even higher than the energy market incentive,” he said.

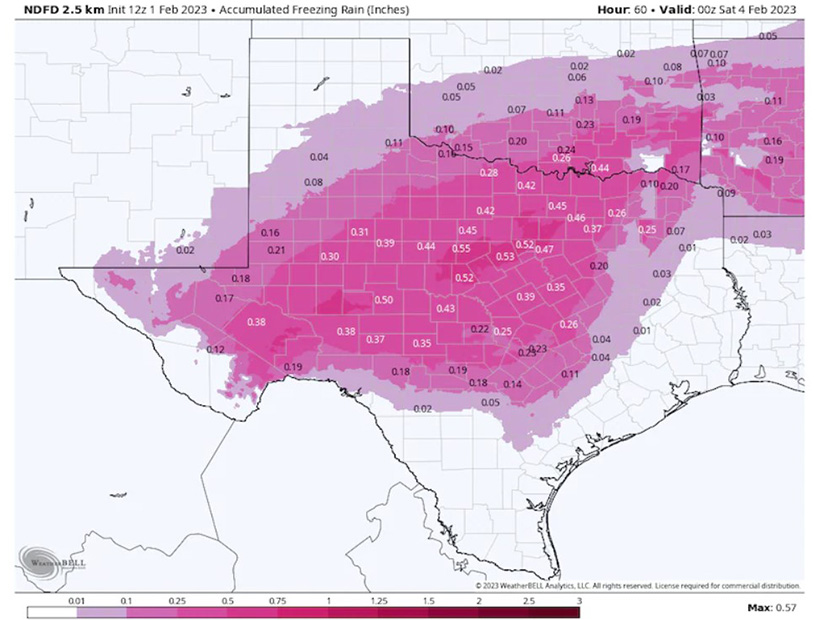

PJM has said that generators may be facing total penalties between $1 billion and $2 billion for as much as 46,000 MW in capacity being offline during the storm, including over a third of gas resources. That has raised concern about significant amounts of generation leaving the market, either through default or determinations that there is too much risk in the exchange. (See PJM Gas Generator Failures Eyed in Elliott Storm Re view.)

“Everybody knew what the potential penalties were. Nonetheless, the behavior did not match … that expectation. … Massive penalties are not the answer here,” Bowring said.

David “Scarp” Scarpignato, of Calpine, suggested that a third product may be needed alongside energy and capacity resources, noting the impact the fuel requirements would have on certain gas generators.

Combustion turbine plants connected to only one pipeline would no longer be able to participate as capacity resources and therefore lose their capacity interconnection rights. Without the guaranteed access to the transmission grid when shortage pricing is in effect, those units may no longer be economical, he said.

Steve Lieberman, of American Municipal Power, said the majority of generator conversations around the MSOC come down to properly defining their units’ capacity performance quantified risk (CPQR) — the risk that they will face non-performance penalties. AMP has proposed one of six design concepts currently being discussed by the RASTF, along with the IMM.

“I believe what Winter Storm Elliott has taught us is we need to put the scalpel away and it might be time for the chainsaw. … We do agree CP is a failure; it was an experiment that we implemented after the polar vortex,” he said.

AMP’s proposed design includes a higher degree of fuel availability for capacity resources, namely dual fuel or onsite inventory, and would expand the use of ELCC accreditation to thermal resources.

“An approach that’s similar for thermals and non-thermals alike is our preference,” Lieberman said, adding that he has reservations about ELCC, but feels that having one accreditation approach for all resources is best.

Stakeholders Seek More Clarity on Offer Caps

With deadlines approaching for June’s 2025/26 Base Residual Auction, Jeff Whitehead, of GT Power Group, said that generation owners will soon have to make decisions about their CPQR and unit-specific offer caps. He said guidance from PJM and the IMM on what will be allowable would aid in the drafting of those figures.

He noted that without changes to the current auction schedule, there are few parameters that can be changed in time, primarily the performance assessment hour assumption.

“I think we need to come to a common agreement on what is a reasonable basis for including Winter Storm Elliott, or I’ll say more broadly the changes in the penalty risk view that comes out of that event,” he said.

Bowring said he believes the current MSOC construct is correct and the best way to incorporate the winter storm data into offer caps is by rerunning the simulations the Monitor conducts with the data from Elliott added in. Part of his consideration of the storm’s impact is that to an extent the emergency conditions were the result of generators being unavailable.

“We have to operate in a rational defined space, and that space is going to be calculating what we think the impact on CPQR is of the actual facts of Elliott,” he said. “Given that this is the first significant PAI event since the introduction of the CP model, it is unlikely to have a large effect on CPQR.”