Commissioners Approve 90-10 Split on JTIQ Cost Allocation

SPP’s state regulators last week approved staff’s proposed cost allocation for the five projects in the RTO’s Joint Targeted Interconnection Queue (JTIQ) study portfolio.

The Regional State Committee, which has specific authority over cost allocation, accepted several recommendations from the Cost Allocation Working Group during a virtual quarterly meeting Jan. 30.

The JTIQ study with MISO was designed to find potential projects on the RTOs’ northern seam that could reduce congestion and allow additional resources, primarily wind farms, to interconnect with the two systems. The RTOs’ staff have proposed a cost allocation that assigns most of the portfolio’s $1.06 billion in costs to generation. (See MISO, SPP Propose 90-10 Cost Split for JTIQ Projects.)

The RSC unanimously approved the CAWG’s recommendations that:

- generators bear 90% of the portfolio’s capital costs and that load cover the remaining 10%;

- load’s portion of the JTIQ’s annual transmission revenue requirement (ATRR) be based upon adjusted production costs, as outlined by the RTOs’ joint operating agreement; and

- allow each building transmission owner to recover the non-capital construction costs allocable to generator interconnection customers through the TOs’ formula rate template in their respective regions.

The commissioners also unanimously approved the CAWG’s recommendation that SPP staff ensure the portfolio is implemented in a “reasonable manner” to improve its chances of securing U.S. Department of Energy funding to improve the benefit-cost ratio for all SPP load. SPP and MISO have joined forces with the state of Minnesota and the Great Plains Institute to apply for DOE grants from the latter’s $10.5 billion Grid Resilience and Innovation Partnerships (GRIP) program. (See “SPP, MISO Applying for DOE Funds to Help with JTIQ Portfolio,” SPP MOPC Briefs: Jan. 17-18, 2023.)

The committee revised the CAWG’s motion by adding the word “reasonable” before “manner” to address a complaint from North Dakota Public Service Commissioner Randy Christmann.

“What I’m reading here is that we are willing to implement this in whatever manner the DOE comes up with in order to get them to pay for our desires,” he said. “That just basically commits us to agreeing to anything they come up with. I’m fine with pursuing the DOE funding, as long as we’re not committed to doing whatever they want.”

Three of the committee’s 11 members — representing Louisiana, North Dakota and Oklahoma — voted against the CAWG’s recommendation that SPP’s 10% load share in the current portfolio and the next study of the southern party of the MISO-SPP seam be regionally allocated on a load-ratio share basis consistent with previous RSC policies.

“I don’t think we should be making our allocation decisions based on balancing our regions,” Christmann said. “I don’t like the idea of passing something based on its pluses and minuses and saying we’re going to do this one regionwide, and in exchange, we’ll do whatever the southern end comes up with regionwide to whether it meets the criteria or not.”

David Kelley, SPP vice president of engineering, said the recommendation was consistent with other policies the RSC has reviewed and approved. He said the grid operator’s experience with importing and exporting power during winter storms proves additional transmission interconnections between regions provides “greater reliability and resiliency … going forward.”

Texas Public Utility Commissioner Will McAdams said he views the JTIQ portfolio as a “building block of a greater reliability framework” where everybody chips in.

“If you have a need on a seam, you’re going to build transmission just like road planners build highways. If you build a highway, everybody gets to use that,” he said. “We’re going to need to replace new generation, and the guiding principle for me is I would rather that new generation settle in our SPP footprint to where our RTO can control those resources … and then if they have excess, sell into MISO during scarcity periods at a profit to help reduce the cost on their loads.

“To me that makes sense, and if we see that occur in both the SPP northern area as well as the South, then that benefits everybody,” McAdams added.

Christmann proposed a separate motion that the JTIQ portfolio only receive construction notifications when the executed generator interconnection agreements can pay for 50% of the eligible engineering and construction costs.

“We’re preparing to do an approval to construct based on the fact that GI customers are going to pay 90%. That can be our plan, but if they don’t come through, somebody is going to pay the costs of that project or these projects,” he said.

John Tuma, Minnesota PUC | © RTO Insider LLC

John Tuma, Minnesota PUC | © RTO Insider LLC

Minnesota Public Utilities Commissioner John Tuma acknowledged Christmann’s concerns but pointed out that no one is forcing companies to invest in generation and that they’re capable of making their own judgments.

“I’m hoping they make the right judgment because they got to come in front of me for recovery,” Tuma said.

“If you’re a generator interconnection customer going through the process, you don’t have any certainty that the transmission will be there,” Kelley said. “Signing up to pay for transmission that may or may not be there is not something that they could get financing for.”

“My concern is that this unravels the way we normally get these people signed up for projects. … This solves a lot of the problems,” Tuma said. “I think it also jeopardizes the DOE funding because a condition like this could put a lot of the projects and ability for these projects to go forward in jeopardy. We are messing with some financial situations that I think are going to unravel what we’re doing with JTIQ and the ability to get this paid at a reasonable rate.”

Christmann’s motion failed, receiving only supporting approval from members representing Louisiana, Nebraska and Oklahoma.

Saying she valued the conversations during the discussion, SPP CEO Barbara Sugg expressed a “high degree of confidence that the generators will be there.”

“We still have a lot of work to do in the partnership with MISO that is already proving to be beneficial for both SPP and MISO and our states and our end-use customers,” Sugg said. “We’ve got to keep this moving forward.”

Missouri’s Rupp Opposes RCAR III

The RSC approved the Regional Allocation Review Task Force’s third Regional Cost Allocation Review (RCAR III) of SPP’s highway/byway transmission cost-allocation methodology.

The mechanism assigns 100% of all 300-kV or above transmission upgrades’ ATRR to all 17 transmission zones on a regional basis using a load-ratio share. One-third of upgrades with voltage ratings between 100 and 300 kV are allocated regionally and two-thirds to the host zone’s transmission customers.

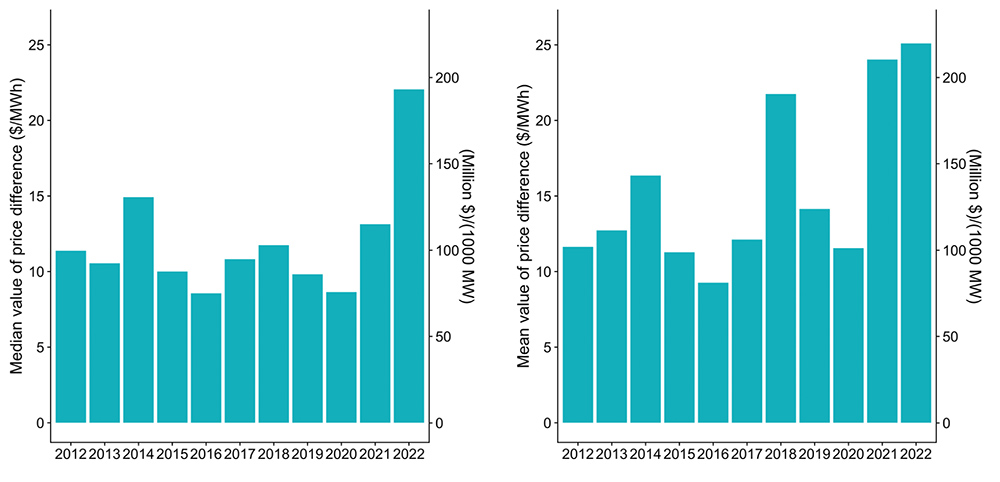

RCAR III, the first such review since 2016, indicated every zone exceeded the RARTF’s 0.80 benefit-cost threshold and w above 1 when analyzing projects approved for construction since June 2010 and in service prior to 2020.

The review was conducted using the Integrated Marketplace’s daily results paired with analysis on transmission planning models, limited to those projects in service before 2020. The task force said the methodology is expected to provide more reasonable results and avoid technical issues from past RCAR studies.

Still, RCAR III drew the ire of Scott Rupp, chair of the Missouri Public Service Commission, who cast the only vote against its approval, saying he couldn’t in “good conscience” attach his name to something “that’s just so bad.”

“I feel like I’m Pontius Pilate. I’m just washing my hands with this,” Rupp said. “We’re being told that, ‘Hey, this is the one that’s the best. This is the one that’s going to fix everything and look, everybody’s great.’ I can tell you personally, that things are not great.”

Utilities in southern Missouri have long complained about the RCAR process, saying system congestion has limited their ability to move energy. The City Utilities of Springfield transmission zone was the only one found deficient in the 2016 study; it was also among six zones, mostly in the Midwest, that was deficient in the 2013 review. (See “Cost Allocation Review Cycle Could Extend to 6 Years,” SPP Markets and Operations Policy Committee Briefs.)

In December, the southern Missouri region experienced extremely low voltages caused by resource trips, lack of deliverability and parallel system flows. Empire Electric District had to shed about 25 MW of load for 15 minutes on Dec. 22.

“Basically, what SPP has done is they’ve just taken the formula and they’ve tinkered with the methodology again until they got a result that they wanted, that would just quiet everybody that’s been having concerns,” Rupp said. “Southern Missouri has been saying, ‘Hey, we need help down here’ for 10 years. Every year, we do a lessons learned after one of these things, but the lesson we’ve learned is [we’re] going to get hosed.”

Saying she felt compelled to defend SPP’s honor, Sugg said she is very aware of the region’s problems and that she respected Rupp’s position.

“This is not the place for me … or anybody else to try to unpack all of the things that you said,” she told Rupp. “I will say … I am committed to us working to … alleviate some of the challenges that we face in that area. You’ve not seen the last of this, and please don’t think that I’m dismissing anything that you’ve said.”

The previous RCARs were completed every three years. FERC in 2017 approved SPP’s request to conduct the review every six years; the grid operator said that would save staff time and consulting costs. (See FERC Approves 6-Year Cycle for SPP RCAR Review.)

Safe Harbor Criteria Unchanged

The RSC also approved the CAWG’s recommendation to keep the current $180,000/MW safe harbor criteria for a network study’s directly assigned upgrade costs (DAUC) after customers request transmission service.

To qualify for safe harbor treatment from some or all DAUC, transmission customers must meet three base-plan funding criteria: a five-year minimum commitment term; 125% or less of load in all designated resources; and, if the designated resource is wind, that 20% or less of the designated resources come from wind.

Customer can request a waiver of the criteria, and the RSC and SPP’s Board of Directors have approved the requests under certain circumstances.

The CAWG reviews the safe harbor limit and criteria each year and conducts a more in-depth analysis every five years. The group has also opened an action item to continue studying performance-based accreditation’s effects on the 20% wind rule and the 125%-of-load resource limit.

John Krajewski, who consults for the Nebraska Power Review Board, told the committee the safe harbor criteria keeps transmission customers from being charged the full rate for service and the cost of any upgrades.

This policy “basically keep customers with these long-term requests from paying twice for the same facilities,” he said.

Krajewski shared the CAWG’s recent analysis of the safe harbor requirements. It indicated 18 of 49 load-serving entities are over the 20% limit, but that a vast majority of requests qualified under the safe harbor limit.

Ex-KCC’s Albrecht Chairs CAWG

Shari Feist Albrecht, KCC | © RTO Insider LLC

Shari Feist Albrecht, KCC | © RTO Insider LLC

Former Kansas regulator and past RSC President Shari Feist Albrecht has returned to SPP as the CAWG’s chair.

Albrecht chaired the Kansas Corporation Commission during much of her eight-year tenure as a commissioner. She was succeeded by Andrew French in June 2020 after her second term expired.

She has rejoined the commission as a part-time consultant. As a member of the Utilities Division’s SPP Workgroup, her responsibilities include representing Kansas on the CAWG.