The Edison Electric Institute has ratcheted up its projections of U.S. electric vehicle adoption, and with it the number of charging ports and grid upgrades that will be needed.

EEI on Oct. 2 released “Electric Vehicles Sales and the Charging Infrastructure Required Through 2035,” an update of a 2018 report that looked as far ahead as 2030.

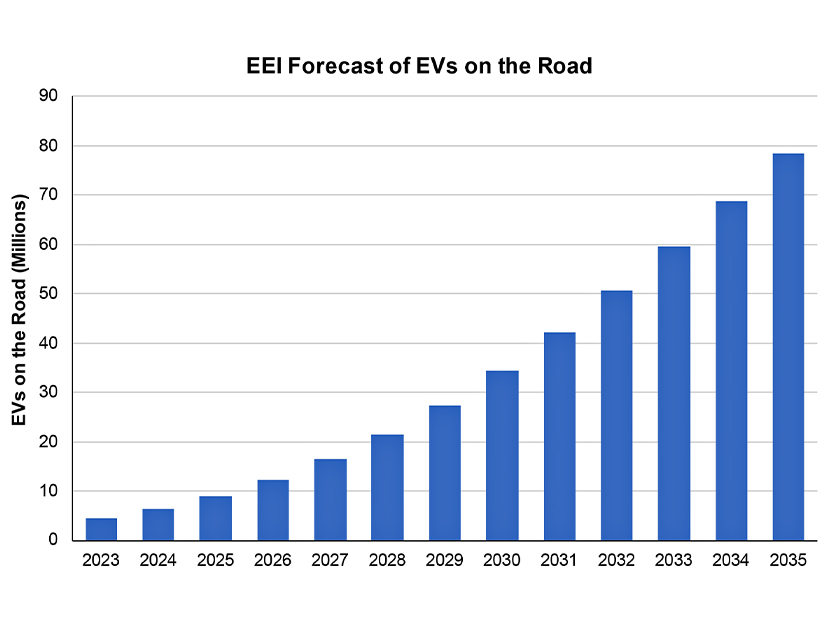

The 2018 edition predicted that 18.7 million light-duty EVs would be on U.S. roads by 2030 and said they would need an array of 9.6 million charge ports to keep running.

After six years of rapid EV sales growth, the updated report predicts 34.4 million light-duty EVs will be on the road in 2030 and 78.5 million in 2035. To support them, it calculates a 2035 need for 42.2 million charge ports.

EEI based the new numbers on four independent forecasts analyzed by the National Renewable Energy Laboratory. In announcing the new report, EEI said significant infrastructure upgrades to support this change already are underway, but more are needed.

EEI Senior Vice President of Customer Solutions Phil Dion said in the news release: “We are excited to continue working with our members around the country to evaluate grid capacity and other infrastructure needs due to the growing number of EVs in their service territories. Our members remain committed to supporting policies, especially those focused on proactively enhancing the energy grid, to ensure the transition to EVs is done in a cost-effective way that is also convenient, equitable and seamless for all drivers.”

The report does not factor in the substantial need for additional public charging infrastructure that would be created by large-scale electrification of medium- and heavy-duty vehicles.

The report indicates that electric companies are preparing for this demand in many ways, including developing make-ready infrastructure for site hosts that will procure the charging equipment, installing and owning the charging infrastructure themselves, offering rebates to defray the costs of buying and installing charging equipment, offering time-of-use rate structures, requiring demand response capability for charging equipment and educating EV drivers and charger site hosts.

The report states that EV charging will not only create unprecedented growth in demand, but also may create localized pinch points, particularly along highway corridors, where large charging stations would be needed if there is a wholesale switch to EVs for long-distance travel.

The authors cite recent studies by National Grid, Xcel Energy and other electric companies showing that grid upgrades and proactive planning should begin as soon as possible to meet future demand. (See Study Projects Power Demands of Highway EV Charging Network and DOE Funds Studies of Heavy-duty EV Charging Network Needs.)

The authors noted that The Electric Power Research Institute has launched its EVs2Scale2030 initiative to start working toward the “unprecedented” coordination of diverse stakeholder groups that will be needed to enable a national transition to EV travel.

Notwithstanding the recent fluctuations in the EV industry, most projections call for steadily increasing EV adoption.

EEI said improvements in battery technology, decreases in vehicle costs and favorable federal/state policy decisions have caused the EV market to expand and caused the growth projections to increase.

There are unknown variables, including the future popularity of plug-in hybrid vehicles (PHEVs), which combine an internal combustion engine with a battery smaller than those in battery electric vehicles (BEVs).

PHEVs cannot use DCFCs, the fast-working chargers that cost substantially more to install and place much higher demand on the grid than L1 and L2 chargers.

If enough American car buyers choose PHEVs over BEVs, fewer DCFC ports will be needed. The report indicates that 15% PHEV adoption could save several billion in capital costs for charging infrastructure compared with 10% adoption.

The reported projects that 325,000 DCFC ports will be needed in 2035, each with a price tag potentially ranging into the six digits, and they will be critical to soothing the range anxiety that deters some car buyers from considering BEVs.

But that is less than 1% of the projected total number of ports, the report says. The other 99% are L1 and L2 chargers — 85% at residences, 7% at workplaces or multifamily dwellings and 7% at public charging sites.

EEI is the industry association for U.S. investor-owned electric companies.