Wind Energy Plays Key Role During December Storm

AUSTIN, Texas — ERCOT staff reported to the grid operator’s Board of Directors last week that despite “not insignificant” forced outages during the December winter storm, it set a new winter demand record and supported “reliable execution throughout event.”

Fossil fuel outages from fuel restrictions and cold weather spiked in the early-morning hours of Dec. 23, knocking more than 14 GW of generation offline at one point. Fortunately for ERCOT, wind resources, the early fall guys during the deadly February 2021 storm, helped fill the gap with about 30 GW of energy at times during the night Dec. 22-23.

“This is a great example of the dependency we have on renewables, because for part of the 22nd and the 23rd, we were in renewable territory,” Director John Swainson said during the board’s Feb. 28 meeting. “If the wind had stopped blowing, we would have been in deep [expletive].”

“As load shot through our forecast, we needed another [6,000] or 7,000 MW,” Texas Public Utility Commission Chair Peter Lake said.

Stoic Energy principal Doug Lewin — who follows ERCOT and, among other data, its forced outages — told RTO Insider that about 25 GW of capacity was offline at some time between Dec 22 and 24. ERCOT went into the event with 6 GW already offline, despite the lack of snow and ice, he said.

The grid operator’s data included 655 individual outages at 348 units, peaking at close to 20 GW during the storm. Initially, 127 outages were considered weather– or fuel supply–related, with a high of almost 4.5 GW. Outages or derates at 97 units were considered weather related (35 were wind), and another 30 were caused by fuel issues; 23 of the latter were at gas units.

ERCOT Director John Swainson | © RTO Insider LLC

ERCOT Director John Swainson | © RTO Insider LLCAlmost 1.5 GW of large flexible loads, such as data centers and bitcoin miners, responded to market prices and curtailed their usage. ERCOT also deployed a total of about 2.5 GW of firm fuel supply service to make up for gas restrictions in North Texas.

Like other grid operators during the storm, ERCOT underestimated the drop in temperatures and its effect on load. In the days before the storm, staff had projected demand would almost reach 70 GW. Instead, it peaked at 73.9 GW on Dec. 23, more than 4 GW than the official record peak set during the 2021 storm and its load shed.

“It was a fairly successful event from a risk perspective. It was also one of the coldest events that we’ve seen in the last 15 years,” said Dan Woodfin, vice president of system operations, referencing the more recent storm. “The key message here is that this under-forecast didn’t have any impact on reliability because pretty much all the generation was all buying, and so we were prepared for much higher load than what actually occurred.”

Woodfin said national weather models underestimated “how quickly and how deep” the storm arrived in Texas. Dec. 22-23’s load-weighted daily minimum temperatures of 13.4 and 16.3 degrees Fahrenheit during the December event were lower than all but two of the 2021 storm’s days.

He said the load-forecast models “overplayed” the demand reduction from businesses shutting down for the holiday weekend and were unable to rely on historic data without load shed for the temperatures. Staff have since identified lessons learned and begun improving the forecast models with a focus on extreme cold events, Woodfin said.

ERCOT is still investigating the forced outages’ root causes.

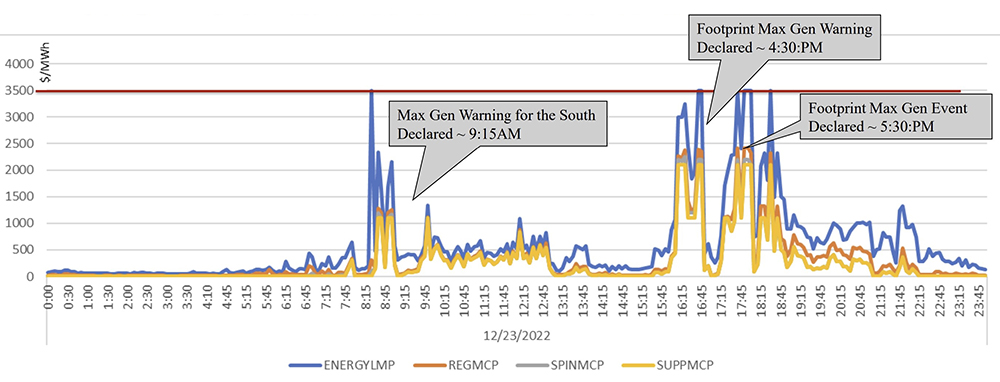

Carrie Bivens, ERCOT’s Independent Market Monitor, attributed prices that peaked at $4,500/MWh on Dec. 22 to the normal economic dispatch of energy storage resources.

“It was fairly significant pricing event,” she said. “The reason the prices were high is price-setting resources were energy storage resources during that time. They typically have high opportunity costs and high offers, and they were mostly setting the price during that time.”

She said the issue was an example of a case in which real-time co-optimization would have had an effect. The IMM has for several years pushed the market tool’s implementation, which is currently sidelined by the state’s market redesign efforts.

Vegas Applauds Sunset Review

ERCOT CEO Pablo Vegas told the board that the grid operator supports recommendations made following a review by the state’s Sunset Advisory Commission.

“Fundamentally, I think some of the changes can be summarized as improvements to communication, making sure that when we communicate information and reports; … that we’re clear [and] transparent, and we take out the engineering jargon,” he said, “and that what we’re recommending needs to happen in order to always keep reliability at the forefront.”

The commission, which also simultaneously reviewed the PUC and the Office of Public Utility Counsel because of their interrelated responsibilities, recommended:

- process changes so ERCOT can restrict the commissioners’ presence during executive sessions and to better define the sessions;

- adding a second commissioner to the ERCOT board as a non-voting member;

- requiring ERCOT to send a biannual industry report to the legislature;

- directing ERCOT and the PUC to re-evaluate the grid operator’s performance metrics and create a public communication guidance document; and

- ordering ERCOT to include appropriate budgetary funding for “qualified” economic planning staff.

Under state law, ERCOT, the PUC and OPUC, as do all state agencies, undergo regular sunset reviews to assess their continued need and their programs’ efficiency. The Legislature will consider the sunset commission’s recommendations when the report is filed and make final decisions before its session ends May 29.

Directors Approve Rule Changes

The board approved seven nodal protocol revision requests (NPRRs) and single changes to the Planning Guide (PGRR) and Retail Market Guide (RMGRR) previously endorsed by the Technical Advisory Committee:

- NPRR1144: provides a limited exception to the requirement that loads included in an ERCOT-polled settlement metering facility’s netting arrangement only be connected to the grid through the facility’s metering point(s). The exception would allow no more than 500 kW of auxiliary load connected to a station service transformer be connected to a transmission or distribution service provider’s (TSP/DSP) facilities through a separately metered point using an open transition load transfer switch listed for emergency use.

- NPRR1147: sets fast frequency response’s ancillary service offer floor 1 cent/MW lower than other responsive reserve services categories to allow fast frequency response’s procurement up to the current limit, without proration with other categories.

- NPRR1149: charges qualified scheduling entities (QSEs) an ancillary service failed quantity if their supply responsibility is not met in real time by their portfolio’s resources, based on a comparison of their real-time telemetry.

- NPRR1151: eliminates the protocol requirement that the Protocol Revision Subcommittee hold at least one meeting per month.

- NPRR1153: adds two existing fees (public information request labor and ERCOT training) to the grid operator’s fee schedule; creates a $500 registration fee for resource entities, TSPs and DSPs, and subordinate QSEs; deletes the system administration fee’s current value and the map sales fee; and restructures existing fees for generator interconnection or modification, full interconnection study applications and wide-area networks.

- NPRR1158: eliminates the weatherization-inspection fee’s sunset date and changes its invoicing period from a quarterly to a semiannual basis.

- NPRR1159: provides needed references to the Retail Market Guide accounting for Texas standard electronic transaction processing options for municipally owned utility or electric cooperative service areas. The change is aligned with RMGRR171, which adds language establishing the mechanism that opt-in munis or co-ops without an affiliated provider of last resort (POLR) that have not delegated authority to designate POLRs to the PUC would follow to provide their initial POLR allocation methodology; and updates and confirms such allocation methodology.

- PGRR102: requires resource entities and interconnecting entities to provide operations dynamic model quality test results that demonstrate appropriate performance for submitted operations dynamic models, and makes non-substantive clarifying changes.

The board also approved:

- Vegas’ selection as CEO and the corporate officers’ ratification;

- the Reliability and Markets Committee’s charter and revised charters for the Finance and Audit and Human Resource and Governance committees;

- changes to the financial, investment and market credit risk corporate standards;

- the selections of Clif Lange and Caitlin Smith as TAC chair and vice chair, respectively; and

- modifications to the directors’ ethics agreement.