SPP said Thursday that it has executed eight funding agreements with Western Interconnection entities for the first phase of its Markets+ energy market, clearing the way to begin its development a month early.

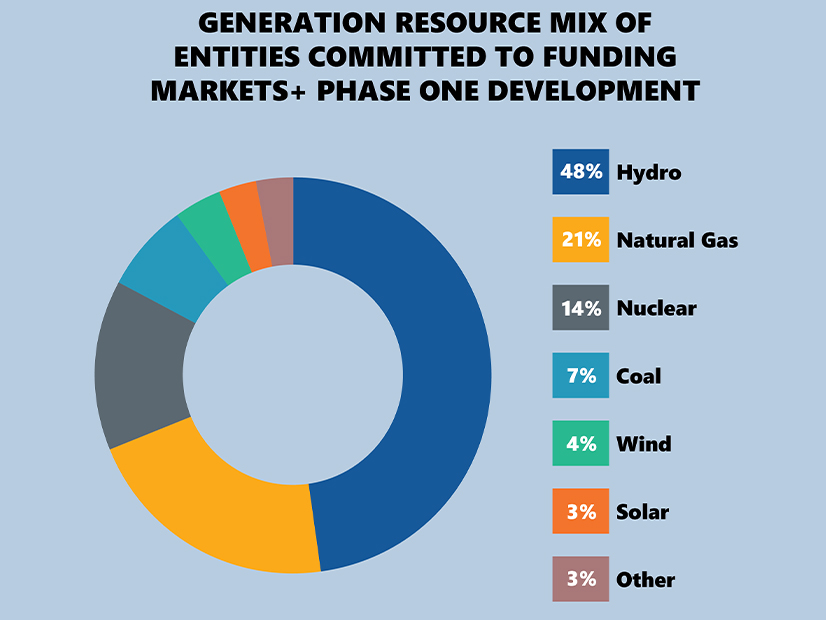

The entities serve more than 250,000 GWh of net energy for load (NEL) annually in the Western Interconnection, representing more than 40 GW of peak demand. Their resource mix is heavy on hydropower (48%), followed by natural gas (21%) and nuclear (14%).

Markets+ entities’ fuel mix | EIA

Markets+ entities’ fuel mix | EIA

Those signing agreements with SPP were Arizona Public Service, Bonneville Power Administration, Chelan County (Wash.) Public Utility District, NV Energy, Powerex, Puget Sound Energy, Salt River Project and Tucson Electric Power.

SPP said several nongovernmental organizations, public interest organizations, power marketers and other interested stakeholders have signed similar agreements with the RTO. Parties can continue to sign agreements through April 1 and be able to participate in forming the Markets+ stakeholder process.

The grid operator has already begun Markets+’s first development phase, which had been scheduled to begin April 1. During this phase, staff will work with potential market participants and other stakeholders to draft tariff language and protocols and to establish the governance structure’s main components consistent with its final service offering before filing them with m.

A formal kickoff for the first phase has been scheduled for April 18-19 in Westminster, Colo.

SPP had defined the project’s critical mass as 150 GWh of NEL and at least two contiguous balancing authorities.

Paul Suskie, SPP | © RTO Insider LLC

Paul Suskie, SPP | © RTO Insider LLC

“We had a minimum goal of who would sign up for phase 1. We have exceeded that goal,” SPP General Counsel Paul Suskie said at the Energy Bar Association Western Chapter’s annual meeting in San Francisco on Thursday.

He also told the audience that the amount of load signing for the first phase would exceed SPP’s existing RTO footprint. The grid operator set a new peak demand mark of 51.1 GW last July.

“Reaching critical mass for phase 1 participation is a monumental step in bringing Markets+ closer to reality,” CEO Barbara Sugg said in a statement. “A regional market will mean reduced costs for members, improved reliability, improved grid efficiency, increased trading opportunities and progress toward renewable integration goals. … We look forward to continued collaboration in the months ahead.”

“We’re excited about the potential benefits that Markets+ could generate for our customers,” Erik Bakken, Tucson Electric Power’s vice president of energy resources and chief sustainability officer, said in a statement. “Expanding market options in our region can improve our ability to integrate renewable resources without compromising reliability.”

During a regularly scheduled web meeting shortly after the announcement, SPP staff said they have begun work to compress the first phase’s 21-month timeline down to 12, as requested by several Western participants. Options include staff drafting the governing rules rather than beginning the process within the working groups; leverage “boilerplate” market-design elements where possible; and identifying design elements that can be postponed to the second phase or later.

“We’ve been looking hard at the phase 1 scope that came out of the final service offering,” SPP’s Carrie Simpson said, “and trying to identify ways to reduce the scope but also still delivering the product everyone wants, just in a much faster timeline.”

Compressing the timeline would mean filing at FERC in the first quarter next year, rather than the fourth.

Mark Holman, a managing director with Powerex, said his organization is a strong proponent of “go-faster, get-there-sooner.”

It’s “great to see the announcement today and that we’re getting going on this phase early. I think 12 months is reasonable,” he said.

SPP has budgeted $9.7 million for drafting the tariff and protocols and filing them at FERC. Accelerating the work will only accelerate the spend, Simpson said.

The grid operator has proposed Markets+ as a day-ahead and real-time market that helps Western utilities not yet ready for full RTO membership to centralize unit commitment and dispatch. SPP is also developing its RTO West market on another track.

Suskie told the EBA meeting that he thought RTO West would be implemented first, noting that Markets+ is a novel program. Because FERC is familiar with the RTO concept, he said, its approval of the latter could come sooner.

Hudson Sangree contributed to this report from San Francisco.