MISO responded to unease over its proposed capacity accreditation methodology Friday with a workshop to show stakeholders that it lines up with a recent report on accreditation design principles.

The RTO invited a representative from Energy Systems Integration Group (ESIG), which released the report last month, to the workshop. However, stakeholders continued to insist that accreditation should exist to simply reflect the reliability value of units, not send new capacity procurement signals.

Telos Energy’s Derek Stenclik, who serves on ESIG’s Redefining Resource Adequacy Task Force, emphasized that “there is no such thing as perfect capacity.” He said accreditation should hit a “sweet spot between reliability and economic efficiency,” making sure the methodology sends price signals to new market entrants.

MISO said Stenclik was not advocating for any particular accreditation method but laying out options.

ESIG’s report recommends that grid operators consider accreditation designs that evaluate energy availability during risky periods, use a similar and simplified method to accredit all resources, and align incentives in both capacity accreditation and real-time performance. That would “not only simulate availability during typical risk periods but ensure performance during actual scarcity events,” according to the report.

MISO is proposing all resources’ accreditation be predicated on availability during “resource adequacy hours,” or conditions with emergencies or tight supply. The methodology will also adjust unit accreditation by a capacity value determined by loss-of-load expectation. The equation’s direct LOLE piece would replace the RTO’s use of unforced-capacity values that rely on historic forced-outage rates.

The move to a marginal accreditation methodology would assign solar generation near-zero capacity credits within the decade. The thought is that an influx of solar generation is only helpful to a point and will shift daily generation peaks to when the sun sets.

MISO’s preferred accreditation design was contested during a Resource Adequacy Subcommittee meeting earlier this month. Stakeholders proposed several revisions and a pair of motions opposing the process. (See MISO Stakeholders Debate Capacity Accreditation, RA.)

Stenclik said accreditation designers should decide whether their philosophy is valuing capacity while determining the next-best investments, or simply assessing the units’ historical performance. He said a marginal approach arrives at saturation points for wind, solar and storage more quickly than one based on past operations.

ESIG concluded that accreditation should be tied to actual operations and that a combination of simulated, prospective capability and historical performance captures a wider range of risks, he said.

“If we’re only looking at how my portfolio did during risk periods in the last three years, my risk periods in the next three years are going to be very different as the resource transition continues,” Stenclik said. He said accreditation can draw on “a matrix of risk hours that are both past- and forward-looking.”

He said accreditation could be surveyed using a load-serving entity’s entire fleet. RTOs take stock of the LSE’s total supply side and demand-side resources and determine the total risk and benefits they introduce to the system, Stenclik said.

During the workshop, stakeholders asked whether MISO is open to removing marginal calculations from its accreditation, arguing it will undervalue capacity.

Zak Joundi, the RTO’s director of resource adequacy coordination, said the workshop was not intended to host another debate on the accreditation proposal. He said staff will continue vetting the accreditation proposal in the stakeholder process.

“It’s not like we just rolled this out. This has been 18 months of discussion,” he said of MISO’s proposal.

During the recent Gulf Coast Power Association’s annual MISO/SPP conference, MISO Independent Market Monitor David Patton said, “If we’re brave and we accredit resources right, the lights won’t go out. But it remains to be seen whether we do that.

“We need to be honest about the limitations of different resources,” he added.

Patton said different resource classes have different contributions to reliability. He said MISO should accurately assess those characteristics and known fuel issues by season to inform accreditation.

Signs Point to Renewables, Storage

No matter what happens with MISO’s accreditation proposal, the grid operator is certain to be awash in renewable energy, a market analyst said recently.

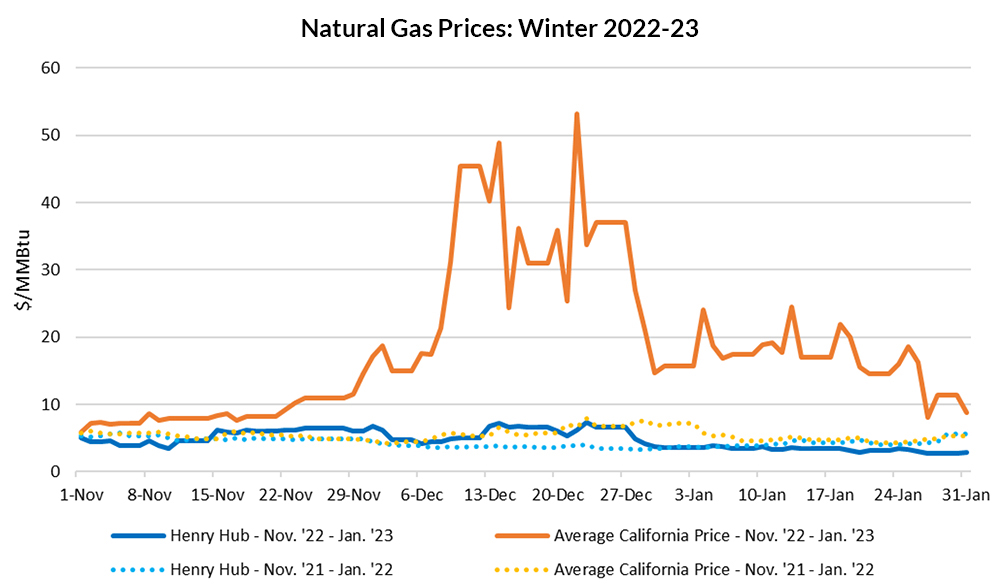

Ascend Analytics’ Brent Nelson said during a March webinar that high natural gas prices, solar generation and standalone storge tax credits and increased demand for clean energy mean MISO and PJM renewable developers are eager to begin construction.

“The kid in the candy shop is the analogy here,” he said, adding that there’s currently a “land rush” to snap up optimum sites for wind and solar resources.

Brent said despite gas prices dropping in the past few weeks, there’s “a pretty permanent long-term structural uplift in the market expectations.” He also said there’s “regulatory concern over stranded-asset risks” on new natural gas plants.

“Storage is the pretty clear new capacity resource,” he said.

Nelson said multiple RTOs are struggling with how to accredit capacity to meet reliability standards in a transitioning fleet mix. He said he doesn’t see good answers.

“I think one of the things we’ve seen over that last year is that there’s been a systemic underestimation of critical system risks in cold weather,” Nelson said. “If the critical system condition that you’re worried about is when the wind’s not blowing, by definition that’s the time that you’re worried, then you have to rethink how you accredit a resource.”

Nelson predicted that both PJM and MISO will see coal resources retire without extensions. He said coal will get “squeezed out” of markets, unable to compete with solar and wind.

High natural gas prices will keep energy prices high in the near term, but substantial renewable energy buildout will eventually bring them down, he said.

“I think the concept of baseload is a false construct. What you need is to meet demand. And so, if you have variable supply, you want some other variable supply that can fit around it,” Nelson said. “Baseload as a concept isn’t something that we need. What we need is something that will deliver reliability and energy at minimum cost.”

Nelson said he doesn’t expect MISO capacity prices to hit net cost of new entry in next month’s 2023/24 planning year auctions, but he said clearing prices are entering an era of instability. MISO’s capacity market will “oscillate between near-zero and near-price cap levels” for years as utilities lean on the optional market to make up their needs, Nelson said. For that reason, MISO utilities will strive to build, own and contract capacity outside of the market, he predicted.