WASHINGTON — Acting FERC Chairman Willie Phillips on Wednesday said he would continue to prioritize the transmission initiatives his predecessor started in his first public comments since being named to run the agency at the beginning of the year.

Transmission is important to ensuring reliability and resilience, Phillips said, and they have been areas he has focused on since joining FERC in 2021. The Inflation Reduction Act should accelerate the transition towards clean energy that the industry is going through, which will also need ample new transmission.

“I’m glad to say that the transmission NOPRs [Notices of Proposed Rulemakings] and proceedings that we started last year, they’re aimed at doing just that,” Phillips said at Energy Bar Association Northeast Chapter’s Winter Summit. “As your chairman, I want to make sure that we keep the momentum going on these important transmission reform efforts.”

Phillips also made similar comments before the D.C. Public Service Commission’s Clean Energy Summit the same day.

“We’re not going to sit on our hands,” Phillips said at the PSC, where he was chair before he joined FERC. “I’ve already started to engage my colleagues, to engage them and talk about, what are the ways we can continue to move forward? I think that’s the only way to reach the administration’s goal of clean energy by 2035.”

While some have argued that building out the infrastructure needed to combat climate change is at odds with environmental justice, Phillips said, he is not one of them.

“I think with the opportunities with advanced reconductoring, in particular, where you don’t just have to build, but you can have these lines that are able to reduce the amount of energy loss and increase the amount of energy that can flow across for many, many miles, I think that there’s so many opportunities to save money,” he added.

Advanced transmission technology can reduce the need for new transmission; that not only addresses more traditional environmental justice concerns but ensures the transition is done affordably, he added.

The departure of former Chairman Richard Glick means that FERC is at a 2-2 partisan split among its four remaining commissioners, but Phillips told EBA that would not stymie its efforts. (See Glick Bids Farewell to FERC.)

“I submit to you that when it comes to doing important things, really important things, for our nation, we are not as divided as politics might suggest,” Phillips said. “I think there is a real opportunity if we approach each other as colleagues, and with respect.”

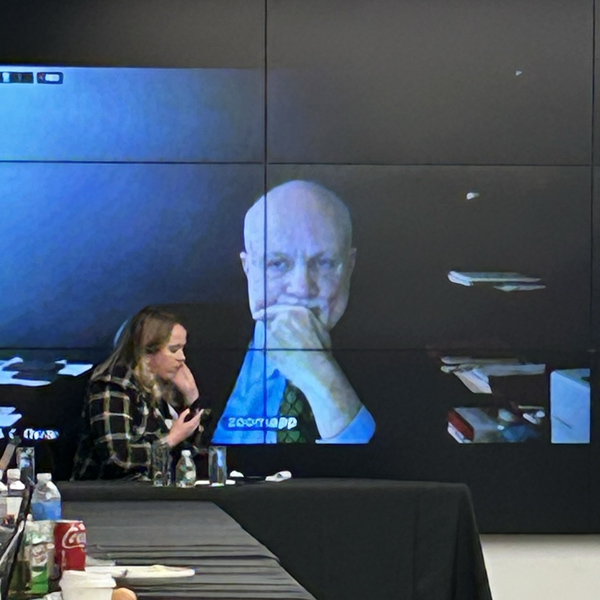

FERC Commissioner Mark Christie joins remotely | © RTO Insider LLC

FERC Commissioner Mark Christie joins remotely | © RTO Insider LLC

Republican Commissioner Mark Christie had echoed that sentiment earlier at the EBA meeting.

“I’m not a math wizard at all — I majored in history — but the magic number is still 3,” Christie said. “That’s how many votes it takes to get an order out and that hasn’t changed.”

Christie cited some statistics that Glick compiled before his last meeting in December, including that 98% of the orders under the previous chairman were voted out with four or more votes.

But Christie also conceded that there are contentious issues such as the natural gas pipeline certificate policies that the Democratic majority proposed last year over his and fellow Republican Commissioner James Danly’s objections. However, most of the work before FERC is under the Federal Power Act, he said, and he did not see any partisan splits stopping that from moving forward.

Phillips also touched on geopolitics, saying that while the people of Ukraine have obviously suffered the most under Russia’s invasion, its effects have been felt throughout the energy industry as the war scrambled global supplies and has contributed to price spikes.

Europe, many countries in which used to rely on Russian sources of energy to meet a significant amount of their demand, has seen the worst of that, with talk earlier in the year of running short on resources that require significant energy to produce, such as fertilizer and steel.

“And it was a real concern talking to my European colleagues, that that was going to impact us here,” Phillips said.

Keeping the lights on will continue to be a priority for Phillips, as he cited the need to plan for extreme weather, as seen over the holidays, and increase the security of the grid against both cyberattacks and physical attacks, especially after the recent shootings of substations in North Carolina and Washington state.

“What is clear is that we’ve had, yet again, a wakeup call,” Phillips said. “Another wakeup call that threats to our bulk power system … are real; that they require us at FERC to refocus our efforts on reliability and resilience.”

At both events, Phillips recalled his childhood in Alabama, telling EBA that being named to run FERC is the “greatest time in his career.”

“I know the impact that agencies like the D.C. Public Service Commission and the Federal Energy Regulatory Commission can have on the individual; on the family; on the community,” he said at the PSC summit. “And so, as a regulator, I think it is incumbent upon us to make sure that we do all that we can to build our power to make sure that those people from underserved communities; that they have a voice; and that we take that voice into consideration and make our decisions in a meaningful way.”