MISO has concluded that Pearl Street’s SUGAR automation software is an effective alternative to the power flow simulations it used to conduct to identify network upgrades for generation projects in the queue.

MISO released an analysis comparing the software’s ability to pinpoint upgrade needs for new generation entering the system with MISO’s previous analyses on the 2021 cycle of generation proposals. The RTO said SUGAR performed at a 99.23% match rate with “minimal deviations” when searching for thermal constraints, a 100% match rate with some extra identified constraints when looking for flowgate limits and a 99.03% match rate when spotting voltage issues with “justified” minor violations.

Ahead of the analysis, MISO said SUGAR would have to identify at least 98% of constraints uncovered through its legacy analyses to be considered a success. MISO said across all three comparisons — thermal, flowgate and voltage — SUGAR results aligned with MISO studies 99.2% of the time.

MISO is using Pearl Street’s SUGAR (Suite of Unified Grid Analyses with Renewables) software to screen generation projects and perform the first phase of studies in the queue. It’s betting the tech startup’s assistance with conducting studies can dramatically accelerate its yearslong queue processing. Austin, Texas-based software company Enverus acquired Pearl Street in March.

The RTO plans to start the first phase of studies on the 2023 batch of project proposals in July. It won’t begin analyzing 2025 entrants until the end of the year. MISO hopes to have all projects in those cycles striking interconnection agreements over 2026, with the still-in-progress 2022 cycle proceeding in the second quarter, 2023 in the third quarter and 2025 by the end of 2026. (See MISO Unveils Later Timeline for Queue Processing Restart.)

MISO skipped acceptance of a 2024 queue class altogether. Throughout 2024, it delayed kickoff of studies on the 123 GW of projects that entered the queue in 2023 while Pearl Street assisted with modeling.

The RTO hasn’t processed a new queue cycle in more than a year, saying it needs to introduce study automation and implement a megawatt cap to make processing requests less daunting. (See MISO to Skip 2024 Queue Cycle While it Automates Study Process with Tech Startup.)

MISO found that SUGAR completed the first phase of interconnection studies faster while estimating similar costs for network upgrades. MISO said while it spent 686 days to ultimately estimate $13.36 billion in upgrades for the 2021 queue cycle of projects, SUGAR estimated $13.25 billion for the same batch of projects within 10 days.

MISO staff at an April 22 Interconnection Process Working Group said SUGAR provided a good match for the RTO’s longer-form interconnection studies.

“These results confirm that SUGAR can be utilized in MISO’s [first definitive planning phase (DPP)] studies with minimal impact to stakeholders while also providing significantly increased speed in conducting MISO DPP Phase 1 studies,” MISO wrote in its analysis.

MISO said SUGAR results are in “excellent agreement” with MISO’s previous study process regarding flowgate project assignments. When hunting voltage constraints, MISO said SUGAR landed on 102 of the 103 constraints it previously identified while reporting six more that didn’t turn up in MISO studies. MISO said the additional constraints SUGAR called out are “deemed acceptable within the bounds of engineering judgment.”

MISO also said SUGAR noted 259 of the 261 thermal constraints MISO previously reported. The RTO said it expected small deviations in the output of different powerflow tools.

Meanwhile, one MISO region already has surpassed MISO’s newly enacted 50% of peak load annual interconnection queue cap. (See FERC Approves Annual Megawatt Cap for MISO Interconnection Queue.)

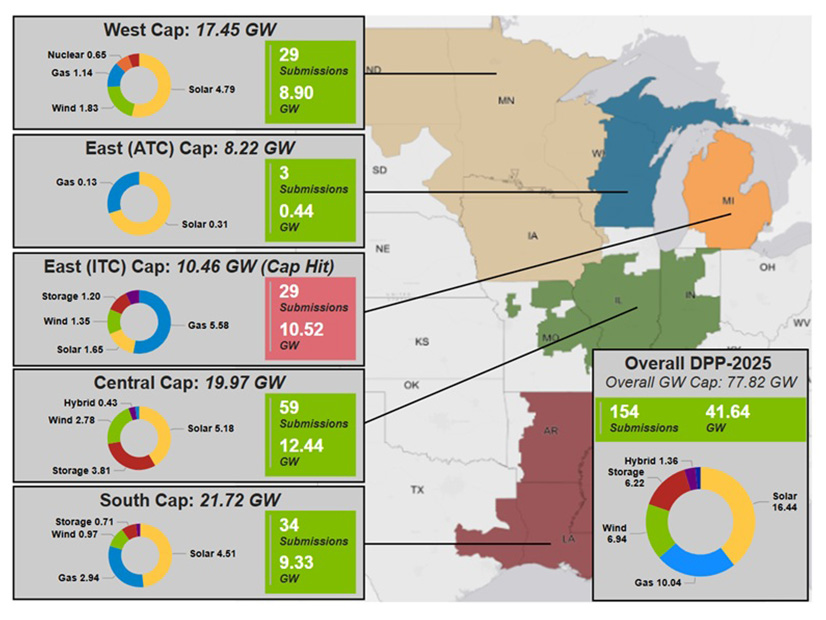

The East ITC study region, which contains Michigan’s Zone 7, exceeded the cap at 29 submittals at 10.52 GW. Any other projects that hoped to enter under the 2025 cycle now must queue up for the 2026 cycle.

MISO has been allowing projects to line up for 2025 queue processing since last year. Its cap for the 2025 queue cycle is nearly 78 GW. So far, MISO has recorded 154 project submissions at 41.64 GW.

At the April 22 meeting, John Liskey, of the Citizens Utility Board of Michigan, said the resources that entered before the East region’s cap was exceeded contain a large amount of gas capacity, which could violate Michigan’s renewable energy standard of 50% by 2030 and 60% by 2035.