Data centers may be driving electricity demand growth in the U.S., but air conditioning helped drive a 4.3% increase in worldwide demand in 2024, “bolstered by severe heat waves in countries such as China and India,” along with data centers, according to the International Energy Agency’s 2025 Global Energy Review.

In fact, the report says, 2024’s record-high temperatures drove a 6% increase in “cooling degree days,” a measure of cooling needs.

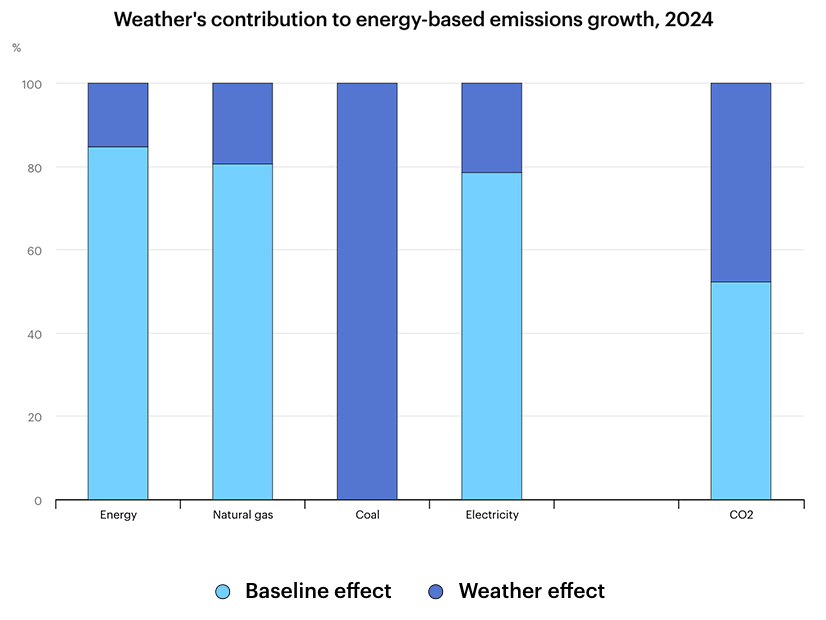

Released March 24, the report estimates that “weather effects contributed about 15% of the overall increase in global energy demand,” while also adding “around 20% to the increase in electricity and natural gas demand and … the entire increase in coal demand.”

Weather also was responsible for about half of the 0.8% increase in the world’s carbon dioxide emissions, which hit record highs of 37.8 gigatons and 422.5 parts per million of CO2, which is a 50% increase over preindustrial times.

IEA heralded the report as “the first global assessment of 2024 trends across the energy sector,” based on the latest data. The report differentiates between overall energy demand and the electricity demand that “is growing rapidly, pulling overall energy demand along with it to such an extent that it is enough to reverse years of declining energy consumption in advanced economies,” IEA Executive Director Fatih Birol said in the press release announcing the report.

“The result is that demand for all major fuels and energy technologies increased in 2024, with renewables covering the largest share of the growth, followed by natural gas,” Birol said. “And the strong expansion of solar, wind, nuclear power and EVs is increasingly loosening the links between economic growth and emissions.”

“CO2 emissions in advanced economies fell by 1.1% to 10.9 billion [metric tons] in 2024 — a level last seen 50 years ago — even though the cumulative GDP of these countries is now three times as large,” according to IEA.

Global GDP grew 3.2%, while overall global energy demand grew 2.2%.

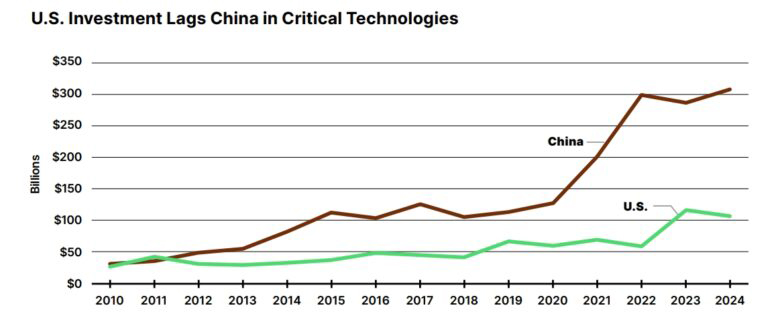

What all these numbers show is that demand growth in the U.S. — and the potential solutions for meeting it — are part of larger global patterns and trends. The report also tracks sectors, like transportation electrification, where the U.S. is lagging behind China for global leadership.

AC and Data Centers

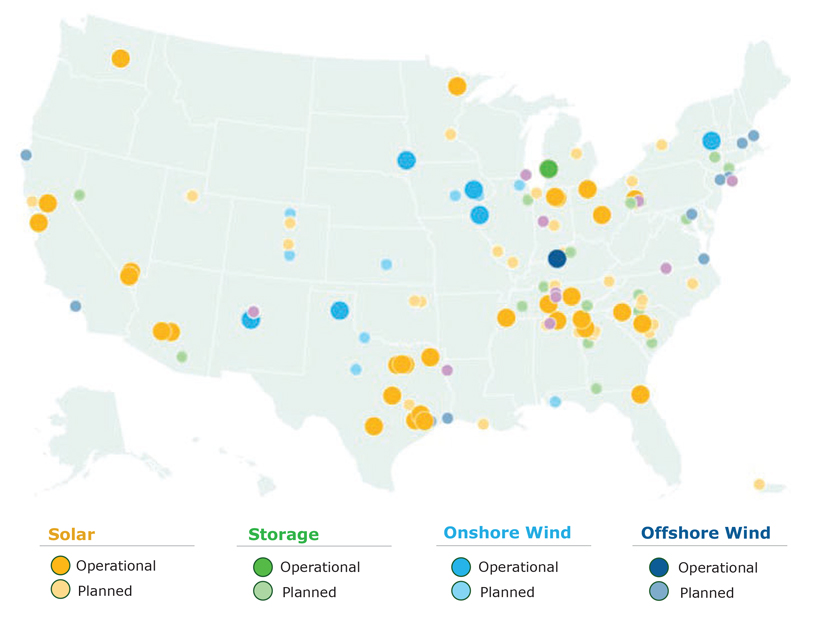

As in the U.S., renewable energy and nuclear resources are coming online fast in response to immediate increases in demand growth, providing more than 80% of new generation worldwide in 2024 — “a step up from 2023, when they accounted for two-thirds of total growth,” the report says.

“Solar PV led the way, increasing by about 480 TWh — the most of any source and far exceeding the previous year. Global generation from solar PV has been doubling approximately every three years since 2016, and it did so again between 2021 and 2024.”

Coal and natural gas still provide 60% of the world’s electricity — and grew 1% and 2.7%, respectively, in 2024 — the report says. Again, extreme weather events — particularly heat waves — accounted for about one-fifth of demand growth for natural gas.

Still, natural gas demand in the residential and building sectors grew only 1%, the report says.

The continuing dominance of fossil fuels notwithstanding, the IEA says renewables and nuclear are changing the world’s electricity mix. In 2024, for the first time, they generated two-fifths, or 40%, of all electricity.

Nuclear generation rose by more than 7 GW in 2024, up 33% over the previous year. New nuclear plants under construction grew by 50%. But these new plants were being built exclusively with Chinese and Russian designs, the report says, setting a challenge for U.S. companies seeking to break into global markets.

The U.S. definitely is behind growth curves in transportation electrification, according to the IEA. Kelley Blue Book pegged EV sales at 8.1% of total sales in 2024, versus 20% worldwide. China leads in this sector, with EV sales growing 40% year over year in 2024, although 80% of that growth was from plug-in hybrids.

China also is providing consumer subsidies of up to $3,000 “to encourage consumers to replace older, less efficient cars with new energy vehicles,” the report says.

Noting that buildings accounted for nearly 60% of total growth in electricity use worldwide — due to air conditioning and data centers — the report also tracks heat pump market growth, where China again is the global leader.

But the U.S. is the second-largest heat pump market, and sales are growing. While heat pump sales globally edged down 1% in 2024, they were up 15% in the U.S., where heat pumps outsold natural gas furnaces by 30%, the largest increase recorded to date.