LA JOLLA, Calif. — Regional initiatives aimed at increasing coordination and collaboration among Western power entities are essential to tackle mounting technical and political challenges, panelists said during a discussion at the spring joint meeting of the Committee on Regional Electric Power Cooperation and Western Interconnection Regional Advisory Body on April 2.

Many of the challenges the Western Interconnection faces are coming out of the White House, according to WECC CEO Melanie Frye.

Frye pointed to executive orders impacting the federal workforce, sweeping tariffs and funding pauses for projects in the West. All of this is coming at a time when the risk to reliability is “out front and center,” Frye said in reference to wildfires in Los Angeles, data center demand growth and cybersecurity threats, among other issues.

Coordination and collaboration are key to facing these challenges, Frye said.

An example of such collaboration, according to Frye, is WECC’s adoption of five risk areas the organization’s Board of Directors approved last year, including:

-

- the effects of drought and long-term aridification on the Western grid;

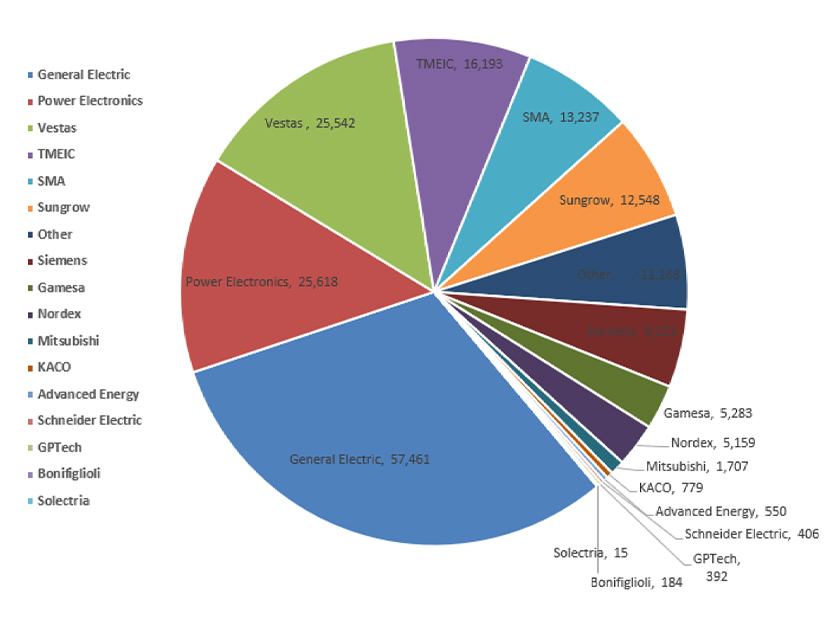

- reliability challenges related to inverter-based resources;

- data accuracy and modeling of the interconnection;

- coordinated planning of the resources in the transmission system; and

- energy policy.

“We know we have an integrated grid, and I think it’s going to take the communication, the coordination, the collaboration and the courage to make sure that we continue to keep those lights on,” Frye said. “Through those four C’s, I think we have tremendous possibilities to advance the desires of all of the various states and provinces that are in our footprint.”

Keegan Moyer, a partner at Energy Strategies, said most of the major successes in the Western interconnection, like the Western Energy Imbalance Market, have come through regional coordinating efforts.

However, successful initiatives require trial and error, and “you have to stick with them sometimes for many, many years for them to have any benefit at the end,” Moyer contended.

Additionally, state leadership in regional initiatives is “paramount,” Moyer said.

“So when you look across … what we’re doing now in the region, whether it be [Western Transmission Expansion Coalition], [Western Resource Adequacy Program], the activities going on in WECC, Markets+, [Extended Day-Ahead Market], all these different efforts, state engagement is critical just like it has been in the past,” Moyer said.

Sarah Edmonds, CEO of Western Power Pool, pointed to WRAP as a successful initiative that has brought together Western resources and helped representatives across the energy industry find common ground “to solve the problem of a very serious and looming threat to reliability and resource adequacy in the West.”

However, referencing the other speakers, Edmonds also noted there are challenges in the West, “and that has been difficult for all of us to manage.”

“There’s a lot of layers that you have to navigate through, and you have to make a lot of connections between initiatives and efforts that seem disconnected, but are, in fact, quite organically connected in a number of ways,” Edmonds said.

Despite the many challenges, the Western Interconnection “will decide its own future,” Frye said.

“And I think it’s really important that we not lose sight of the fact that, you know, we’re operating the grid that’s existed for decades, and we know how to do that,” Frye said. “We know the people in this room, and we know the people in the industry that we need to bring to the table. So I think those are important things to not lose sight of.”