Most regions of the North American grid remain at elevated risk of supply shortfalls this summer, NERC said in its 2023 Summer Reliability Assessment released Wednesday, with an organization official warning the media that “the system is close to its edge.”

In presenting the assessment, John Moura, director of reliability assessment and performance analysis, and other NERC staff stressed the impact on reliability of changing weather patterns, combined with the transition to renewable energy sources that has left some areas relying on weather-dependent technologies like wind and solar power. In a video released alongside the report, NERC said that “generator retirements continue to increase the risks associated with extreme summer temperatures.”

“With the grid transformation in full force, the retirement of conventional generation remains highly concerning,” Moura said. “That’s something that we’d really like to focus on in the coming years as we … respond to environmental rules [and] enable a cleaner grid, but also maintain reliability every step of the way.”

Weather Driving Demand

NERC publishes the assessment each year to identify potential regional reliability issues and topics of concern, covering the June to September timeframe. This year MISO, Ontario and New England, SPP, ERCOT, SERC’s Central subregion — comprising all of Tennessee and portions of Georgia, Alabama, Mississippi, Missouri and Kentucky — and the U.S. Western Interconnection all “face risks of electricity supply shortfalls during periods of more extreme summer conditions,” the assessment said.

According to the National Weather Service, above-normal temperatures are likely across most of the continental U.S. and Alaska, while most of Canada is expected to see normal or below-normal temperatures.

The assessment marks an improvement in one regard from last summer because MISO is no longer assessed at high risk, which indicates the potential for insufficient operating reserves in normal peak conditions. NERC said the reduced risk level is because of higher firm import commitments coupled with lower forecasted demand for the region, though its resources are also projected to be lower than last year. MISO’s anticipated reserve margin has increased to 23% this year, from the 21% predicted for summer 2022.

Resources are also expected to be lower this year in New England and Ontario, though still adequate for normal peak demand, confirming the regional entity’s own summer assessment released earlier this month. (See NPCC Warns of Tight Summer Margins in Ontario.) NERC warned that “generation and transmission outages will be increasingly difficult to accommodate” in Ontario for the foreseeable future because of generator retirements, especially among the province’s nuclear fleet.

NERC also expressed concern that utilities would be “unable to reschedule certain outages” during summer, as the Northeast Power Coordinating Council suggested in its assessment. The ERO said that Ontario might need to rely on as much as 2,000 MW of non-firm supply from other areas, along with “additional operating actions,” though NPCC said the province would likely need “only limited use” of its operating procedures during the summer.

SERC-Central has seen its forecasted peak demand rise by more than 950 MW since 2022, with no accompanying growth in anticipated resources. However, while the subregion’s prospective reserve margin is significantly lower than last year as a result, entities reported to NERC that they expect to “address unexpected short-term issues by leveraging diverse generation portfolios and spot purchases from the power markets when necessary.”

IBR Issues Continue in Texas

Mark Olson, NERC | NERC

Mark Olson, NERC | NERCFor Texas, the report’s authors noted that the growth of inverter-based resources (IBRs) in the region continues to create concerns around “system stability and strength,” along with rising curtailments of energy production because of transmission constraints, frequently at solar sites. The ERO has issued multiple warnings about the reliability of IBRs in recent years after events like the Odessa disturbances in 2021 and 2022, when the Texas Interconnection lost multiple gigawatts of solar PV and synchronous generation. (See NERC Repeats IBR Warnings After Second Odessa Event.)

Mark Olson, NERC’s manager of reliability assessments, also observed that the region’s growing use of solar generation carries additional risks because of the mismatch between solar PV sites’ most productive time in the early afternoon and the period of greatest demand later in the day. Without dispatchable generation, utilities may find themselves operating closer to the edge than the numbers would indicate at first glance.

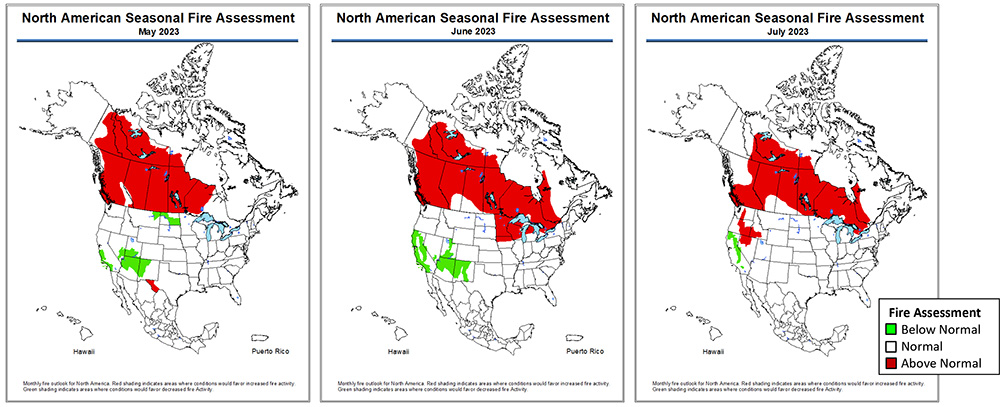

In WECC’s U.S. footprint, NERC warned that while resources in the interconnection are sufficient to support normal peak demand, a wide-area heat event could create problems for multiple subregions that normally rely on regional transfers to meet peak demand when solar production falls off. In addition, the assessment noted the risk of wildfires to the transmission network, which can limit the transfer capacity and lead to localized load shedding.

Olson also noted that while California’s hydroelectric system has experienced some relief from snowmelt refilling reservoirs, it is too early to tell whether this supply will continue to aid the region in late summer.

“Higher temperatures now can lead to a lot of melt early on, [but] much of the summer risks in the West tend to be later in the season when hydro is normally starting to be lower. So it’s harder to project how the current rainfall and snowpack may play out later into the season,” Olson said.

Supply Chain, Spare Parts Issues

Other potential reliability issues noted in the report include low inventories of replacement parts, such as distribution transformers, that could delay restoration of power following hurricanes and severe storms. Additional supply chain issues, along with labor shortages, could cause challenges for maintenance, summer preparedness and new resource additions.

The assessment also noted that EPA’s Good Neighbor Plan, which will require significant reductions of emissions at power plants and industrial facilities in 23 states, will likely limit the operation of coal-fired generators that are currently used for dispatchable generation. (See EPA Good Neighbor Plan Expected to Accelerate Coal Plant Retirements.) NERC recommended that entities familiarize themselves with the plan’s electric reliability provisions and be prepared to “act to preserve generation resources … to support periods of high demand.”

Industry groups seized on the assessment’s warnings about coal retirements as ammunition in their arguments against both the Good Neighbor Plan and EPA’s more recent proposals for carbon dioxide emission standards at power plants. (See Regan: New EPA Standards Designed to not Jeopardize Grid Reliability.) America’s Power, which represents coal-fired generators, said in a statement that retiring coal plants “will needlessly expose consumers to potential power outages,” while Jim Matheson, CEO of the National Rural Electric Cooperative Association, said that “America’s ability to keep the lights on has been jeopardized” by growing demand and restrictions on supply.

“American families and businesses expect the lights to stay on at a cost they can afford. But that’s no longer a guarantee,” Matheson said. “Nine states saw rolling blackouts last December as the demand for electricity exceeded available supply. … Absent a major shift in state and federal energy policy, this is the reality we will face for years to come.”