The debt ceiling compromise hammered out between President Joe Biden and House Speaker Kevin McCarthy (R-Calif.) would cut the time allowed for reviews under the National Environmental Policy Act (NEPA) to two years for a full environmental impact study and one year for a less intensive environmental assessment.

The main text of the Fiscal Responsibility Act (FRA), released Sunday, would raise the debt limit through Jan. 1, 2025; claw back some federal funding, such as billions in unused COVID-19 funding; and cap federal spending at current levels through 2024.

But 27 pages of the 99-page bill are focused on streamlining and accelerating permitting, including the designation of a single lead federal agency for such reviews and an expansion of the use of “categorical exclusions,” or waivers that would exempt projects from NEPA evaluations.

Speaking at press conference on Sunday, McCarthy called these changes “transformational.”

NEPA “hasn’t been reformed in 40 years,” McCarthy said. “It’s a frustration with people all across this country, on both sides of the aisle. [It] doesn’t matter if you want to build a road [or] you want to build a renewable energy project. That all gets stopped and studied for years. It’s a frustration. That’s millions of dollars wasted. That is all changing now so we can build again in America. We can make America strong. We [can] compete with other countries.”

Rep. Garret Graves (R-La.), one of the chief GOP negotiators, described the bill’s NEPA provisions as “shrinking the scope” of federal environmental reviews.

“NEPA has grown to just study all these things that don’t have anything to do with the environment, which I would argue … has worked against the protection of the environment,” Graves said during the Sunday press conference. “So, we’re trying to refocus the scope back on that, on the environmental impacts, and making sure we get the best environmental outcomes.”

But the White House framed the permitting provisions as a win for the key climate provisions of the Inflation Reduction Act, which the Republicans’ original debt ceiling package, the Limit, Save, Grow Act (H.R. 2811), had sought to roll back.

“We secured measures that will harness government efficiencies to accelerate construction projects across the country,” a White House official said during a background press call Sunday. “Specifically, the agreement includes measures aimed at boosting the coordination, predictability and certainty associated with federal agency decision-making. …

“And the agreement, importantly, makes these changes without curtailing the substantive scope of the NEPA statute,” the official said. “It doesn’t cut down the statute of limitations, as was proposed in [the GOP bill], or impose barriers to standing, or taking away injunctive relief or other judicial remedies.”

Republican proposals for changes to NEPA could have cut the window for judicial challenges from six years to as little as 60 days.

Both Biden and McCarthy emphasized that the bill is the result of negotiations in which neither side got everything they wanted. McCarthy also stressed that once the text of the bill was released, the House of Representatives would not vote on it for 72 hours to give lawmakers and the public time to review it.

Amid grumblings on both sides that concessions in the bill are too deep, questions remain on whether Republican and Democratic leaders in the House and Senate will be able to rally the votes they will need to get it to the president’s desk. Biden urged lawmakers in both houses to pass it, and McCarthy expressed confidence that the majority of Republicans would fall in line and vote for the bill.

NEPA Reviews

With Graves as a key GOP negotiator, the FRA’s permitting provisions incorporate many but not all the provisions from his Building U.S. Infrastructure through Limited Delays & Efficient Reviews Act, originally introduced in 2021.

In addition to the time limits on environmental reviews, the FRA would set a limit of 150 pages for EISes and 300 pages for projects of “extraordinary complexity … not including any citations or appendices.” EAs would be similarly limited to 75 pages, plus citations and appendices.

It would also require the designation of a lead federal agency to coordinate and set a schedule for any environmental review. And state, local or tribal agencies could be enlisted as co-lead or cooperating agencies.

If a lead agency did not produce an environmental review within mandated deadlines, the bill would allow a deadline extension, “in consultation with the applicant … that provides only so much additional time as is necessary to complete such environmental impact statement or environmental assessment.”

The bill specifies that the scope of such reviews should focus on “reasonably foreseeable environmental effects of the proposed agency action [or] any reasonably foreseeable adverse environmental effects which cannot be avoided should the proposal be implemented.” A “reasonable range of alternatives” would have to be examined, including negative environmental impacts arising from not completing the project.

It would also expand the use of categorical exclusions by allowing one federal agency to use the categorial exclusion that another agency has issued for a specific project. It would allow the use of “programmatic environmental” reviews, which cover a specific region or corridor in which one or more projects are located. The programmatic review can be used in the permitting of individual projects in the area covered by the review for up to five years or longer, “unless there are substantial new circumstances or information about the significance of adverse effects that bear on the analysis.”

The bill does not define what “reasonably foreseeable” environmental impacts are, and as noted by White House officials, it would not cut back the current six-year time frame for legal challenges to a NEPA environmental review.

More Changes in Offing?

In a major win for Sen. Joe Manchin (D-W.Va.), the bill calls for expedited completion of the embattled Mountain Valley natural gas pipeline (MVP), a provision also included in his permitting bill, the Building American Energy Security Act.

The FRA would declare the 303-mile project “in the national interest” and order the secretary of the Army to complete any final permitting on the pipeline within 21 days of the enactment of the law.

It would also prohibit any further litigation on the project, save for challenges to this provision itself, which could only be heard by the D.C. Circuit Court of Appeals.

This limit raises a question on whether passage of the FRA would retroactively nullify Friday’s decision from the D.C. Circuit overturning FERC’s decision to not perform a new EA of the pipeline. The decision requires FERC to perform the study but does not stop construction on the pipeline, which is 94% complete. (See related story, DC Circuit Partly Vacates FERC Gas Pipeline Approval.)

In a statement released Sunday, Manchin claimed credit for securing the Mountain Valley provisions. “I am pleased Speaker McCarthy and his leadership team see the tremendous value in completing the MVP to increase domestic energy production and drive down costs across America and especially in West Virginia,” he said. “I am proud to have fought for this critical project and to have secured the bipartisan support necessary to get it across the finish line.”

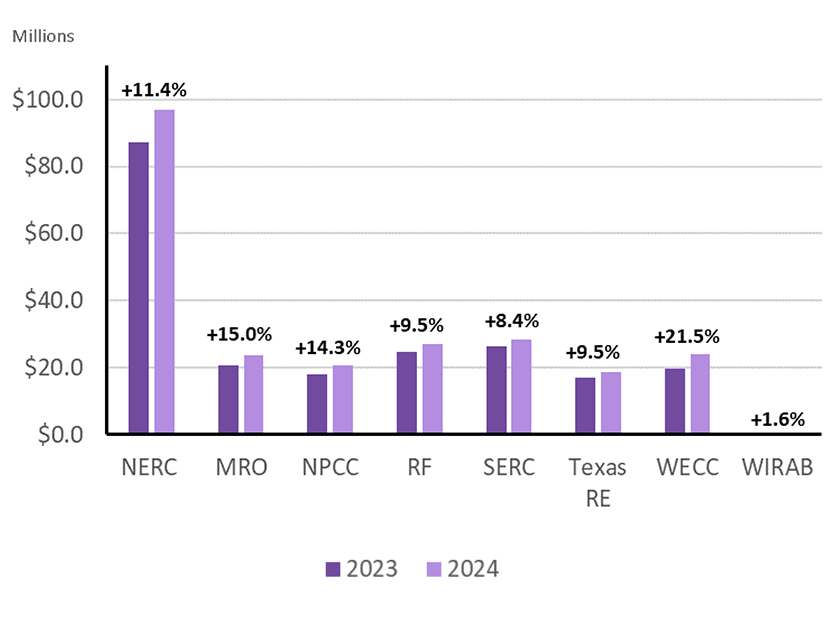

For transmission advocates, the FRA would authorize an “Interregional Transfer Capability Determination Study.” It would task NERC with completing this study in 18 months, looking at current transfer capabilities between “neighboring transmission planning regions” and making recommendations for “prudent additions to transfer capability” to improve reliability. The completed study would be submitted to FERC, which would have another year, plus a public comment period, to finalize and submit the report to Congress.

Rob Gramlich, president of Grid Strategies, an industry consulting firm, said the FRA contained little of significance to accelerate the permitting and construction of interregional transmission. The study could “raise a lot of people’s awareness about the benefits of transmission connecting regional grids,” Gramlich said. “But there’s still some debate about the details, like why does it take 2.5 years” for NERC and FERC to complete the report.

He also noted that FERC is already studying interregional transfers and recently ended a comment period following a technical conference on the subject. In general, stakeholders support the concept of expanding interregional transfer capability on the grid but differ on how to get there. (See Minimum Transfer Capability Between Regions Debated at FERC.)

The FRA would authorize another study to explore “the potential for online and digital technologies to address delays in reviews and improve public access.” Such an “e-NEPA” portal would allow developers to submit and track the progress of permitting applications online and allow federal agencies to collaborate and edit documents in real time. The bill would appropriate $500,000 for the study, which the White House’s Council on Environmental Quality would conduct and submit to Congress in a year.

The bill’s inclusion of energy storage projects in the FAST-41 process provides another small win for clean energy advocates. Originally set up under the Fixing America’s Surface Transportation Act in 2015 and expanded by the Infrastructure Investment and Jobs Act, FAST-41 allows for expedited permitting of certain infrastructure projects and already has an online dashboard for tracking projects. The White House official said that while some of the FRA’s provisions streamlining permitting do overlap with FAST-41, the processes are different.

Industry consultants ClearView Energy Partners characterized the FRA’s permitting provisions as a “mini-deal” that will “not make the holistic changes Republicans laid out in multiple recent proposals or transmission reforms sought by Democrats.”

The question now is whether the modest nature of the provisions will “mean more reforms [are] in the offing.”

“A reopening of debate looks more likely than actual finalization, but we expect lawmakers to try,” ClearView said. Prior to the deal, the Senate committees on Energy and Natural Resources and on Environment and Public Works had each committed to working on bipartisan permitting bills.

However, ClearView said, “the FRA mini-deal is more likely to undercut momentum for such efforts than to stoke it.”